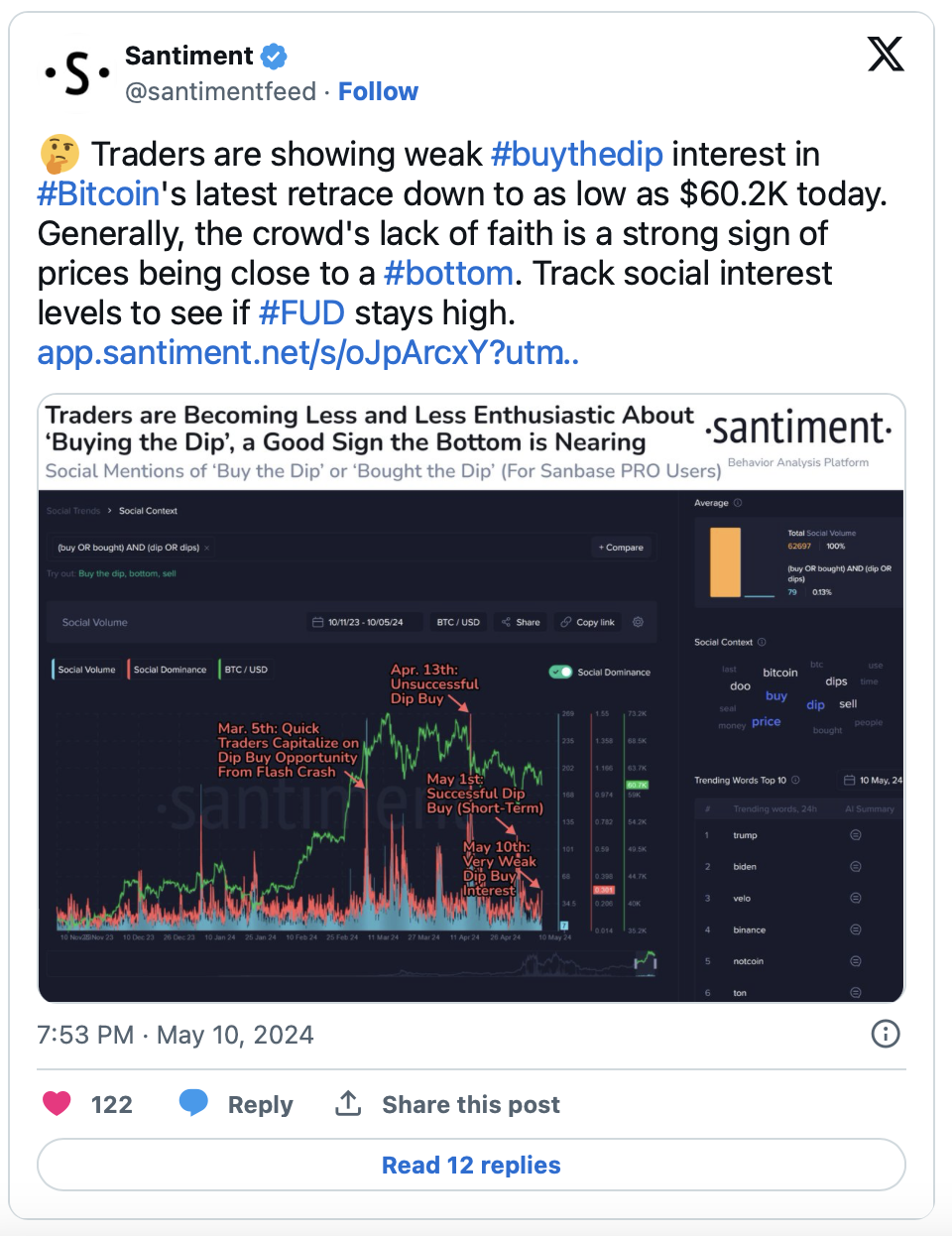

Bitcoin (BTC), has been on a downward trend since reaching an all-time high in March. Crypto analytics firm Santiment indicated that the rapid decline on May 10th showed a decrease in buyer interest at lower levels, suggesting that prices might be nearing a bottom. Analysts at Bitfinex believe the stagnation could continue until the beginning of summer, with the possibility of a significant rally in the second half of the year.

Testing Phase for Bull Market Beliefs

The current consolidation period in the cryptocurrency market has tested investors‘ beliefs that a bull market might be restarting. Despite continuous rally attempts over the past few weeks, all these attempts have been met with sales. Bitcoin recently fell about 5% from $63,000 to just over $60,000 on May 10th due to discouraging inflation expectations from the US and hawkish comments from Federal Reserve policymakers.

On-chain activity shows a significant decrease in transactions within the Bitcoin network. The second largest cryptocurrency, Ethereum, becoming inflationary also indicates low participation in the network. This current consolidation phase reflects the action observed from April to September 2023, where Bitcoin stayed between $25,000 and $30,000 for six months, eventually sustaining a rally to reach an all-time high in March 2023.

Charles Edwards, founder of cryptocurrency hedge fund Capriole Investments, described Bitcoin’s current state as a “deathly boredom” phase and suggested that this consolidation period could last between one to six months. Just before the end of the consolidation period, common sentiments like the block reward halving being priced in, the end of the bull market, and selling to buy at the bottom are expected to bring the lowest sentiment.

Crypto analytics firm Santiment noted that investors showed weak “buy-the-dip” interest during Bitcoin’s recent pullback, indicating a lack of confidence among investors. According to Santiment, this could be a sign that the price is near the bottom.

Bitfinex Analysts: Uncertainty May Continue Until June

On the other hand, analysts at the Bitfinex exchange predict that the market stagnation could continue until early summer, expecting the uncertainty to persist until the Federal Reserve effectively reduces quantitative tightening in June.

However, they believe that the ongoing strength in Bitcoin following the last FOMC meeting, combined with weak job market data and a weakening US dollar, could set the stage for a highly bullish third and fourth quarter for Bitcoin, potentially signaling a new trend in the market.

Türkçe

Türkçe Español

Español