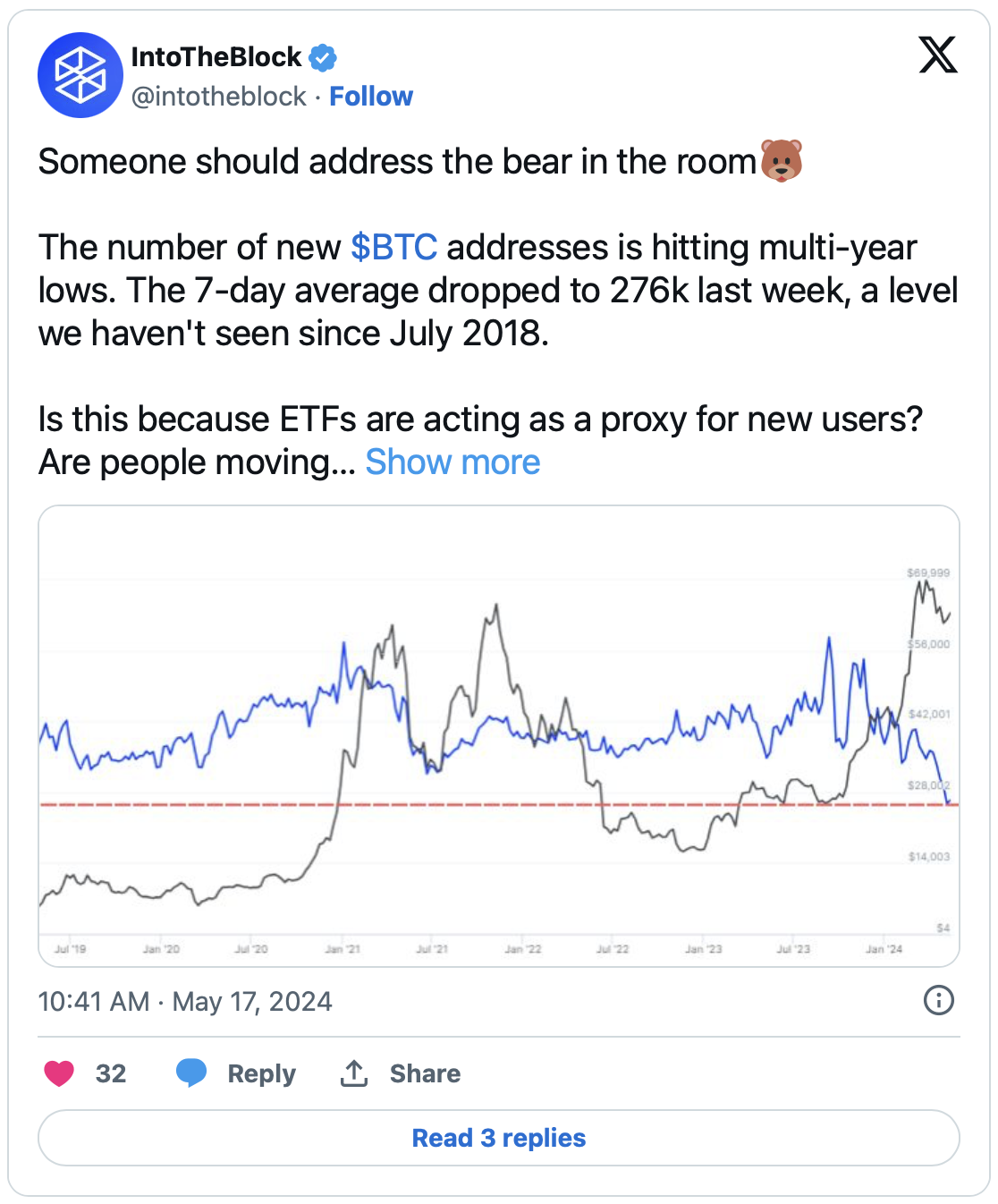

Bitcoin network activity saw a significant decline, with new addresses hitting their lowest since July 2018. On-chain data provider IntoTheBlock reported that only 276,000 new Bitcoin addresses were created on a seven-day average, a sharp drop from 625,000 six months ago. Despite Bitcoin trading around $67,000 after gaining over 7% last week, the decrease in new addresses indicates fewer new investors entering the crypto market.

Importance of the New Addresses Indicator

The “New Addresses” indicator tracks the daily creation of new wallets on the Bitcoin network. Typically, high metrics indicate an influx of new investors. However, returning investors and those creating multiple wallets for privacy also contribute to this number. Generally, a high number of new addresses signals long-term bullish sentiment for Bitcoin. Despite the price increase, the low number of new addresses indicates a decline in new investor entry.

Other related on-chain indicators also show a downward trend. Miners’ revenues, transaction fees, and on-chain transaction volume have decreased, indicating an overall decline in Bitcoin network activity. Typically, increased network activity signals rising demand and price stability, but the current decline reflects investors’ focus on derivative speculation rather than organic usage.

On January 10, 2024, the approval of spot Bitcoin exchange-traded funds (ETFs) by the U.S. Securities and Exchange Commission (SEC) offered the largest cryptocurrency as a traditional investment vehicle. This development diverted interest from on-chain transactions, contributing to the decline in new addresses. Additionally, high transaction fees following the hype surrounding the Runes protocol also impacted network activity.

First Drop Below 700,000 Since March 2020

Moreover, the seven-day moving average of active addresses fell below 700,000 for the first time since March 2020. Although fees stabilized, dropping from an average of $31.4 on April 23 to $2.97 on May 18, the number of active addresses remains extremely low.

The 30-day active address count, which tracks different addresses participating in transactions over 30 days, fell to 12.64 million, a level last seen in February 2019. This indicates a decline in demand for transactions on the Bitcoin network.

Türkçe

Türkçe Español

Español