Bitcoin attempted to turn $69,000 into support on May 22, worrying analysts about a potential drop from local highs. Data from TradingView shows Bitcoin’s price action weakening after testing all-time highs twice in 2021. What lies ahead for Bitcoin? We analyze detailed charts and data.

Key Levels to Watch for Bitcoin

At the time of writing, Bitcoin remained above $69,000, a significant line for some. Trade source Material Indicators mentioned in a recent post on X:

“To confirm an R/S change at the previous ATH level, $69,000 support must hold.”

Material Indicators show a potential resistance/support change at $69,000. However, the company warned that one of its proprietary trading tools indicated a clear bearish signal on daily timeframes:

“For us, a move above $71,500 would be invalid.”

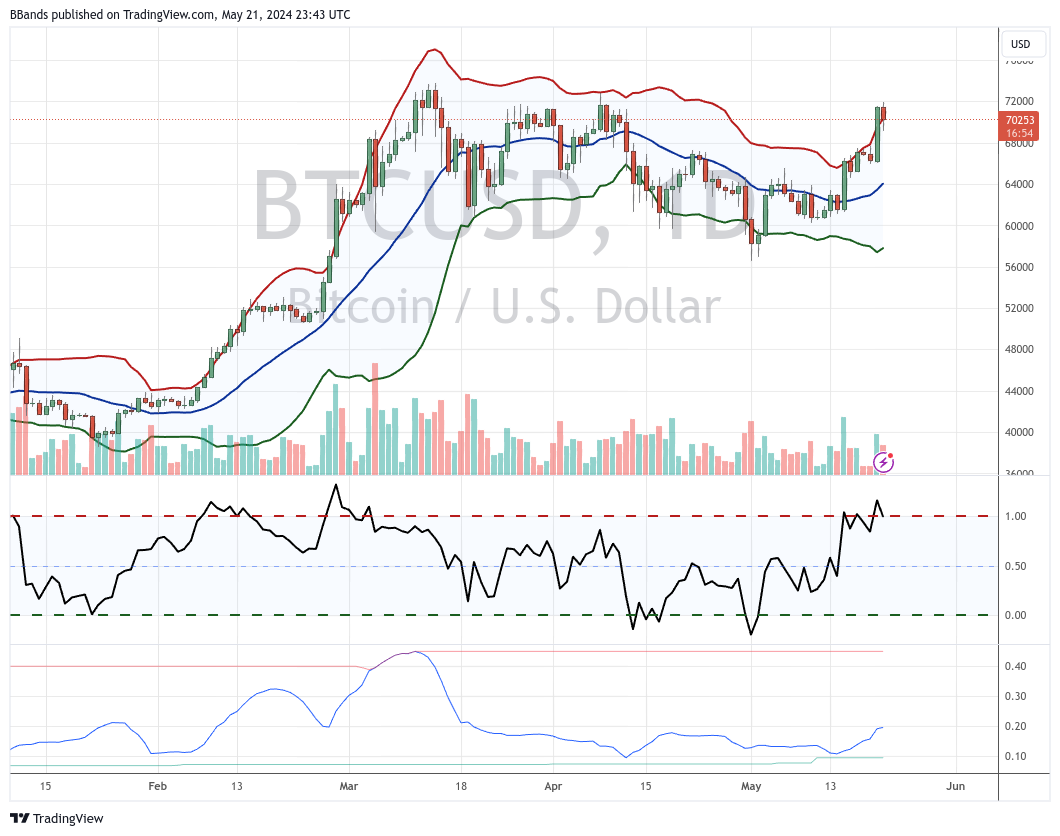

Other analysts were similarly concerned about Bitcoin bulls’ latest attempt to break resistance, fearing increased rejection chances. John Bollinger, creator of the Bollinger Bands volatility indicator, warned about developments that worried him:

“I don’t like the reversal of two bars at the upper Bollinger Band for Bitcoin. It suggests a consolidation or pullback. No bearish trend here, just short-term concerns.”

Bitcoin price predictions for a broader pullback were already circulating within the trading community; popular trader and commentator Credible Crypto was among the most vocal advocates for a return to $60,000 or lower. A new chart uploaded to X reiterated the possibility of being below the starting point of what Credible Crypto called an impulsive move.

What’s Happening on the Ethereum Front?

Meanwhile, the week’s decision on the US identifying Ethereum exchange-traded funds set possible Bitcoin targets for Decentrader co-founder Filbfilb. Updating his X followers, Filbfilb stated that the worst-case scenario, i.e., ETF funds being rejected by regulators, would only reset the market to its pre-move position:

“If the Ethereum ETF is rejected, then resetting to where we were last week is enough.”

Filbfilb suggested that a positive ETF decision could lead Bitcoin back into price discovery and even reach $80,000. The ETH/BTC pair reached its highest levels since mid-March on May 21.

Türkçe

Türkçe Español

Español