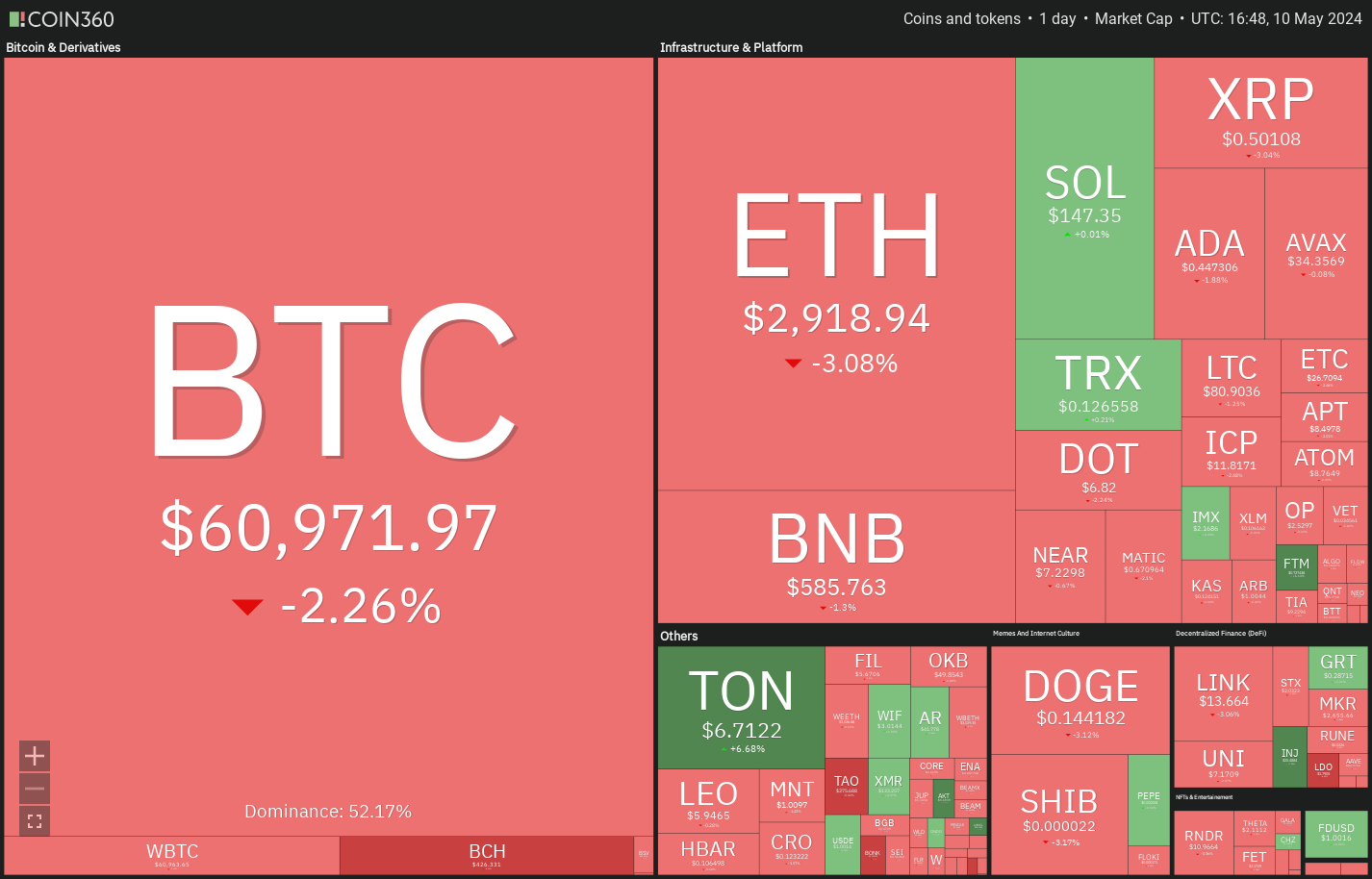

Bears and bulls fight for dominance while Bitcoin continues to search for direction. Glassnode founders Jan Happel and Yana Allemann believe the price will move upward and expect a significant rise on the Bitcoin front in a post.

The uncertainty about the next direction move has not stopped whales from buying. Blockchain data analytics firm Santiment said in a post that whale wallets holding between 1,000 and 10,000 Bitcoins bought approximately $941 million worth of Bitcoin within a 24-hour period.

Bitcoin’s long-term investors seem not to worry about near-term range-bound movements. Twitter co-founder Jack Dorsey, in a recent interview with journalist Mike Solana, said Bitcoin could rise to at least $1 million by 2030 and could even exceed this level thereafter.

Bitcoin bulls are trying to keep the price above the psychological support of $60,000 but faced selling at the 20-day exponential moving average of $62,959. Downward moving averages and a relative strength index (RSI) in the negative zone indicate bears have the upper hand. If the $59,650 support breaks, the BTC/USDT pair could drop to $54,298, which is the 61.8% Fibonacci retracement level.

If the price rises above the 50-day simple moving average of $65,620, this negative view may become invalid in the near term. The pair could then accelerate towards the critical overall resistance of $73,777.

Ethereum has been trading between the EMA 20 average of $3,087 and $2,850 for a few days. Falling moving averages and an RSI in the negative zone indicate an advantage for sellers. A break and close below $2,850 would signal the resumption of the downtrend. The ETH/USDT pair could collapse to the channel’s support line.

The region between the 20-day EMA and the resistance line is likely to serve as a critical resistance. Buyers will need to push the price above this region to suggest a potential trend change, after which the pair could rise to $3,350.

Türkçe

Türkçe Español

Español