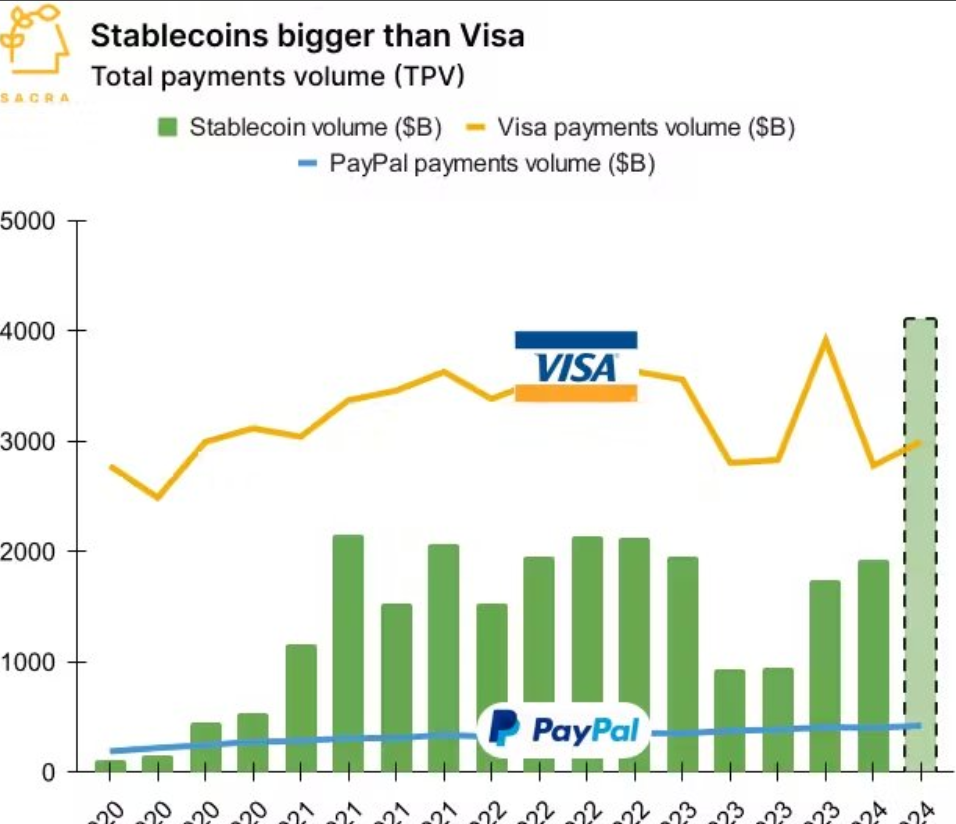

This quarter, it seems likely that stablecoin volumes will surpass those of Visa. According to research firm Sacra, the total payment volume of stablecoins could exceed that of Visa. However, Visa’s crypto head, who disagrees with this view, does not believe stablecoins will achieve this success.

Suitable for Cross-Border Payments

In a blog post written by Sacra’s co-founder Jan-Erik Asplund, the firm emphasizes that stablecoins are an extremely suitable solution for cross-border money movements. According to Asplund, the total payment volume of stablecoins could even surpass Visa, reaching over 4 trillion dollars.

Asplund states that stablecoins facilitate cross-border payments and offer a service not limited to business days, enabling payments to be completed within minutes. Additionally, the low cost of stablecoins stands out; they offer a much more economical option compared to traditional methods.

According to Asplund, today, every major bank is using stablecoins in their payment infrastructures to make transactions more efficient. This situation shows that stablecoins are increasingly being accepted and adopted in the financial world.

Are Stablecoin Transactions Not Performed by Real Users?

Visa‘s crypto head, Cuy Sheffield, mentioned that there is “intense noise” behind the data on stablecoin transactions and argued that these transactions, carried out through automated programs and bots, are not “traditionally acceptable”.

According to a dashboard recently launched by Visa, it is claimed that 90% of stablecoin transactions in the last 30 days were not made by real users.

Stablecoin Transaction Volume in April

In April, the total stablecoin transaction volume reached approximately 2.2 trillion dollars. However, only less than 10% of this volume, namely 149 billion dollars, was classified as transactions actually made by credit companies. The remaining large portion consisted of automated transactions conducted by bots and organizations such as centralized exchanges.

At the end of April, Visa announced a collaboration with Allium Labs to develop a revised stablecoin transaction metric for a dashboard. The company states that the purpose of this new metric is to eliminate potential distortions that could arise from inorganic activities and other artificial inflationary practices. This aims to achieve more accurate and reliable stablecoin transaction data.