After a significant rise in the weekly chart, Render experienced a setback as the entire crypto market began to decline. However, in the last few hours, the token chart turning green has recaptured investor interest. Does this mean RNDR is poised to continue its bull rally soon? We explore this with notable data and RNDR chart analysis.

What’s Happening on the RNDR Front?

According to CoinMarketCap, RNDR investors experienced a volatile period last week with the AI-focused token price increasing by about 20% and facing a correction on May 11. The token’s daily chart has turned green again, indicating that the downward price trend did not last long. At the time of writing this article, Render was trading at $10.90 with a market value of over $4.2 billion.

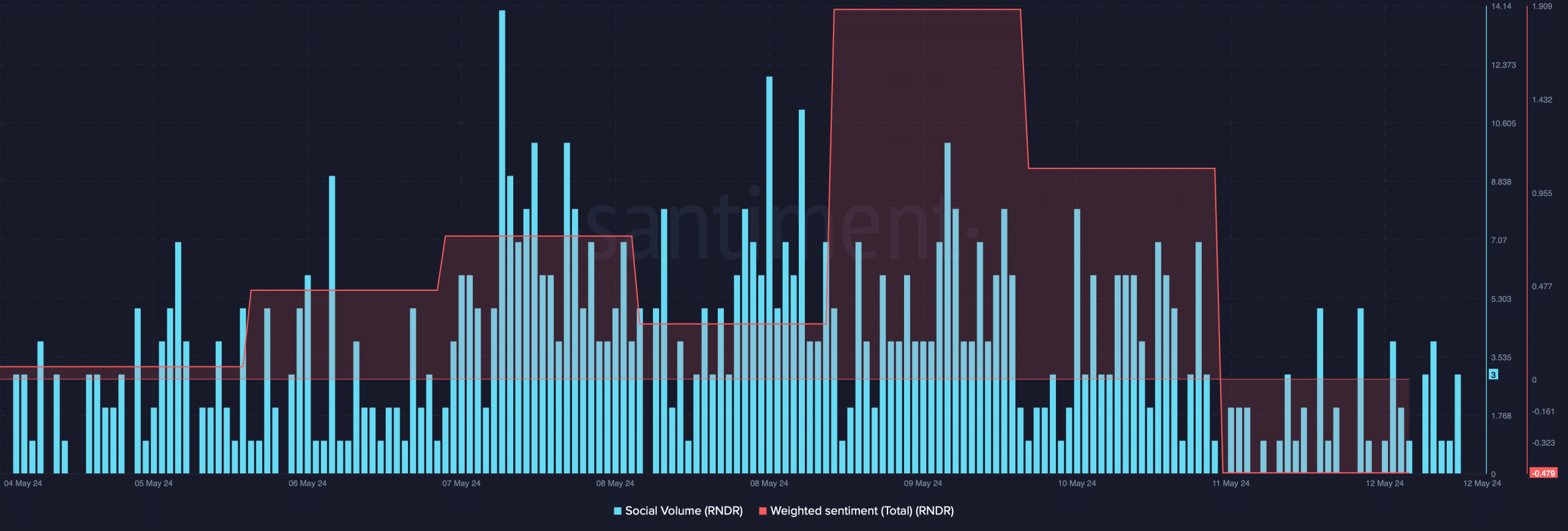

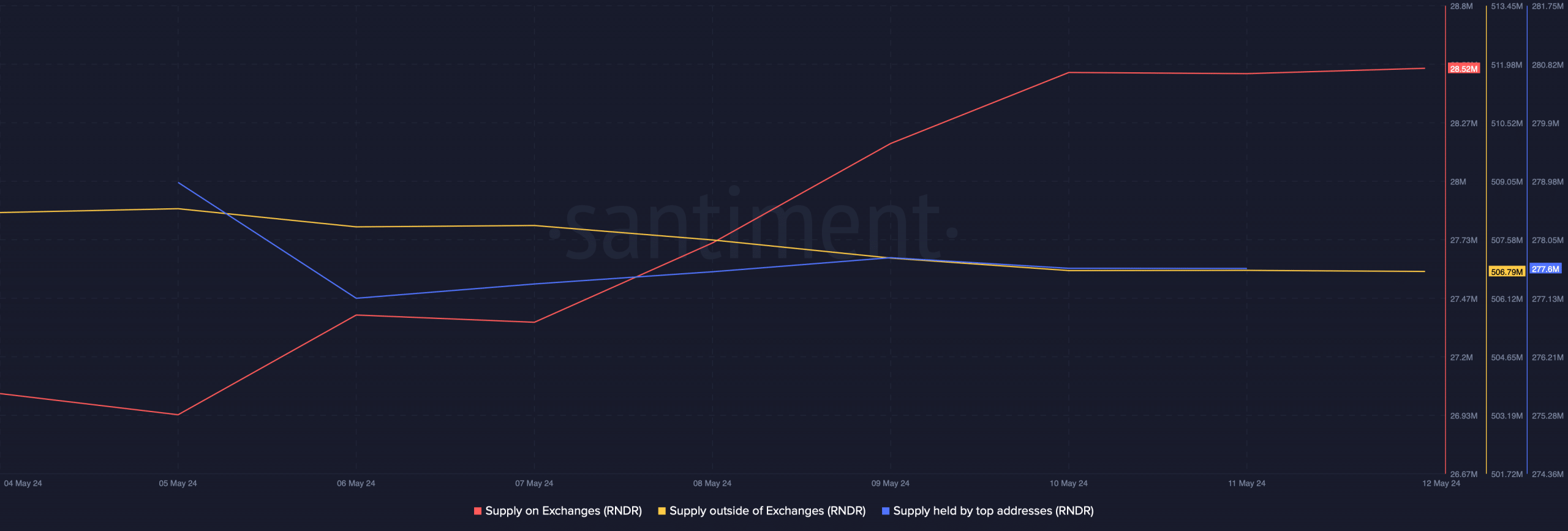

While the token price continued to rise over the week, investors might have thought this step was the peak of the market as token sales began. Analysis related to Santiment data revealed that the supply of RNDR on exchanges significantly increased last week.

