At the end of 2022, SOL experienced a significant crash and hit rock bottom at the beginning of 2023. Following this, SOL made a historic comeback throughout the rest of the year, dominating the market along with its meme coins. Let’s take a look at what is currently happening with SOL.

Current State of Solana Market Volume

Looking at Solana‘s market value, it was around 79 billion dollars on June 5th. The increase during those days paralleled the rise in SOL’s price. After the rise, the value exceeded 80 billion dollars. This was the first time in weeks that the value had risen above the 80 billion dollar range, which last happened in May.

However, the value started to decline right after this point. Following the decline, the value fell below 80 billion dollars again and is currently at 78.2 billion dollars. The decline in value parallels the drop in SOL’s price over the last 24 hours.

SOL Price Movements

Looking at the daily analysis of Solana, the recent consecutive increases are noticeable. Between June 3-5, the price rose from approximately 164 dollars to nearly 173 dollars. On June 5th, SOL saw a rise of just over 1%, reaching 173.5 dollars.

As of the time of writing, Solana’s price has dropped to around 170.5 dollars after a decline of over 1%. Despite the relatively weak decline, it caused the market value to lose nearly 2 billion dollars. Despite the price drop, the overall trend remains positive.

The above chart shows that the price trend is still above the short moving average (yellow line), indicating support at the 160 and 154 dollar levels.

On the other hand, the analysis of Solana’s Relative Strength Index (RSI) suggests potential bullish activity. As of the time of writing, the RSI value remains above 60, which is considered a reflection of the upward trend.

The Future of Solana

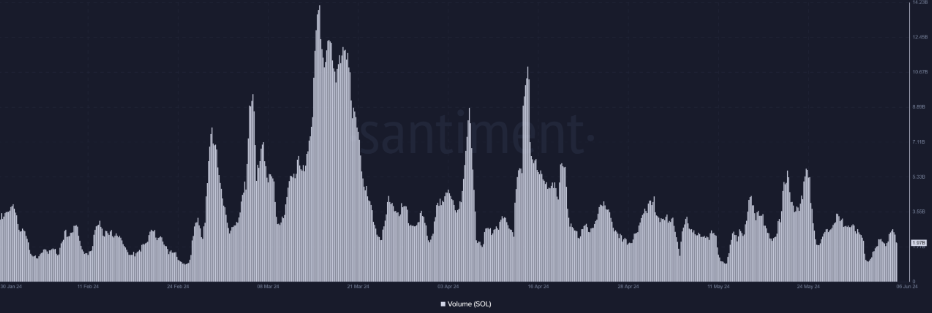

Analyzing Solana’s trading volume, it indicated an increase along with the price on June 5th. The chart showed that yesterday’s values pointed to an exit above 2.6 billion dollars, which was considered an increase despite the decline at the beginning of the month.

As of the time of writing, the 24-hour trading volume has dropped to 1.9 billion dollars after a decline of over 1%. Due to the nearly neutral trading volume, it is still unclear whether buyers or sellers are in control.

Türkçe

Türkçe Español

Español