Legendary analyst John Bollinger issued a cautionary note regarding Bitcoin’s (BTC) recent price surge. As is known, Bitcoin has risen by approximately 13% over the past one and a half weeks, reaching $70,000 and approaching its all-time high of $73,750. This rise has led market analysts and investors to reassess their strategies.

Warned Investors About a Concerning Pattern

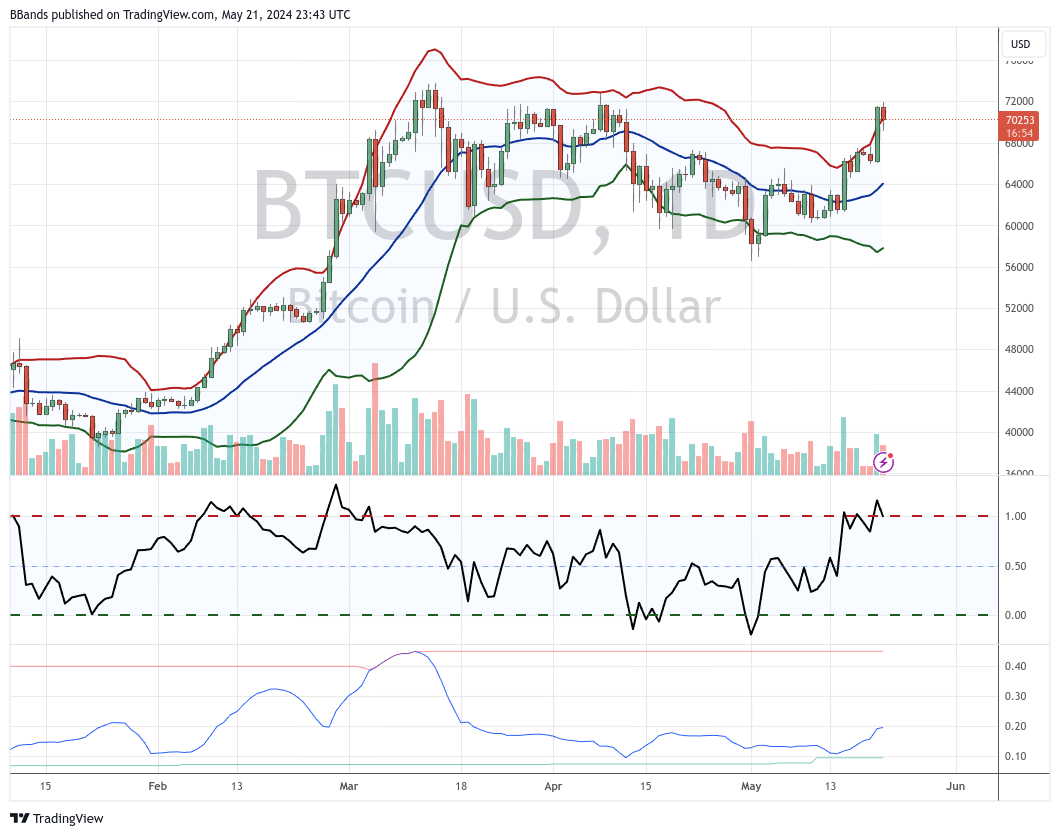

Despite the upward trend, the famous technical analysis tool Bollinger Bands creator John Bollinger expressed caution regarding Bitcoin’s short-term outlook. For those unfamiliar, the Bollinger Bands tool is often used by investors to determine volatility and potential price reversals by plotting standard deviations above and below a simple moving average.

Bollinger noted a concerning pattern in Bitcoin’s price chart, indicating a potential pullback or consolidation period. Specifically, he highlighted a two-bar reversal trend at the upper Bollinger Band, which typically signals a temporary market correction.

Although the famous analyst’s short-term analysis appears worrisome, he remains optimistic about Bitcoin’s long-term prospects. His cautious stance is based on technical indicators rather than a fundamental bearish outlook. This reflects the current market sentiment, where optimism about the largest cryptocurrency’s future growth is tempered by awareness of potential short-term volatility.

Focus on Whether Bitcoin Can Surpass Its Record

Bollinger’s analysis comes at a critical time for Bitcoin, as it is currently trading just 6% below its recent peak. The market is closely watching whether the largest cryptocurrency can surpass its previous record, which seems increasingly likely given the current trajectory. While Bollinger’s short-term concerns suggest caution, his enduring confidence in Bitcoin’s overall upward trend highlights the strong position of the largest cryptocurrency.

As Bitcoin approaches its all-time high, the balance between optimism and caution will be crucial for crypto enthusiasts in this market. Bollinger’s perspective reminds us that even in a strong upward trend, vigilance is necessary, and potential market corrections should be anticipated. This balanced approach can help investors make informed decisions in the highly volatile cryptocurrency market.