Coinbase’s announcement of its financial performance for the first quarter of 2024 has led to varying expectations between the crypto community and traditional investors. Speculation is rising about whether the crypto community’s forecasts will prove more accurate than those of typical investment analysts, ahead of Coinbase’s financial results announcement on May 2nd. Here are some notable data and details regarding Coinbase.

What’s Happening at Coinbase?

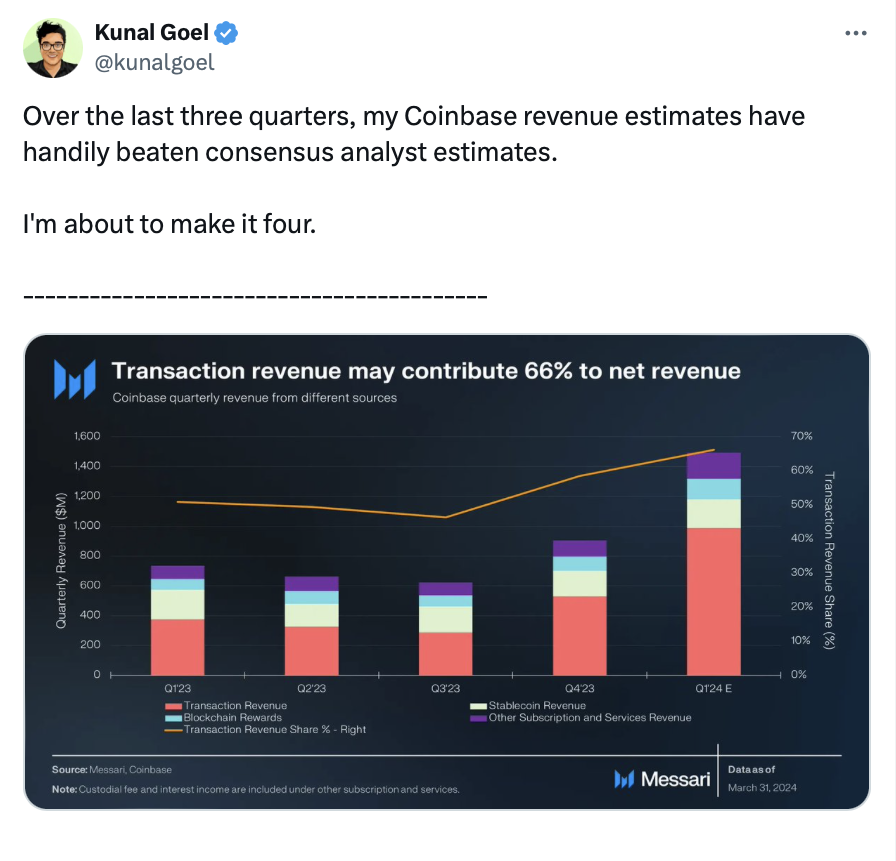

Crypto research firm Messari analyst Kunal Goel stated that Coinbase’s revenue forecasts have easily surpassed consensus analysts’ estimates over the last three quarters, and he mentioned in an X post:

“I estimate that Coinbase will grow by 65% in the first quarter of 2024, achieving $1.5 billion in net revenue. My estimate is much higher than the consensus forecast of $1.2 billion for gross revenue.”

According to a recent report by Zack’s Equity Research, Coinbase has now surpassed consensus estimates for earnings per share (EPS) as well as consensus revenue for the last four quarters. According to Tipranks, out of 24 consensus analysts tracking Coinbase (COIN), nine recommend buying, eleven suggest holding, and three advise selling.

Young Ko, former CFO of Polygon Labs, believes it is very likely that Coinbase’s earnings will exceed expectations. Ko also stated in a post on X on April 24th that several factors will only support the momentum ahead of the earnings report to be released on May 2nd.

These include hopes that Coinbase will announce a victory in its lawsuit against the United States Securities and Exchange Commission (SEC) and positive reports about the Layer-2 Ethereum protocol Base’s revenue. At the time of publication, COIN’s stock price was at $236.43, indicating a 4.67% increase for the day according to Google Finance, but reflecting a 15.47% decrease over the last 30 days.

Coinbase and Wall Street

Meanwhile, crypto commentator 0xCristian, stated in a post on April 16th that the success of Coinbase’s Layer-2 network Base will positively impact the first quarter earnings report of 2024, and he added:

“Set to significantly surpass fourth-quarter earnings, which will impact the stock price. Large volumes were seen for Base and Coinbase Wallet in the first quarter.”

Revenue from Base could be the X factor for Coinbase this last quarter, a common belief within the crypto community and this time. A factor mostly overlooked by Wall Street. According to investment research firm Fintel, Coinbase’s momentum score was recorded at 93.98, approximately 21.87 index points higher than Nvidia (NVDA) and 80.84 index points above Tesla (TSLA).

Türkçe

Türkçe Español

Español