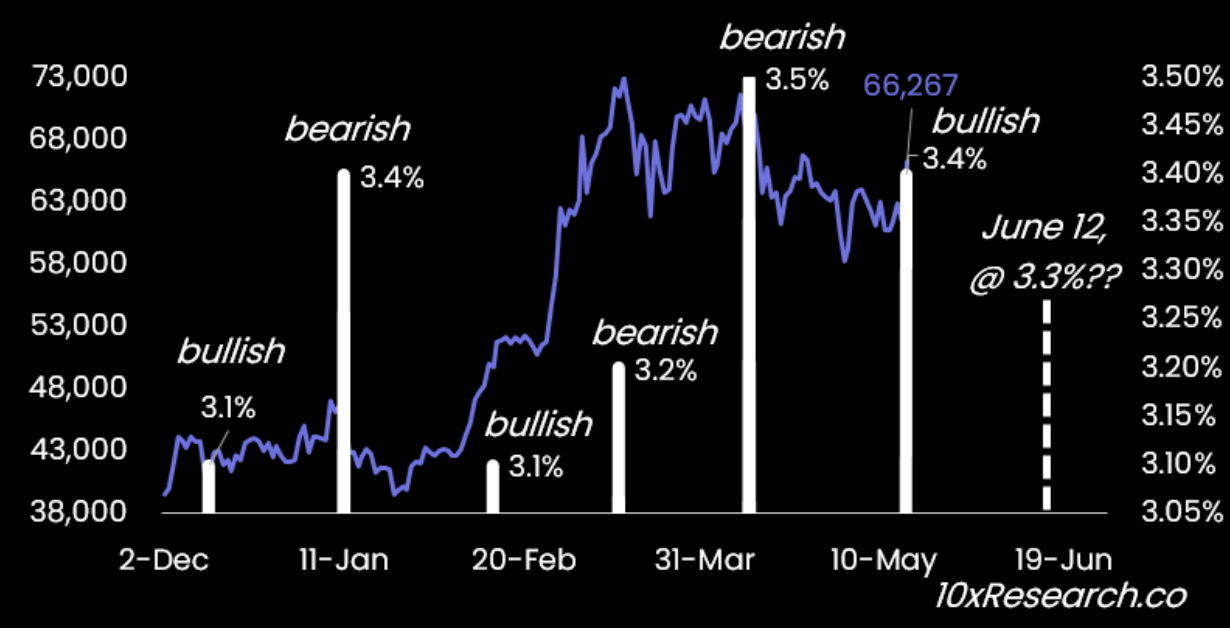

According to a crypto analyst, Bitcoin needs to see a slowdown in US inflation next month to consider surpassing its all-time highs reached in March. 10x Research chief researcher Markus Thielen stated in a report dated May 29, before the US Bureau of Labor Statistics (BLS) releases the Consumer Price Index, that if inflation comes out at 3.3% or lower, Bitcoin should see its all-time high.

What’s Happening on the Bitcoin Front?

This development represents a 0.1-point decrease from the previous CPI result of 3.4% on May 15. Thielen believes that there will be spot Bitcoin exchange-traded fund (ETF) inflows in the two weeks before the May CPI results are announced.

However, if the CPI results come out higher than expected, momentum may weaken as seen earlier this year. For the past two weeks, since May 13, spot Bitcoin ETF inflows tracked by Farside data have been positive every day, with the highest day of total inflows being May 21 at $305.7 million.

Thielen argued that there are no random movements in Bitcoin prices and that everything depends on critical factors, with inflation being the main factor. There have been several instances this year where Bitcoin prices fell following higher-than-expected CPI results.

Macroeconomic Data and Bitcoin

On April 10, the CPI was announced at 3.5%, only 0.1% above expectations. Just a few weeks later, on April 30, Bitcoin’s price fell by 6.67% to $56,000. Thielen noted that despite $611 million in inflows on the first day of spot Bitcoin ETF funds on January 11, the rest of January’s inflows were disappointing.

He suggested that the main reason for this was the higher-than-expected CPI results. Thielen commented on the matter:

“The CPI came in at 3.4%, above the expected figure of 3.2% and the previous month’s 3.1%. It’s no coincidence that Bitcoin was weak in January, stronger in March, but consolidated for two months.”

Türkçe

Türkçe Español

Español