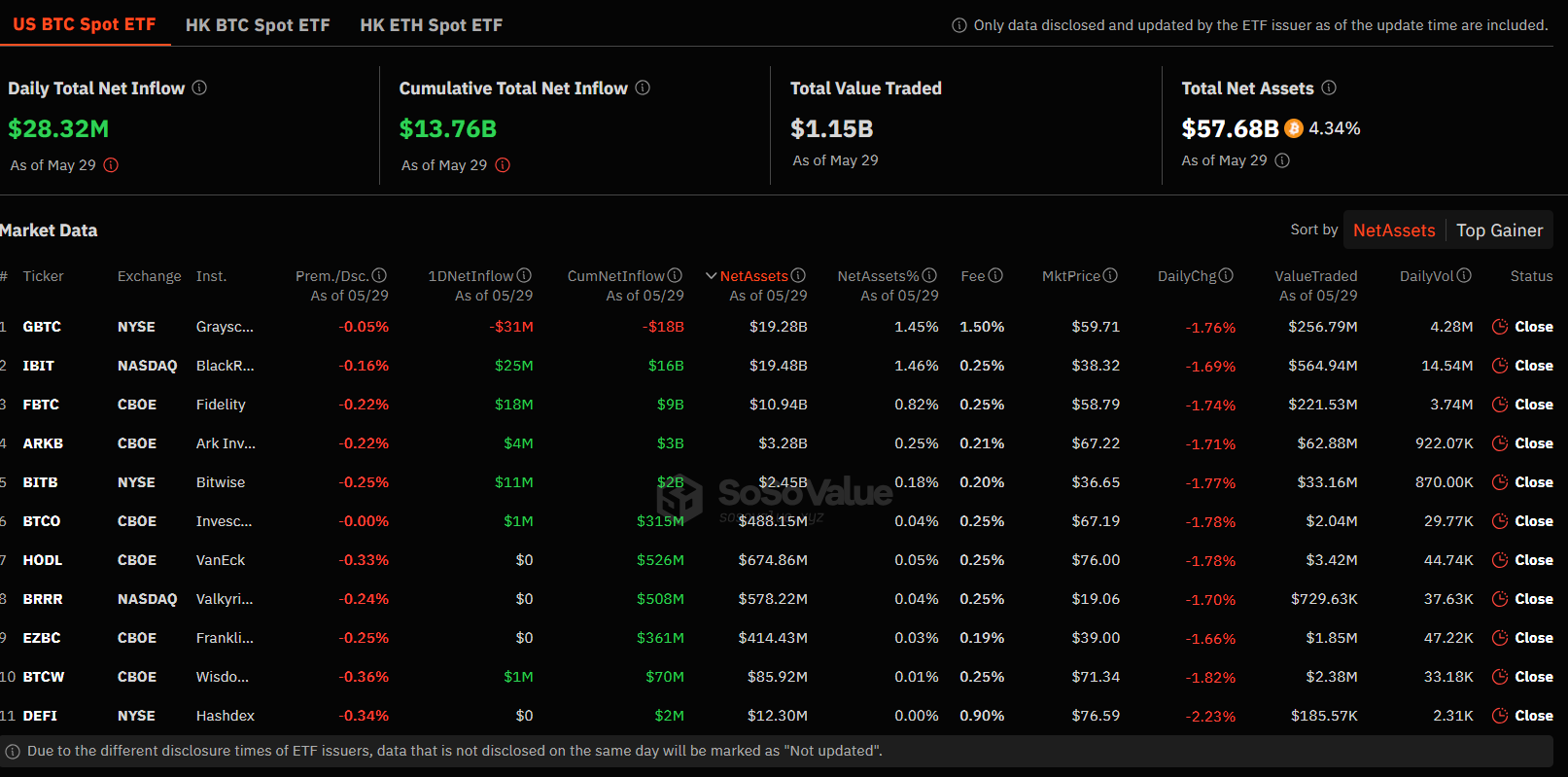

On May 29, 2024, significant activity was observed in the Spot Bitcoin Exchange-Traded Funds (ETF) market, with several companies experiencing substantial capital inflows. Overall, companies collectively received a significant net investment of $28.3 million. This figure demonstrated the growing investor interest in financial products related to Bitcoin.

Spot Bitcoin ETFs

Blackrock‘s IShares stood out with a notable inflow of $25 million among various companies. This significant investment showed investors‘ confidence in Blackrock’s Bitcoin ETF offerings.

Fidelity also experienced a significant fund flow, receiving $18 million. This indicated that Fidelity’s Spot Bitcoin ETF attracted considerable investor interest and further solidified Fidelity’s reputation as a reliable institution in the financial sector.

Bitwise closely followed with an inflow of $11 million. Bitwise is known for its innovative approach to cryptocurrency investments, and this inflow reaffirms its position in the market. ArkShares received a more modest but notable investment of $4 million. Although smaller compared to Blackrock and Fidelity, this inflow indicates steady interest in ArkShares’ Bitcoin ETF offerings and reflects a diverse investment environment.

Grayscale Experienced Outflows

Invesco and WisdomTree also saw positive inflows. Invesco received $1 million, and WisdomTree received $1.1 million. In contrast, Grayscale’s Bitcoin Trust (GBTC) faced a significant outflow with investors withdrawing $31 million. This outflow likely highlights a shift in investor preference away from Grayscale’s products due to market dynamics or competition from other ETF providers.

Meanwhile, Franklin, Valkyrie, and VanEck did not receive new investments. Consequently, on May 29, 2024, the Spot Bitcoin ETF market saw significant activity with substantial investments in several major companies. Blackrock, Fidelity, and Bitwise were the primary beneficiaries of this influx, while Grayscale experienced notable outflows.

Türkçe

Türkçe Español

Español