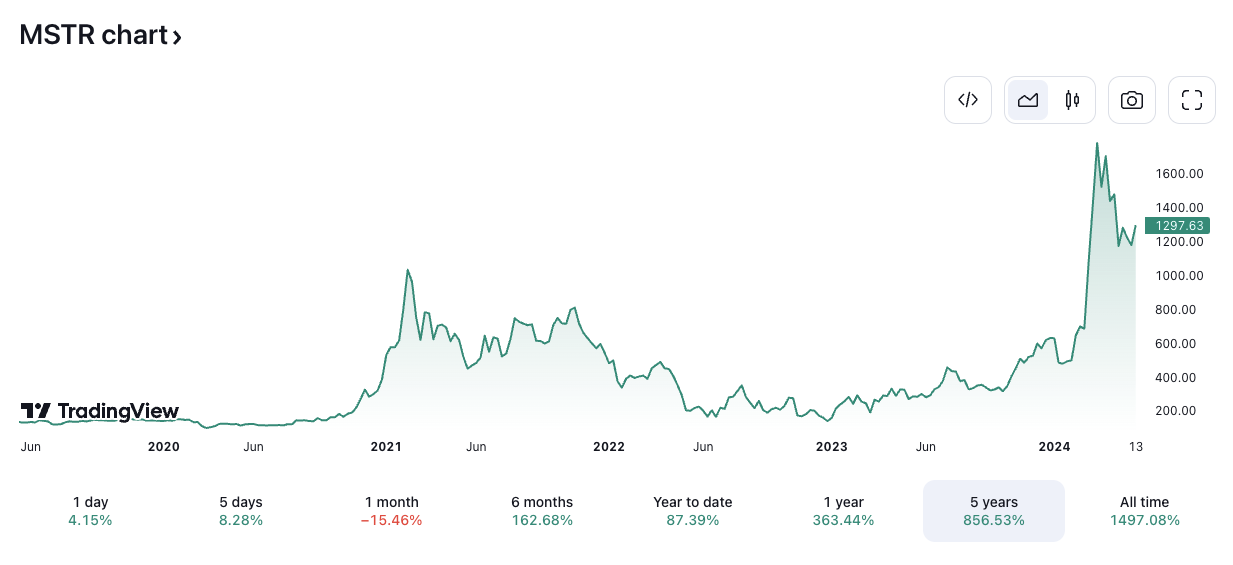

The American software company MicroStrategy, known for its significant Bitcoin (BTC) investments, has once again made headlines. With a BTC reserve currently valued at $13.5 billion, MicroStrategy is set to join the prestigious MSCI World Index starting May 31. This move follows a notable increase of over 87% in MicroStrategy’s stock price to date.

MicroStrategy’s Addition to MSCI World Index and Bitcoin

MicroStrategy’s inclusion in the MSCI World Index is evidence of its growing influence in the global stock market. MSCI, a leading provider of investment decision support tools, acknowledged MicroStrategy as one of the top three additions to its index by market value. This recognition is a result of MicroStrategy’s significant presence in the financial world.

Meanwhile, MicroStrategy’s rise in the stock market parallels its strategic Bitcoin investments. With its latest acquisitions, increasing its Bitcoin holdings to approximately 214,400 BTC valued at around $13.5 billion, MicroStrategy continues to assert its strength as a major player in the cryptocurrency market. Notably, the company’s Bitcoin purchases, at an average cost of $35,180 per BTC, currently face a significant unrealized gain of about $6 billion.

The remarkable performance of MicroStrategy shares is closely linked to the trajectory of the cryptocurrency market. Since hitting rock bottom along with the crypto market in December 2022, MicroStrategy shares have increased in value more than eightfold. Considering Bitcoin’s impressive 45% rise in 2024, this outstanding performance is particularly noteworthy.

MicroStrategy’s growing reputation as a Bitcoin proxy has enabled traditional market investors to invest in the largest cryptocurrency. With its substantial BTC holdings, representing over 1% of the total Bitcoin supply, MicroStrategy has become a preferred option for indirect Bitcoin investment in the traditional investment world.

Billions Follow the MSCI World Index

MicroStrategy’s inclusion in the MSCI World Index reflects the increasing integration of Bitcoin investment into traditional investment portfolios. As billions of dollars track or benchmark against the MSCI World Index, MicroStrategy’s addition signifies growing acceptance of cryptocurrency investment among mainstream investors. Furthermore, with the recent launch of spot Bitcoin exchange traded funds (ETFs) in the U.S., this trend is expected to accelerate.

Additionally, MicroStrategy continues to innovate in the cryptocurrency market alongside its Bitcoin investments. The company recently announced plans to launch a Bitcoin-based decentralized identity solution, further solidifying its pioneering position at the intersection of Blockchain technology and traditional finance.

Türkçe

Türkçe Español

Español