Bitcoin price is fluctuating due to many factors and has recently been under more pressure on the macroeconomic front. SEC’s anti-crypto moves should not be forgotten. SEC is making it extremely difficult for crypto companies as it aims to lay the groundwork for rejecting an Ethereum ETF. So, what are the current predictions for BTC, DXY, and SPX?

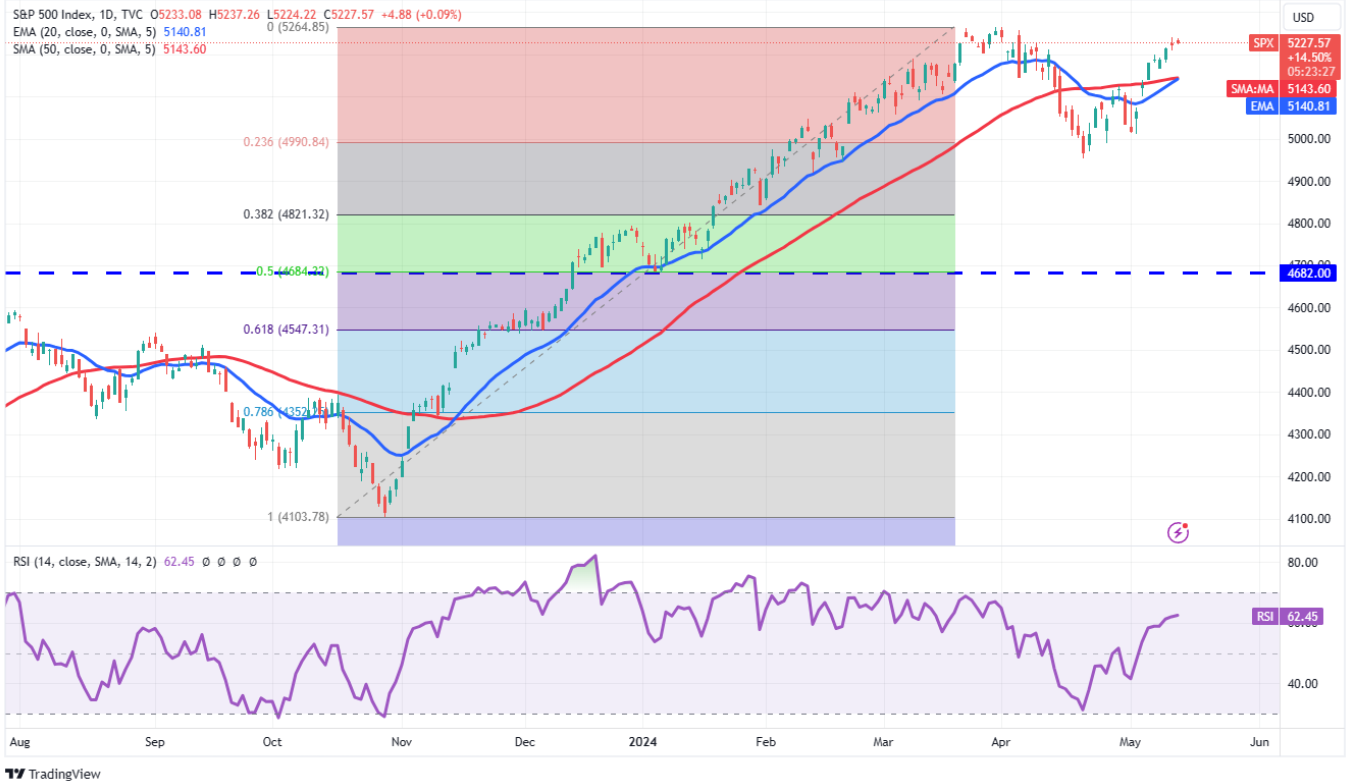

S&P 500 Index Commentary

The 20-day exponential moving average (5,140) is upward sloping and RSI is positive. If the 5,265 level is surpassed, we might see the index run towards 5,500. This is of course supportive for cryptocurrencies as there is a positive correlation. Bears will likely attempt to stop the rise at the resistance level and if successful, they will target the 4,950 level.

DXY Chart Commentary

Dollar index has a motivating outlook. When the index surpasses 105, pressure increases and rallies do not last long. If the inflation data on Wednesday is also favorable, it could open up more room for risk markets. A strengthening dollar is quite risky for Bitcoin and other risk assets.

The target for the index is the 104 level and if it closes below, 103 will be targeted. A bounce from the 104 level, representing the 50-day SMA, could push the dollar index to 106.5 and beyond. However, despite predictions of the Fed‘s interest rate cuts dropping to an annual 2, the index has not reached feared levels.

Bitcoin (BTC)

Bitcoin‘s recovery at the $60,000 level is motivating, but more is needed. As mentioned above, inflation data could play a key role here. Even if temporary, market expectations of three or more rate cuts this year would be highly supportive for Bitcoin.

Bulls have been unable to sustain Bitcoin above the 20-day EMA ($62,671) and at the time of writing, the price is at this threshold. If they are successful, we could see BTC’s price move to $65,456 and from there to $73,777. If inflation did not decrease in April, then we should prepare for new lows following $59,600 and $56,500.

Türkçe

Türkçe Español

Español