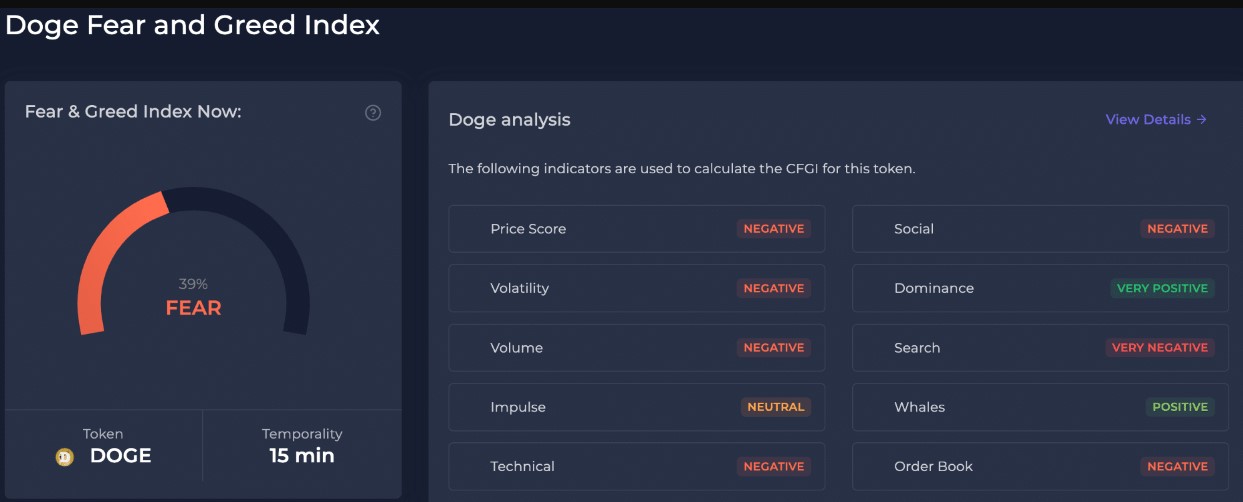

Dogecoin (DOGE), did not perform the best in this cycle. A week ago, it saw some minor gains following the excitement of the spot Ethereum ETF and witnessed an 8% increase in one day. However, at the time of writing, the charts are on a downward trend. What are the latest data on the world’s largest meme cryptocurrency?

DOGE Holders

Data from IntoTheBlock revealed that the majority of DOGE holders (83%) are profitable at the current price. Therefore, despite recent losses, long-term investors are still in an advantageous position. Notably, 63% of Dogecoin’s supply is held by whales. The strong correlation with Bitcoin (0.86) could be an indication that Dogecoin’s price movements are largely influenced by broader market trends, especially Bitcoin movements.

Last week’s nearly equal inflows of $221.14 million and outflows of $221.68 million from exchanges could indicate balanced buying and selling activity among investors. In fact, Dogecoin has solidified its position as neither bulls nor bears have been able to dominate the charts.

DOGE Futures

Dogecoin’s sudden spikes in short liquidations correspond to sudden price increases, which could indicate that rapid uptrends force short sellers to exit their positions at a loss. The general trend reveals a mix of long and short liquidations without a consistent increase in either, pointing to a market characterized by speculative trading and sudden price changes rather than consistent directional movement.

This liquidation pattern could also be consistent with DOGE’s ongoing price performance. Despite its resilience, the market remains marked by short-term rallies and corrections. Like a typical meme token, examining Dogecoin’s monthly chart reveals that the cryptocurrency grapples with volatility and market sentiment. For example, over the past month, DOGE has exhibited a series of volatilities but primarily moved within a limited price range of approximately $0.135 to $0.175.

Türkçe

Türkçe Español

Español