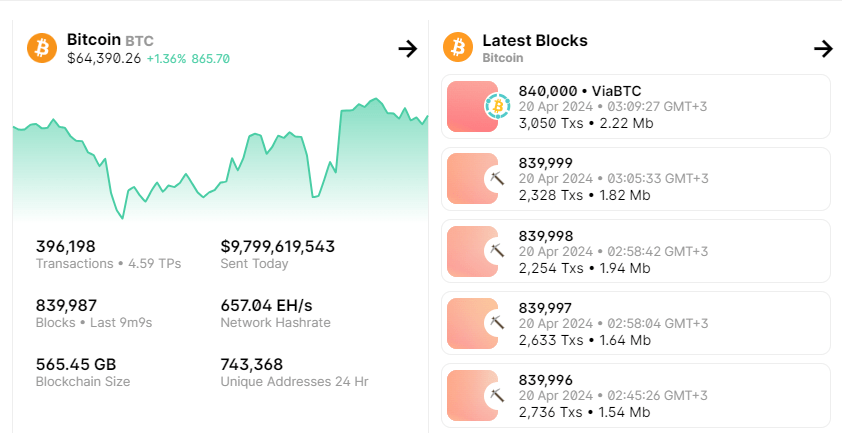

After high expectations, the Bitcoin (BTC) block reward halving event was successfully carried out in the early hours of the day, reaching another milestone in the life cycle of the cryptocurrency. This event, which occurs approximately every four years, reduces the mining reward by half, thereby decreasing the rate of new BTC creation by 50%. According to data from leading analysis platforms such as Mempool.space and Blockchain.com, the block reward halving took effect precisely at 03:09 AM, at block 840,000.

Expert Opinions Post Bitcoin Halving

With the completion of Bitcoin‘s 4th block reward halving, daily miner rewards have dropped from 900 to 450 BTC. Analysts consider the reduction in new BTC supply entering the market as a catalyst that might drive up the price of the largest cryptocurrency. Additionally, the ongoing strong demand for spot Bitcoin ETFs, as mentioned by Bitcoin-supportive legislators like Senator Cynthia Lummis, is expected to further boost the upward momentum.

However, leading financial institutions such as JPMorgan and Deutsche Bank have presented a contrary view, suggesting that the market has already priced in Bitcoin’s block reward halving. Kok Kee Chong, CEO of the Singapore-based cryptocurrency exchange AsiaNext, also pointed out the limited price movement following the halving, indicating its anticipated nature.

The industry now awaits potential strong price rallies in Bitcoin and altcoins in the coming weeks and months, supported by continued institutional investor interest.

What’s Next for Bitcoin?

Although the general outlook for Bitcoin post-halving remains positive, broader macroeconomic factors indicate significant challenges. Signals from the U.S. Federal Reserve (Fed) about pausing interest rate cuts and increasing geopolitical tensions in the Middle East are affecting investor sentiment in the short term. Moreover, the block reward halving has a notable impact on Bitcoin mining companies, potentially affecting their revenue streams significantly. While the halving could reduce miners’ annual revenues by billions of dollars, the largest cryptocurrency could mitigate this impact if it maintains its upward price trajectory.

Looking ahead, Bitcoin’s price might face selling pressure from miners wanting to compensate for post-halving revenue losses in the coming weeks. Despite short-term fluctuations, long-term investors are advised to consider historical models showing that peak prices typically occur 518-546 days after a halving, suggesting potential accumulation during dips. If this trend continues, Bitcoin is expected to reach its next peak around September-October 2025.

Current data shows BTC has risen 3.34% in the last 24 hours to $64,175. Data indicates the largest cryptocurrency’s price has dropped 5.22% over the last 7 days but has risen 5.20% over the last 30 days.

Türkçe

Türkçe Español

Español