Bitcoin community grows increasingly concerned as BlackRock’s spot Bitcoin exchange-traded fund (ETF), iShares Bitcoin Trust (IBIT), has not recorded any new entries since April 24th. This marks the first time since its launch that the fund has paused inflows for several consecutive days.

Noteworthy Period for BlackRock

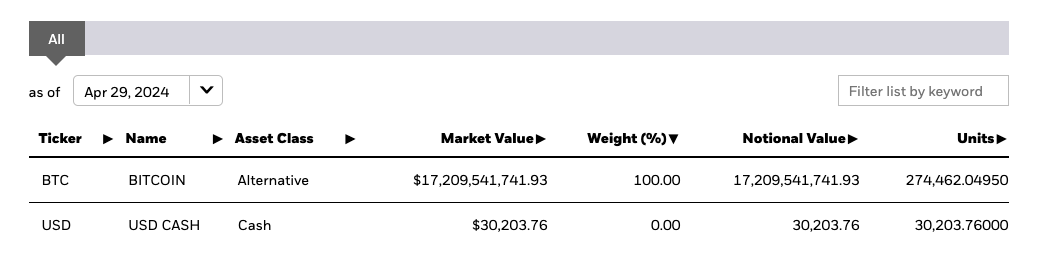

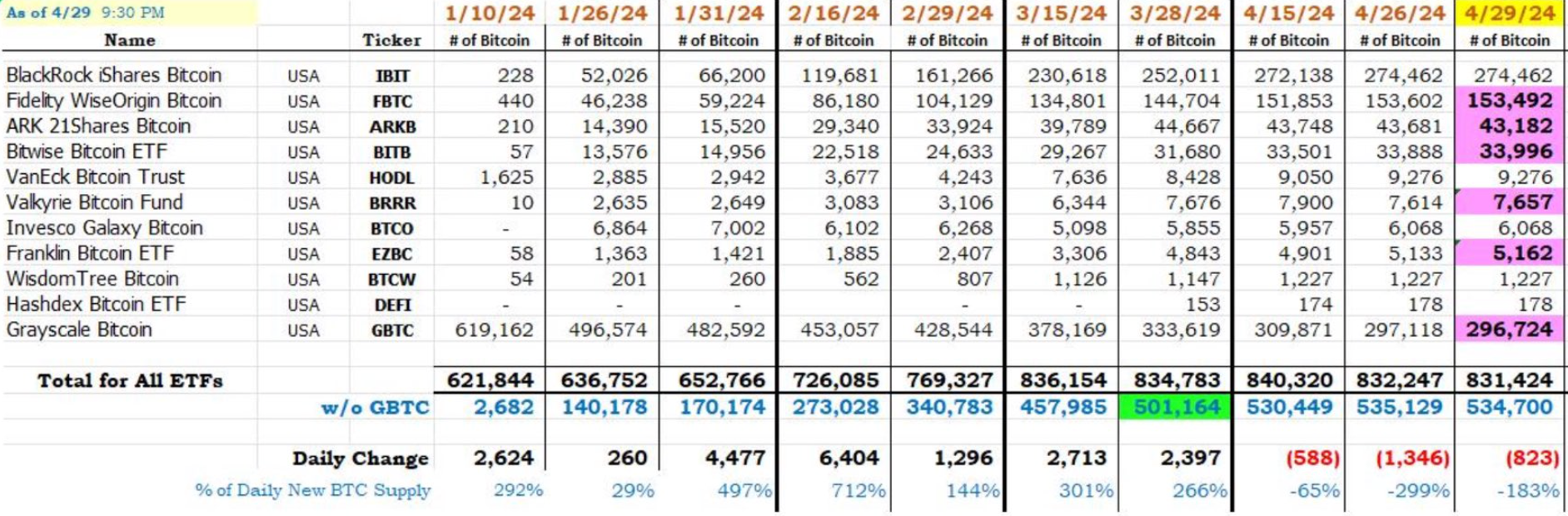

According to data on IBIT’s official page, the fund maintained the same 274,462 Bitcoins over the last four trading days. BlackRock halted IBIT’s 71-day streak of entries on April 24, and the fund’s previous consistent daily new investments have triggered some concerns. Starting with just 2,621 Bitcoins on January 11, IBIT increased its assets by 10,378%.

Some crypto observers expressed concerns about the halt in entries to IBIT, suggesting that such an event is not a good sign for investors. Other industry activists implied that BlackRock’s 71-day entry streak was far more unusual compared to the recent four days with zero entries. Apollo co-founder Thomas Fahrer shared his thoughts on the matter:

“For new Bitcoins to enter or exit an ETF fund, there must be a significant mismatch between supply and demand; so much so that market makers must organize the creation or destruction of creation units. This is not unique to Bitcoin ETFs; ETFs generally operate this way. Most ETFs will record zero entries on most days, and BlackRock’s positive flow trend is an exception to this rule.”

What’s Happening in the ETF Space?

BlackRock’s period of zero entries comes at a time when other ETF issuers, including major seller Grayscale Investments, continue to see exits from their spot Bitcoin ETF funds. According to data from HODL Capital, on April 20, there was a total daily exit of 823 Bitcoins from 10 spot Bitcoin ETFs in the US. On that day, Grayscale Bitcoin Trust ETF (GBTC) held 297,117 Bitcoins, a 52% decrease from before.

Compared to BlackRock’s 274,462 Bitcoins, Grayscale’s GBTC fund currently holds only about 8% more. Despite the slowdown in US spot Bitcoin ETF entries, the funds still remain in a positive territory in terms of total asset changes since trading began. As of April 29, total Bitcoin ETF assets have increased by approximately 33.1% since January 11, reaching 831,424 Bitcoins.

Türkçe

Türkçe Español

Español