Bitcoin and other cryptocurrencies continue to make headlines with their significant drops recently. The market eagerly anticipates a new surge as these declines also breed new hopes. At this stage, the comments made are gaining importance. A recent comment came from former Goldman Sachs executive Raoul Pal. Pal shared the cryptocurrency he invested in with his followers. He also provided information about his other assets.

Raoul Pal Invests in Ethereum Competitor

Recently, Raoul Pal announced that he has heavily invested in a major Ethereum (ETH) competitor. Speaking on the YouTube channel Bankless, Pal emphasized that about four-fifths of his crypto assets are in Layer-1 Blockchain Solana (SOL), with the remainder spread among meme coins, digital collections, and a digital asset-focused investment tool.

Pal stated that 80% of his investment is currently in SOL, adding:

“All of my ETH is now in NFTs; I particularly prefer high-end art NFTs. Afterwards, I transfer part of my portfolio to a hedge fund at Exponential Age Asset Management. Additionally, I have invested about 1% in various assets like dogwifhat, Dogecoin, and Bonk. However, this investment rate only amounts to 1%… To be clear, my exposure to memecoins and other assets covers only 1% of my portfolio. I have invested 80% in Solana.”

Why So Much Investment in Solana

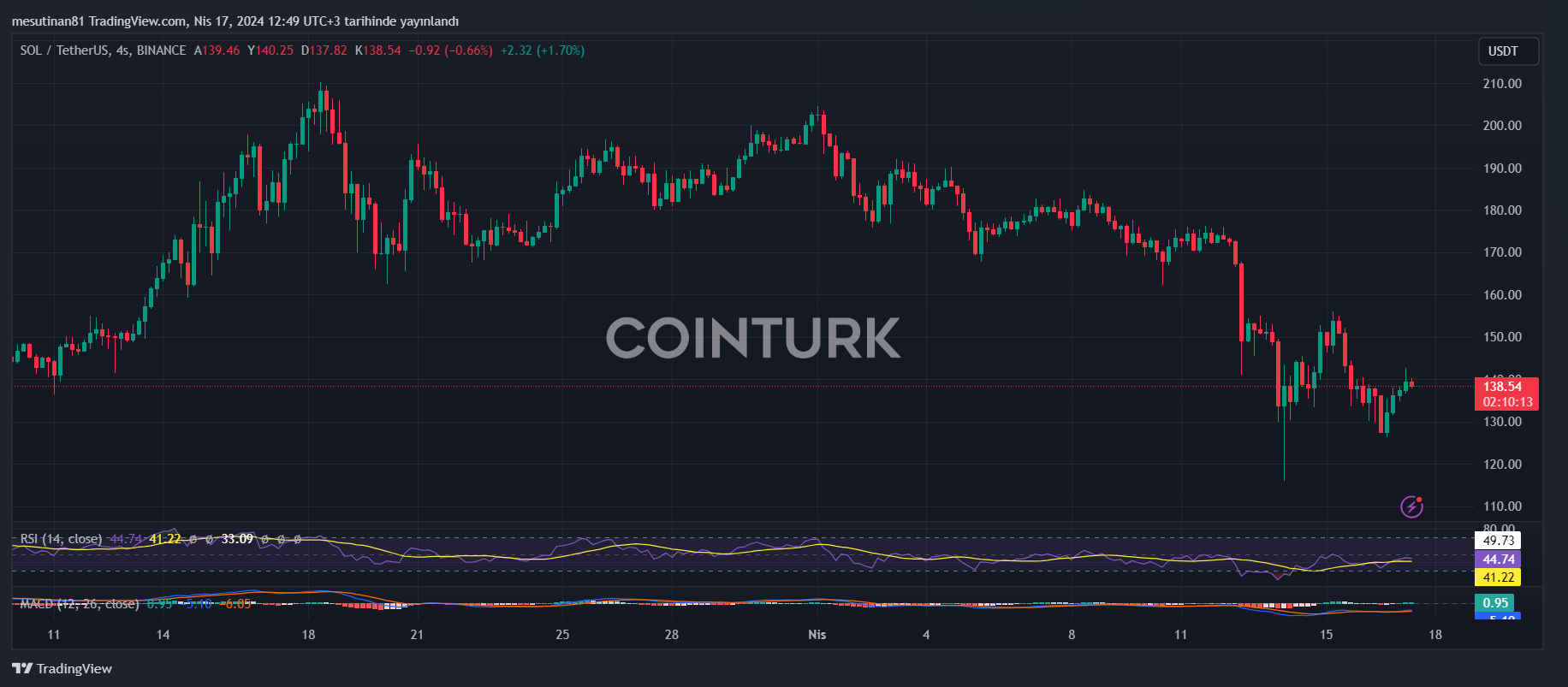

The former Goldman Sachs executive discussed the reason behind his significant investment in Solana, pointing to a specific chart.

“In 2022, the Solana/Ethereum chart was quite striking. This chart led me to invest in Solana around September 2020 and eventually switch entirely to Solana. I just invested in Solana earlier.”

Currently ranked among the top 10 in the cryptocurrency world, Solana is trading at $139. This indicates an increase of over 1,240% from its 2022 closing price of approximately $9.89.

During the same time frame, Ethereum, the leader of altcoins in the cryptocurrency world, climbed from its 2022 closing price of approximately $1,200 to its current price of $3,062. This represents an increase of about 155%.

Türkçe

Türkçe Español

Español