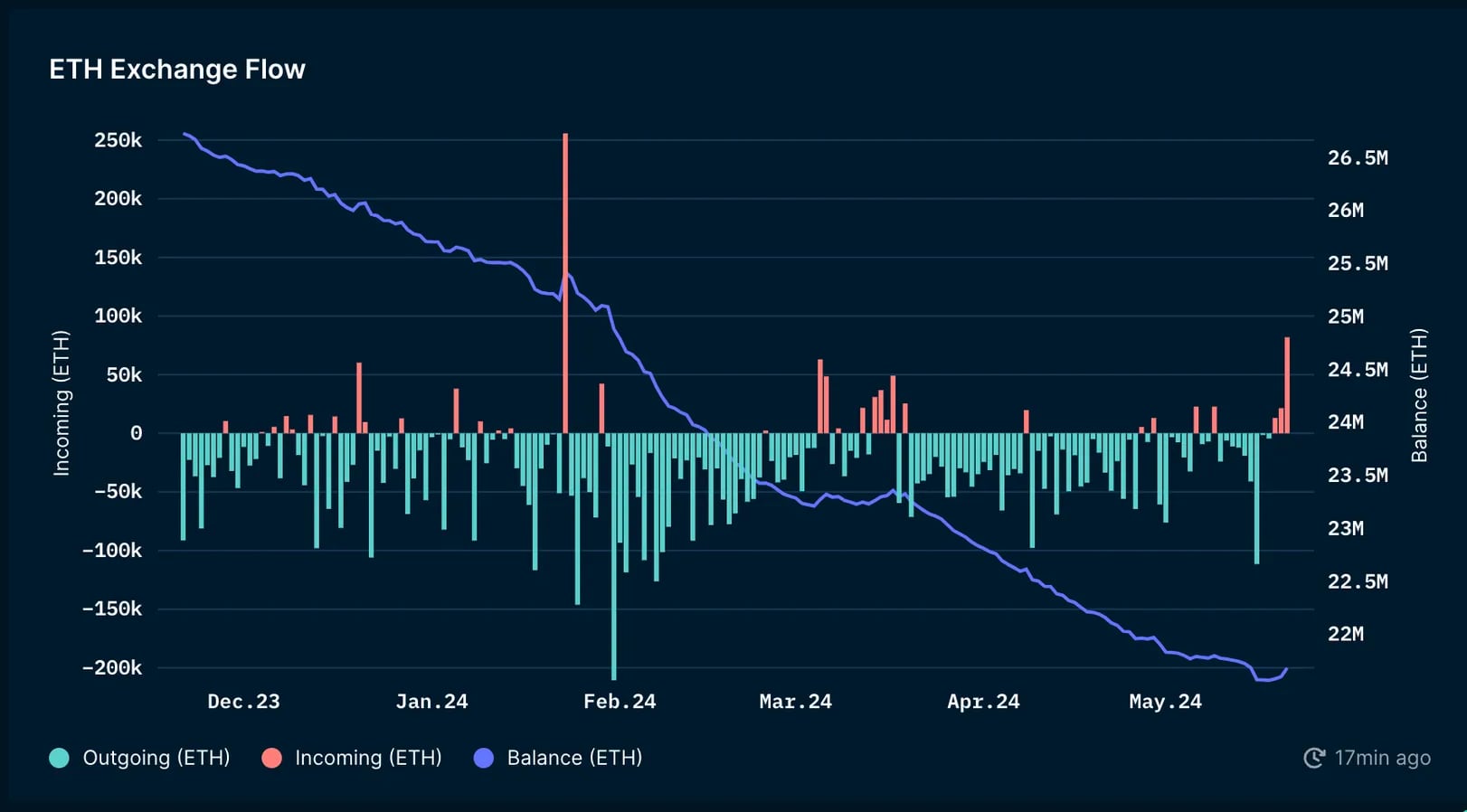

Altcoin king Ethereum (ETH) investors started moving their assets to crypto exchanges at the fastest pace in about four months due to the recent rally and the growing expectation of a spot Ethereum exchange-traded fund (ETF) approval in the US. This situation alarmed ETH investors.

81,840 ETH Transferred to Crypto Exchanges

According to on-chain data provided by Nansen Intelligence, net inflows to crypto exchanges reached 81,840 ETH on May 21. This ETH flow amounts to over $300 million at current prices. This marks the highest daily inflow to crypto exchanges since January 23 and represents the third consecutive day of inflows, deviating from the recent trend of declining ETH balances on crypto exchanges.

The last time consecutive inflows were observed in crypto exchanges was in March, coinciding with a peak period for cryptocurrency prices within the year.

Typically, moving assets to crypto exchanges indicates an intention to sell, while a price pullback of coins/tokens suggests a desire to hold assets long-term. These significant inflows suggest that investors might be looking to take short-term profits following ETH’s sharp price rise.

Many Investors Managed to Capture a 30% Rise

ETH’s rise from around $3,000 to over $3,800 in a single day led many investors to potentially capture a rapid 30% price increase. David Shuttleworth, a research partner at Anagram, noted that individuals likely benefited from the swift price rise. This increase in exchange inflows came as the likelihood of US regulatory approval for spot Ethereum ETFs significantly rose, with regulators asking issuers to update their applications after months of inactivity.

The expectation of spot Ethereum ETF approval has been a major driving force behind the recent rally. As regulators showed renewed engagement, the market responded positively, leading to price increases in ETH, Bitcoin (BTC), and altcoins, and boosting trading activity. This optimism was reflected in significant inflows to crypto exchanges as investors positioned themselves to benefit from potential regulatory developments.

Türkçe

Türkçe Español

Español