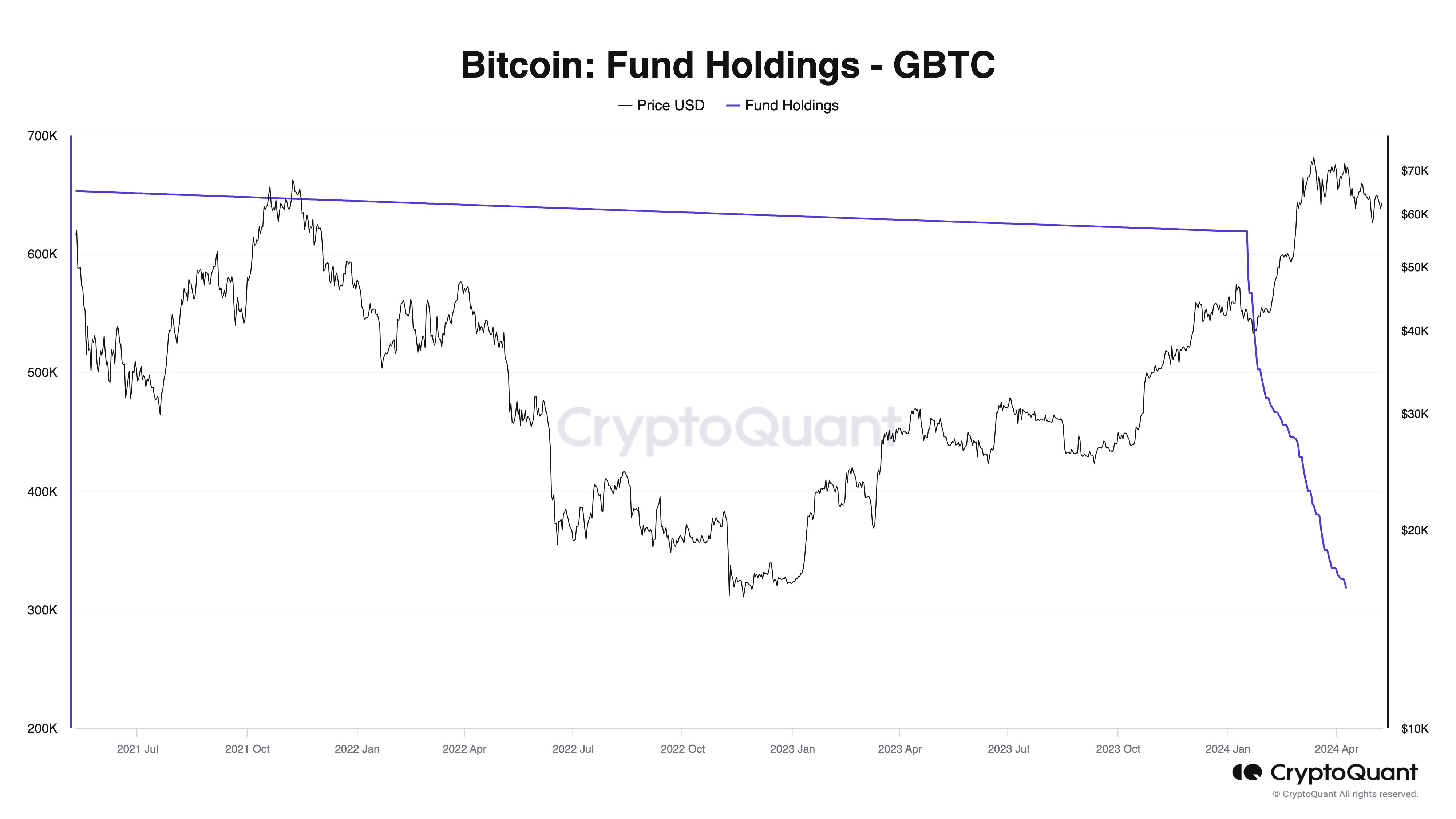

Digital Currency Group (DCG) saw an increase in revenue in the first quarter of 2024, influenced by a recovery in the crypto ecosystem. In a letter to shareholders, the crypto-focused holding reported a 51% increase in revenue to $229 million. Despite a $17.4 billion outflow from the Bitcoin fund since its conversion into an exchange-traded fund in January, Grayscale’s revenue remained stable throughout the quarter.

DCG First Quarter Report Released

The asset manager generated $156 million in revenue thanks to rising asset prices, offsetting losses in managed assets. The fund outflows at Grayscale were due to increased competition among issuers of Bitcoin ETFs offering lower management fees.

While the Grayscale Bitcoin Trust (GBTC) charges a 1.5% management fee, other funds like the Bitwise Bitcoin ETF (BITB) charge 0.2%. The following statements were included in a letter made public by Digital Currency Group:

“While Grayscale anticipates outflows amid increasing competition under the ETF umbrella, the revenue attributed to GBTC in the first quarter still exceeded our expectations.”

Data from YCharts shows that as of May 9, the total assets managed by GBTC exceeded $18.1 billion.

Notable Details for DCG

Other businesses under DCG also reported an increase in revenue during the quarter. The crypto mining pool Foundry’s revenue increased by 35% to $51 million, influenced by staking services and equipment sales. The investment platform Luno’s revenue rose by 46% to $16 million, driven by high transaction volumes.

The holding faced regulatory challenges in the United States. The New York Attorney General (NYAG) recently expanded a fraud lawsuit demanding $3 billion in damages against DCG, CEO Barry Silbert, and the former CEO of Genesis Global Capital, Soichiro Moro.

NYAG accuses the companies of defrauding over 230,000 investors of more than $1 billion through the Gemini Earn program. According to the initial complaint, the lawsuit aims not only to compensate for investment losses but also to ban Gemini, Genesis, and DCG from operating in New York.

Türkçe

Türkçe Español

Español