While preparing this article, BTC price was above $66,800 and increased roughly a thousand dollars after the US market opened. The below-expectation PMI data indicated an economic slowdown, which positively influenced risk markets. The optimistic sentiment could continue with upcoming quarterly earnings reports.

Why Is Bitcoin Rising?

BTC price experienced a $1000 increase within about an hour. We had mentioned that US service and manufacturing PMI data could trigger volatility. While the overly vibrant economic environment puts negative pressure on inflation, the data coming in below expectations signals a slowdown. If Friday’s PCE data also falls below expectations, we might see the macroeconomic pressure start to ease.

In an optimistic scenario, the Fed might start making more dovish statements, and the market could anticipate the first rate cut as early as the September meeting. Conditions are aligning for the Fed to comfortably reduce rates in anticipation of the post-halving rise. BTC could then climb to $69,000, $71,300, and eventually $73,777.

A strong bullish signal would be breaking and closing above the twice-tested $67,300 level. Throughout the week, earnings reports from Microsoft and others are expected to also support the stock markets, which could benefit crypto.

XRP Coin Price Prediction

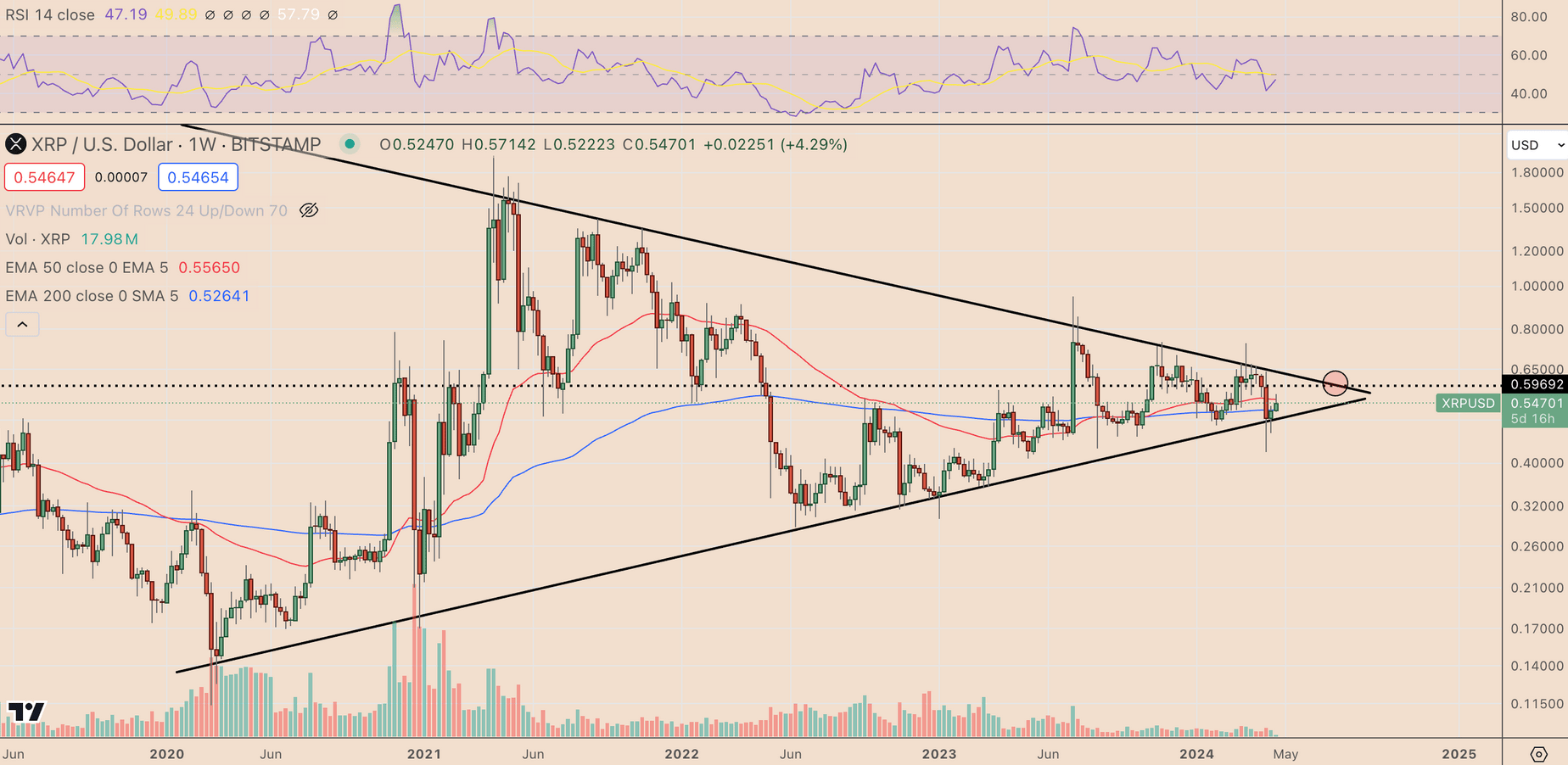

Technically, the recent rise in XRP is linked to maintaining a multi-year upward trend line. XRP Coin price, finding buyers above the 200-week EMA, is now preparing to retest the descending trend line resistance at $0.596. Closures above $0.556 are necessary for this to happen. Currently, the price is just $0.01 below this region, and if BTC continues to rise, a strong attempt could begin.

