Altcoin projects are searching for recovery while Bitcoin managed to rise above $64,000 before the April 28 weekly close. Data from TradingView followed stronger Bitcoin price momentum over the weekend. After hitting a weekly low of $62,400, the BTC/USD pair reversed and continued trading around $63,700 at the time of writing.

What’s Happening on the Bitcoin Front?

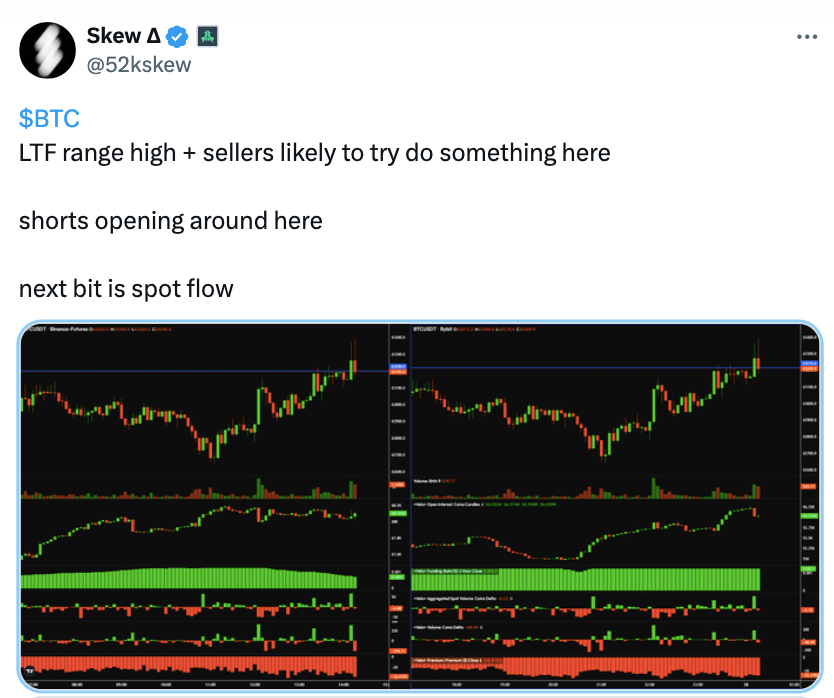

Altcoin projects also performed well in off-hours trading, with the total altcoin market value increasing by about 1% during the day. Popular analyst Skew referred to recent market models via X, stating:

“Altcoin projects made a nice rise but still need to break the tendency to set the highest levels of the week from Monday to Tuesday.”

Skew still suspected that selling pressure could interfere around high levels, preventing bulls from moving much higher.

Continuing his comments on altcoin projects, trader and commentator Moustache was eager to predict that a significant altcoin season could be entering, which could rival anything seen since the market’s all-time highs in 2017.

The famous analyst argued that the monthly dominance chart of the largest stablecoin Tether, which attempted to recover after falling below a rising trend line this year, was just a retrospective test, commenting:

“When USDT.D falls, altcoin projects rise. The biggest Altseason since 2017 is loading.”

Comments on Bitcoin from Prominent Figures

Many crypto analysts awaited the start of TradFi transactions, including Bitcoin futures, for more clues on the direction of the crypto market. Daan Crypto Trades told his followers via X that the weekend price action has been very good so far, stating:

“We are doubtful of seeing any significant movement in Bitcoin until CME reopens.”

Despite consolidating in a range below the all-time highs of the previous cycle, Bitcoin did not disappoint. Investor Alan Tardigrade found the monthly BTC/USD pair promising, stating:

“On the monthly chart, Bitcoin still stands above the triangle’s peak, indicating a bullish trend. A long and solid bull run needs consolidation to build.”

An accompanying graph compared Bitcoin to the pre-breakout period of the Nasdaq Composite Index (IXIC) in 2013.