Recently, Ethereum (ETH) has experienced a significant price increase. In the last 24 hours, Ethereum gained 5% in value, approaching the $4,000 mark. The primary reason for this increase is the rising institutional interest ahead of the launch of the first spot Ethereum ETF. The daily trading volumes reaching $17 billion are a tangible indicator of this interest. Ethereum’s market value has risen to $469 billion.

Emphasis on the $3,956 Level for Ethereum

Famous crypto analyst Rekt Capital emphasized that for Ethereum to maintain its position at the $4,000 level, it is critical to close above $3,956 on a weekly basis.

According to historical data, when Ethereum shows prolonged stability around key levels like $2,791, upward movements generally occur. Rekt Capital’s analysis indicated that surpassing these levels and the return of upward momentum are essential to sustain the recent bullish trend.

Ethereum’s Path to $4,500

DeFiance Capital founder Arthur predicted that Ethereum could reach $4,500 before the spot ETH ETF starts trading. This optimistic forecast is supported by a survey conducted by Wu Blockchain, showing that 58% of participants in the Chinese community believe ETH could reach $10,000 or more in the current market cycle.

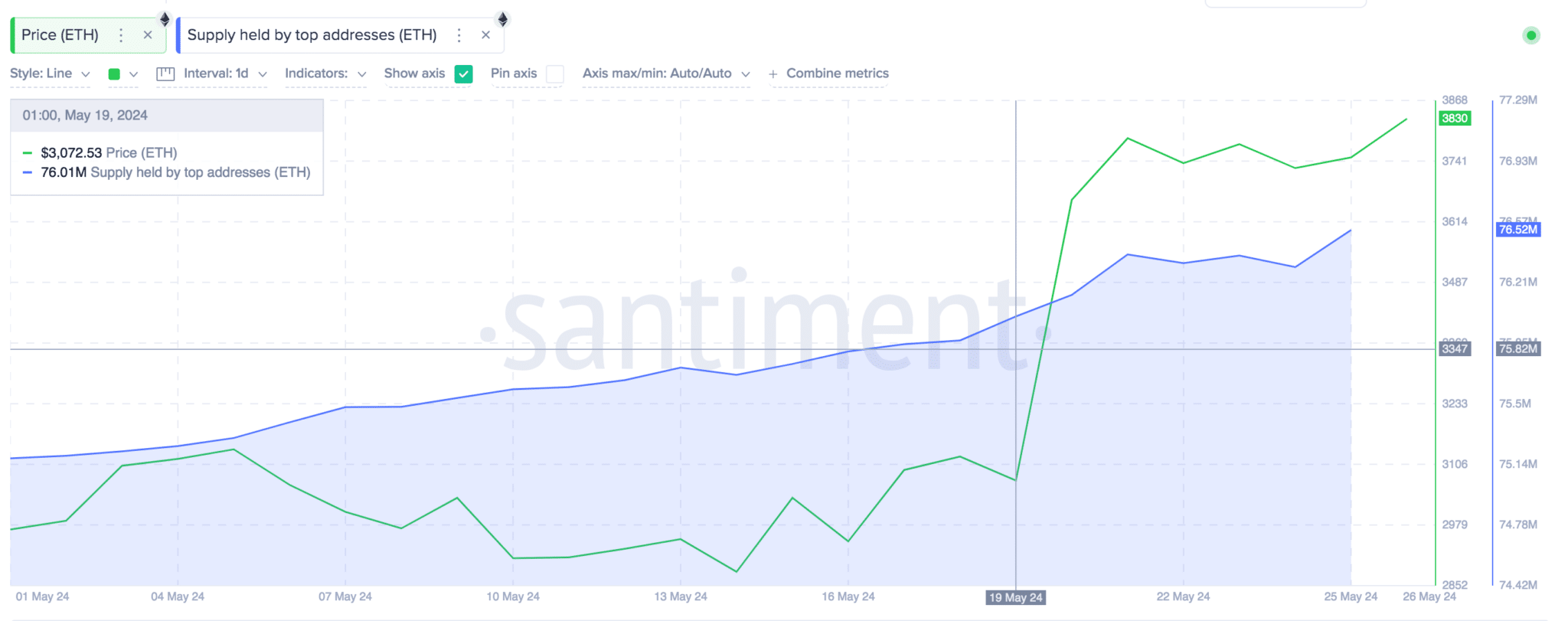

On the other hand, recent data from Santiment revealed an increase in Ethereum accumulation by large investors known as “whales.” On May 19, the top 1,000 Ethereum wallets collectively held 76.01 million ETH. Following Bloomberg analysts’ reports on the potential approval of ETH ETFs by the SEC, these whales significantly increased their holdings. As of May 26, their collective holdings rose to 76.52 million ETH, with a purchase of 510,000 ETH occurring in just five days.

High Expectations for Ethereum’s Price

The approval of the spot Ethereum ETF is expected to trigger significant institutional investments, leading to further price increases. The recent rise in trading volumes and the accumulation of ETH by large investors indicate that the market is positioning itself for this anticipated influx. The bullish momentum is supported not only by technical analyses but also by broader market sentiments and strategic purchases by major stakeholders. Ethereum, the leader among altcoins in the crypto world, was trading at $3,900 at the time of writing.

Türkçe

Türkçe Español

Español