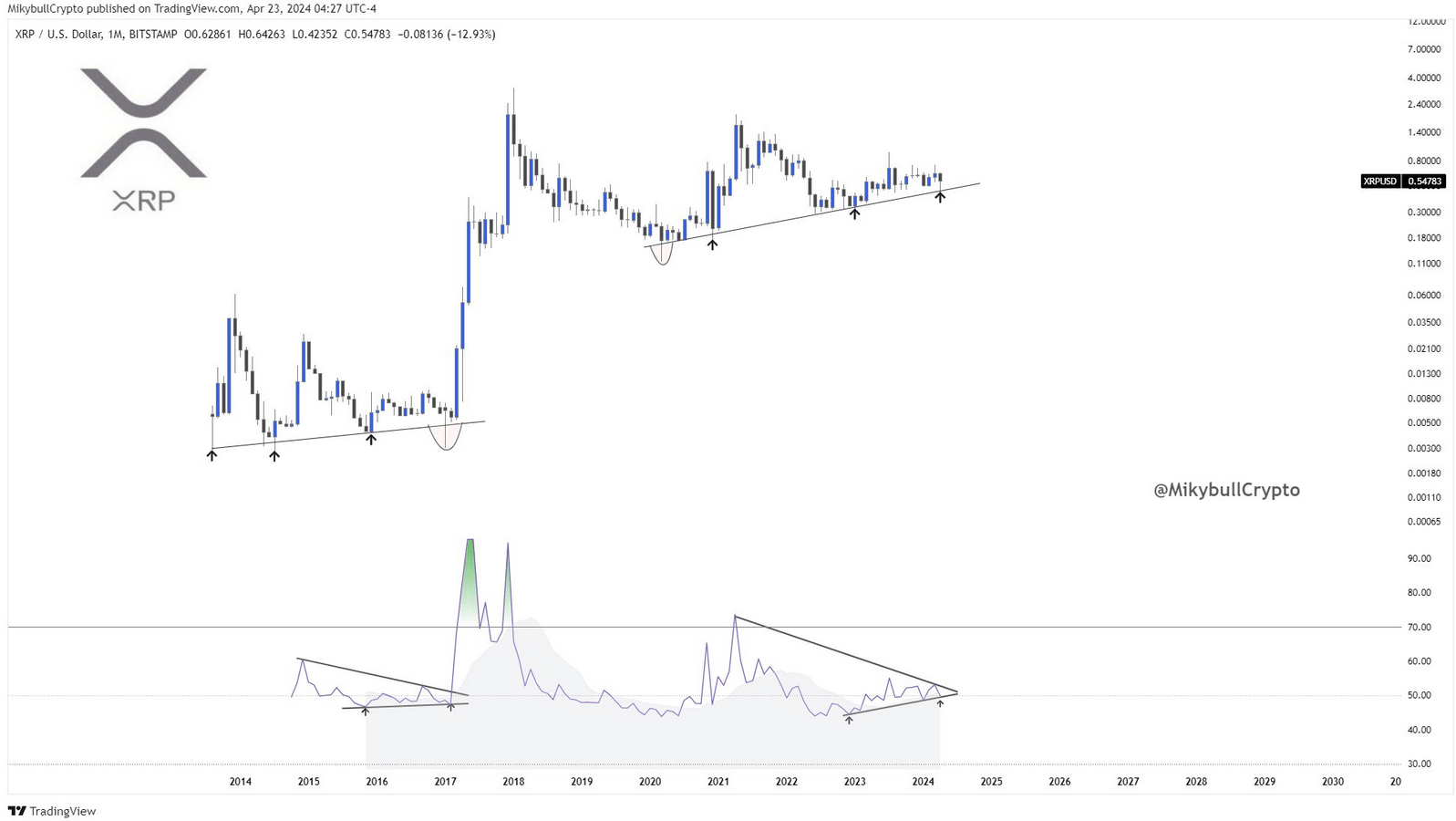

Known by the pseudonym Milkybull Crypto, a cryptocurrency analyst pointed out a fractal on the monthly chart in his latest assessment. According to this, XRP Coin price has been initiating rallies from the rising trend line since 2020.

During the 2014-2017 period, XRP Coin experienced impressive rises similar to today’s scenario. According to the analyst’s prediction, such a scenario could unfold in the coming months.

Türkçe

Türkçe Español

Español