Meanwhile, the decrease in supply outside of exchanges further highlights the high selling pressure. Additionally, the supply held by Render’s top addresses also decreased slightly, indicating that the major players in the crypto market were selling.

RNDR Chart Analysis

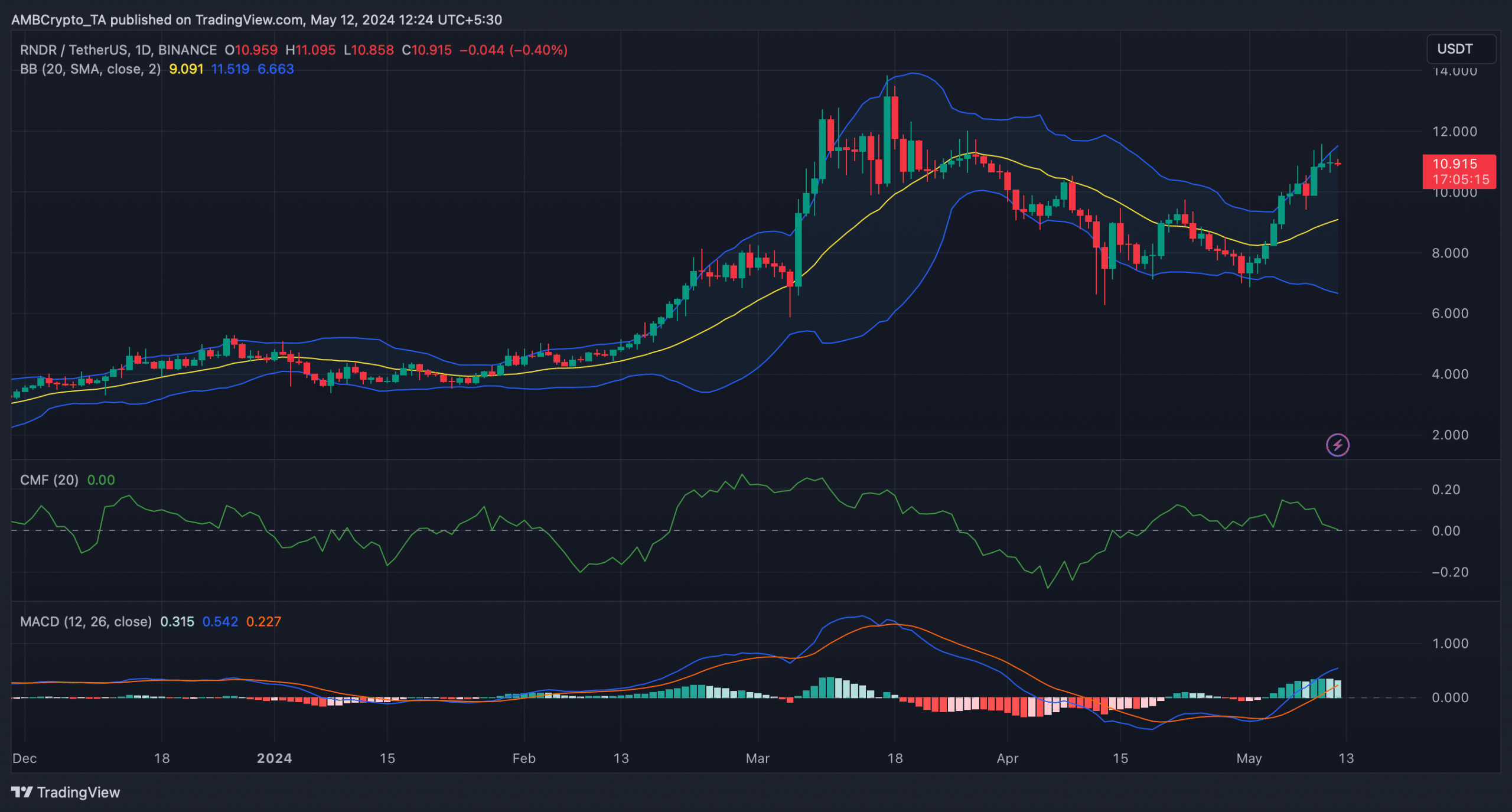

Although the mentioned data shows a downward trend, things might be different. Popular crypto analyst Crypto Tony recently tweeted expecting an upcoming AI token season. Analysts checked RNDR’s daily chart to see if this possibility could materialize in the short term, and according to the analysis, the MACD data displayed a clear upward trend.

The price was also well above the 20-day Simple Moving Average (SMA), which could be considered a bullish signal. However, other indicators suggest otherwise, for example, the token’s price touched the upper limit of the Bollinger Bands, which often results in price corrections.

The Chaikin Money Flow (CMF) also recorded a sharp decline and was moving below the neutral level at the time of writing. These two data points indicate an increase in selling tendency among Render investors and could potentially pull the token price down in the near term.