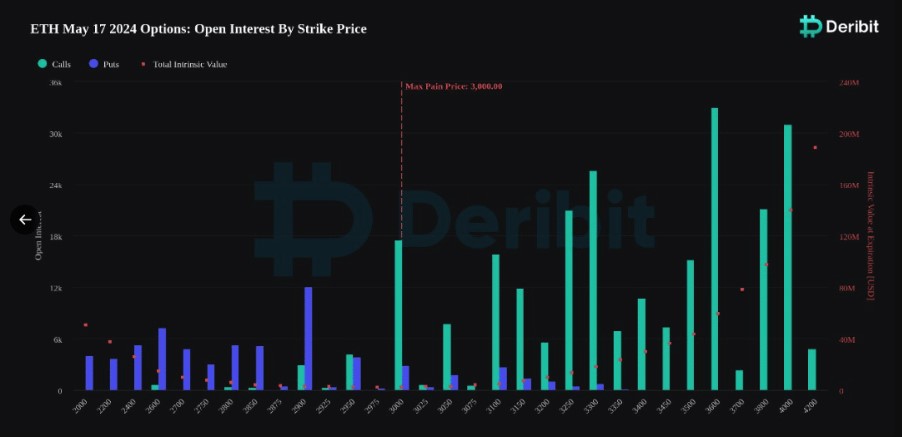

According to data from the leading futures exchange Deribit, Bitcoin (BTC) options with a notional value of $1.18 billion will expire on May 17. Additionally, Ethereum (ETH) contracts worth $950 million will also expire on the same day.

Bitcoin Futures

At the time of writing, Bitcoin’s put/call ratio was 0.61, with a maximum pain point of $62,500. This could mean that analysts of the trading options opened a position to sell a contract. In this case, the expectation is for the token’s price to fall, thus making the position profitable. If the put/call ratio is 0.70 or above, it could indicate that investors are buying more puts than calls.

Conversely, a value of 0.50 or below may indicate a bullish trend in the market. For Bitcoin, the ratio revealed that the number of put and call positions was close to each other. This shows a balance between short and long positions. For ETH, the put/call ratio was 0.21. This could signal that most investors are indicating a bullish trend. If the cryptocurrency trades at or below this level by the end of the day, many investors could face significant financial losses.

Expert Opinion on ETH

If the cryptocurrency’s price reaches or falls below $62,500, the same situation could apply to Bitcoin. At the time of writing, Bitcoin’s price was $66,443, which could indicate that causing a significant drop in the cryptocurrency might be difficult. However, ETH’s value was $3,018. This proximity to the maximum pain point puts ETH investors at a high risk of loss. The weakness of ETH did not deter future investors. Additionally, the options trading repository Greeks.live also shared their views on the matter. Experts stated:

BTC is more balanced between long and short positions, while ETH’s price is weak. This causes market confidence to weaken, making sell calls the absolute main deal.

However, data from Deribit revealed that investors expect ETH to overcome its forward struggles. According to the data, there was an increase in investments targeting $3,600 between the last weeks of May and June. One reason for this prediction could be the upcoming decision by the SEC regarding numerous Ethereum ETF applications. An approval on this front could raise ETH’s price, allowing investors to profit.

Türkçe

Türkçe Español

Español