Bitcoin price experienced a rise early today, once again capturing the attention of investors. Amidst discussions about the Bitcoin halving and its potential impact on prices, analysts have focused on the possible long-term and short-term price scenarios. During this time, some cryptocurrency analysts have also expressed bullish views on Bitcoin’s price.

How Much Will Bitcoin Cost?

The rise in Bitcoin’s price early today seems to have contributed to the optimism following last week’s Bitcoin halving event.

While many analysts are optimistic about Bitcoin’s long-term outlook, some warn of possible price fluctuations in the short term.

In other words, it wouldn’t be wrong to say that market participants are carefully examining Bitcoin’s price outlook. Key market figures are not shy about sharing their views on the market’s future.

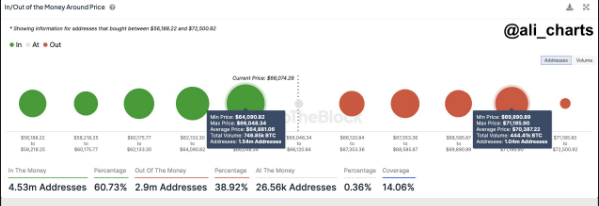

For example, well-known cryptocurrency analyst Ali Martinez recently shared an analysis stating that $66,000 is an important support level for Bitcoin.

Martinez also highlighted that a significant number of wallets, totaling 1.54 million, have purchased 747,000 BTC at this level, naturally turning it into a support.

On the other hand, Martinez sparked a discussion about Bitcoin potentially rising to $71,200 by pointing out a notable resistance level between $69,900 and $71,200.

The Future of Bitcoin

On the other hand, IntoTheBlock indicated that Bitcoin’s current position is in a significant demand zone.

After approximately 1.66 million wallets purchased Bitcoin at an average price of $64,800, it was stated that this level could act as support amid potential downward selling pressure.

Another cryptocurrency analyst, Kaptan Faibik, made a similar comment to Ali Martinez, emphasizing a positive outlook for Bitcoin and highlighting a bullish flag pattern on the daily chart.

Faibik noted that if this formation breaks upward, the price could move towards its all-time high again by May.

Meanwhile, as of writing, the Bitcoin price continues to trade at $66,050 following a 1.67% increase, with its volume over the last 24 hours up 14.63% to $25 billion.

Despite sharp declines before the halving, the recent rises in BTC have brought about a nearly 2% gain over the last 30 days.

Türkçe

Türkçe Español

Español