Blockchain analytics platform CryptoQuant’s CEO suggests that new crypto whales are purchasing Bitcoin (BTC) at a faster rate compared to long-term holders. CryptoQuant CEO Ki Young Ju made critical remarks about Bitcoin’s older whales.

Whale Activity in Bitcoin

Ki Young Ju told his followers on social media platform X that the initial investment made by new whales into Bitcoin is nearly double that of the total held by old whales. The analytics platform manager defines “new” short-term Bitcoin owning whales as addresses containing at least 1,000 Bitcoins with an average cryptocurrency age of less than 155 days. He emphasized that “old,” long-term Bitcoin owning whales have an average cryptocurrency age of 155 days or more, holding at least 1,000 Bitcoins. Young Ju also excludes miner and central exchange addresses from both categories.

CryptoQuant CEO also noted that BTC‘s average inactivity recently reached a 13-year peak, indicating that old Bitcoins are being transferred to new holders, and stated the following:

The ceiling chart for Bitcoin is changing and potentially altering the ownership landscape. Who are the new major accumulators?

BTC Profit Analysis

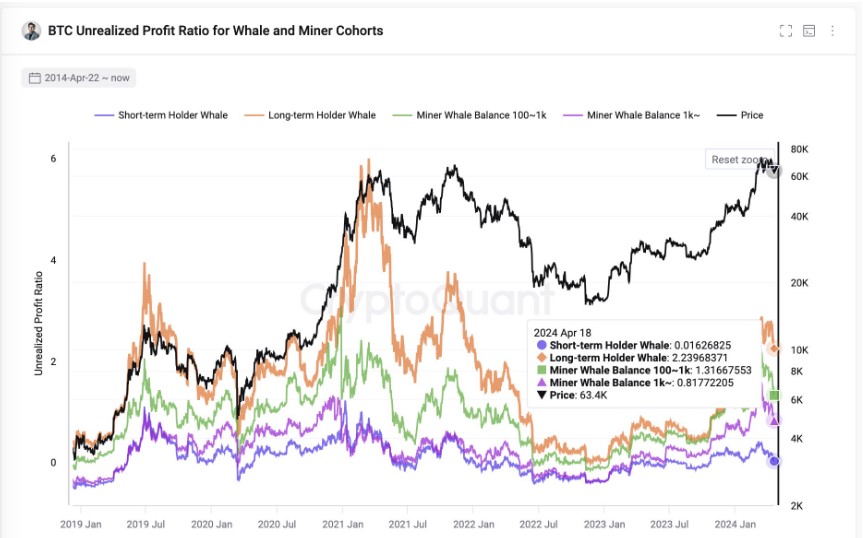

Young Ju also analyzed unrealized BTC profits within the current market cycle, concluding with the following remarks:

Unrealized profits for Bitcoin’s on-chain cohorts: old whales: +223%, new whales (TradFi/ETFs (exchange-traded funds)): +1.6%, small miners: +131%, large miners (mining companies): +81%. In my view, these profits are not sufficient to end this cycle.

The leading cryptocurrency, Bitcoin, was trading at $64,222 at the time of writing. The top-ranked cryptocurrency by market value has seen a decline of more than 3% in the last 24 hours, while it has increased by more than 5% over the past week.