Crypto asset investment manager Pantera Capital plans to raise over $1 billion for a new fund that will offer investors the full spectrum of blockchain-based assets. Scheduled for launch in April 2025, Pantera Fund V will serve as the firm’s all-in-one fund, with slight modifications from the existing Liquid Token Fund, Early Stage Token Fund, Bitcoin Fund, and Venture Funds.

Pantera’s Notable New Step

The fund requires a minimum allocation of $1 million from qualified investors and plans its first close on April 1, 2025. According to a report by Bloomberg on April 25, limited partners will need to contribute at least $25 million. According to Pantera’s website, initial capital, early-stage tokens, and liquid tokens will be included in the asset types for Pantera Fund V.

Currently, Pantera manages a total of $5.2 billion across its four funds. This will be the largest increase of $1 billion for the cryptocurrency industry since Silicon Valley-based venture capital firm Andreessen Horowitz raised a record-breaking $4.5 billion in May 2022.

VC firm Paradigm is also reportedly negotiating to raise up to $850 million for a new cryptocurrency fund; this move, along with Pantera, could signal more institutional capital returning to the sector following the market’s recovery in 2023.

Investment Process Accelerates in Crypto Market

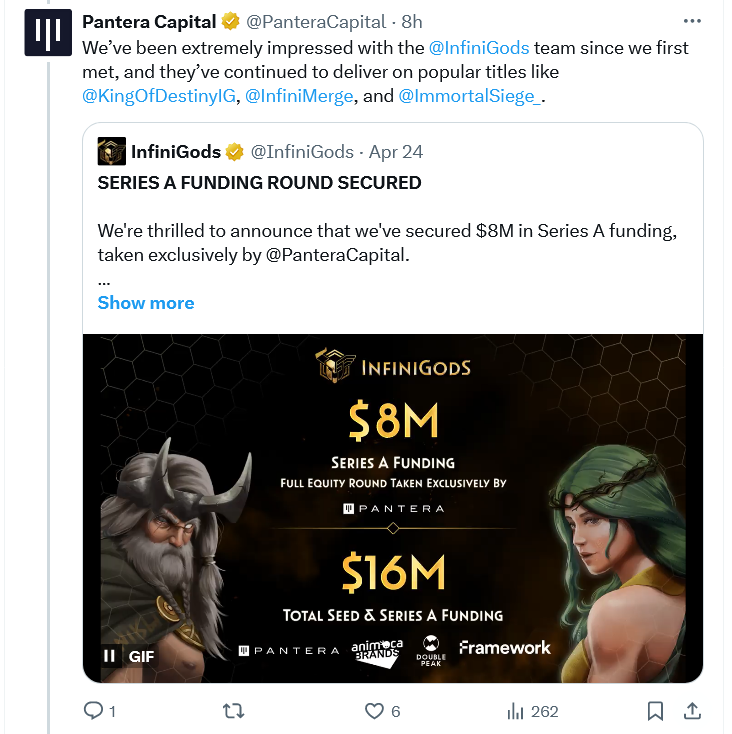

Last week, venture capital firm Andreessen Horowitz announced raising $7.2 billion to invest in various technology-focused sectors including GameFi and artificial intelligence, though its $4.5 billion cryptocurrency-focused fund did not receive any additional capital. Meanwhile, Pantera doubled its investments in the GameFi platform InfiniGods, announcing only an $8 million Series A round on April 25.

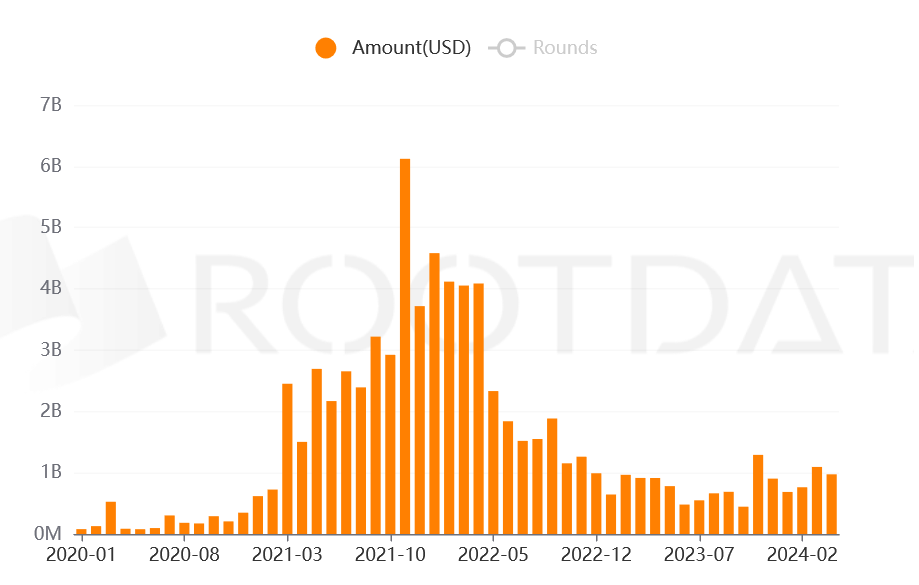

So far in 2024, over $3.5 billion has been raised in 604 financing rounds in the cryptocurrency industry. According to RootData, if the current trend continues, this year’s financing could significantly surpass the $9.3 billion raised in 2023. Despite recent increases, venture capital financing is still far from the previous highs of $31.2 billion and $29.3 billion recorded in 2021 and 2022, respectively.