Bitcoin halving has taken place and we have not yet experienced the rapid declines that cryptocurrency investors feared. The largest spot Bitcoin ETF issuer, Grayscale, is making a new move. This initiative, which caught the attention of Bloomberg ETF analyst Eric, could be a good alternative for investors. Here are the details.

Coming Soon: GBTC Mini Version

Grayscale Investments announced that a mini version of the Grayscale Bitcoin Trust (GBTC) exchange-traded fund will soon be launched. With the new fund, investments can be made at much more attractive rates than the current GBTC transaction fees. In fact, Grayscale also announced that it will have the lowest transaction fee among all spot Bitcoin ETFs.

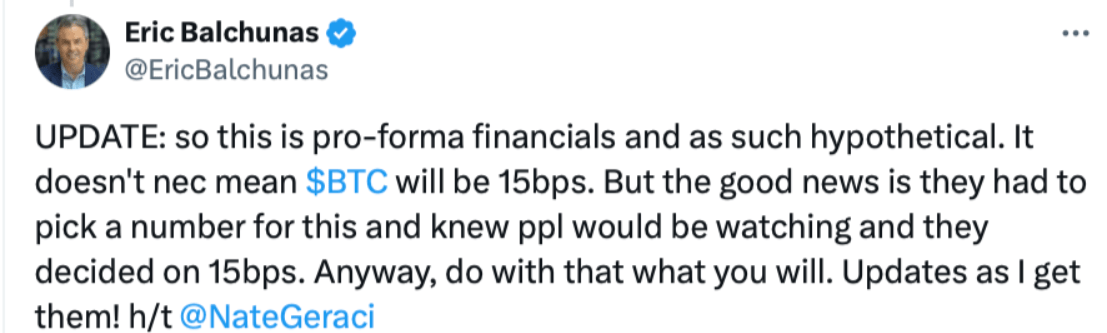

Bloomberg ETF analyst Eric Balchunas recently wrote on his social media account;

“These are pro-forma financials and therefore hypothetical.”

This means that investors should not get their hopes up based on details that are still open to revision on paper.

“The good thing is that they had to set a transaction fee. They settled on 15bps, and this is intriguing.”

Application documents submitted to the United States Securities and Exchange Commission state that the transaction fee for the Grayscale Bitcoin Mini Trust (BTC) has been set at 0.15%. For GBTC, these fees are 1.5%.

Will Cryptocurrencies Rise?

The loss of interest in the ETF channel was related to bankruptcies, macroeconomics, and regional tensions. However, we are seeing these issues gradually being resolved. On April 19, ETFs saw net inflows again. The recent step taken by GBTC can also be considered positive for the demand in the ETF channel.

Apollo’s CEO Thomas Fahrer recently stated on his social media account that Grayscale needs to balance the major GBTC outflows by offering a “cheap” alternative.

“Since the launch of Grayscale, it has lost 315,000 BTC in outflows and they need to close this gap.”

Since the launch date of January 11, GBTC investors have made net sales of $16.73 billion. However, despite this, all spot Bitcoin ETFs have seen over $12 billion in net inflows. This means that a significant portion of investors did not completely abandon BTC with the GBTC sale. If the expected rapid rise period begins in the coming months, the FOMO in the ETF channel could yield impressive results.