Hong Kong saw the first outing of spot Bitcoin exchange-traded funds (ETFs) on April 30, after they started trading on the Hong Kong Securities Exchange. On May 6, the spot Bitcoin ETF from China Asset Management, ChinaAMC, experienced its first daily outflow.

ChinaAMC’s Spot Bitcoin ETF Records an Outflow of 75.36 BTC

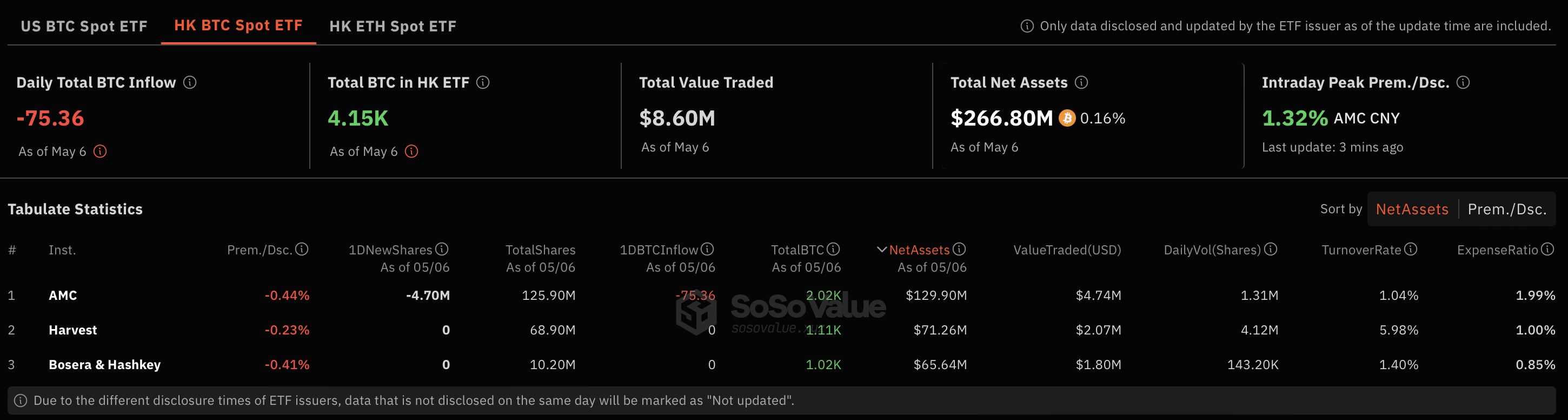

According to data, on May 6, China Asset Management’s spot bitcoin ETF, ChinaAMC, saw an outflow of 75.36 BTC. The other two ETFs saw zero entries. This followed the three spot Bitcoin ETFs’ first trading day, which recorded an entry of 3,910 BTC, according to SosoValue’s data.

SosoValue noted that physical BTCs purchased through in-kind subscriptions for ETF shares do not create a cash entry in US dollars, hence they are not included in the daily net entry statistics. Instead, the company uses the Bitcoin-Flow metric, which measures the actual number of BTCs that entered or exited all ETFs on a specific trading day.

According to the data provider, as of May 6, the three spot Bitcoin ETFs managed by ChinaAMC, Harvest, and both Bosera and HashKey hold approximately 4,150 BTC. The total asset value in the funds, which was $247.7 million on the first trading day, is now at a net level of $266.8 million.

Farside Investors‘ data also points to similar figures, confirming the data provided by SosoValue. According to Farside Investors, on May 6, ChinaAMC’s spot Bitcoin ETF saw an outflow of $4.9 million, while the other two ETFs saw zero entries.

ETFs Reach a Trading Volume of $8.6 Million

According to SosoValue, the total trading volume for the three spot Bitcoin ETFs in Hong Kong reached $8.6 million on May 6. The total trading volume recorded by spot Bitcoin ETFs on May 3 was $8.01 million.

Meanwhile, spot Bitcoin ETFs in the US saw a net entry of $217.06 million on the same day, with Grayscale’s converted GBTC spot ETF seeing its second daily net entry.