Looking back at the past week, the world’s attention turned to currencies on Monday. The cause was the news from spot Ethereum ETFs. Following the optimism around ETFs, Ethereum and Bitcoin prices surged, with ETH nearly returning to the $4,000 level. After this process, all eight ETF applications were approved by the SEC on May 23, causing market fluctuations. While it’s unknown when trading will start in the US, a significant development emerged from DTCC in the past few minutes.

DTCC News for Fidelity

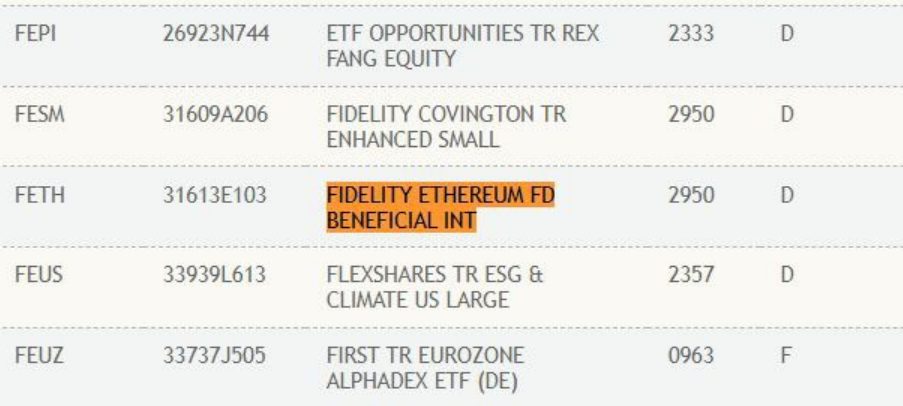

According to recent information, DTCC announced the listing of Fidelity’s spot Ethereum ETF under the ticker $FETH. This had a significant impact following the ETF approvals last week. The potential effects of this event, which occurred after the US markets closed, are already a topic of curiosity.

Fidelity, known for its role in the spot Bitcoin ETF process, is now under scrutiny for its performance in the spot Ethereum ETF sector. While DTCC listings are not definitive indicators for the start of trading, they are thought to contribute positively to public sentiment and the overall process.

Ethereum Price Update

As of the time of writing, Ethereum continues to find buyers around the $3,780 region after a 1.57% pullback in the last 24 hours. Additionally, the gains made by ETH in the past seven days have nearly disappeared.

Ethereum’s market cap has fallen to $452 billion following the pullback. Meanwhile, a 10% drop in 24-hour trading volume has resulted in a value of $17 billion, which is interpreted as a significant loss of investor interest.

The loss of interest is thought to be significantly influenced by statements from US officials in recent days. A Fed official recently caused market panic with comments about interest rate hikes. While there is no certainty about when rates will decrease, the market and its participants seem to be eagerly awaiting positive news from the Fed.