Bitcoin price remains stable on Sunday, while altcoins suffered significant losses over the weekend. The negativity in altcoins is fueled by the anticipation of the Fed decision to be announced on Wednesday. So, which altcoin category garnered the most interest in May? Could a similar scenario occur in June?

Most Popular Altcoins

Real World Asset (RWA) tokenization has surpassed many sectors to become the most popular area within crypto. RWA, with the potential to turn into a trillion-dollar market, is an area where many traditional finance companies have also invested. Even state banks are experimenting with tokenized bond issuance on Ethereum and other networks.

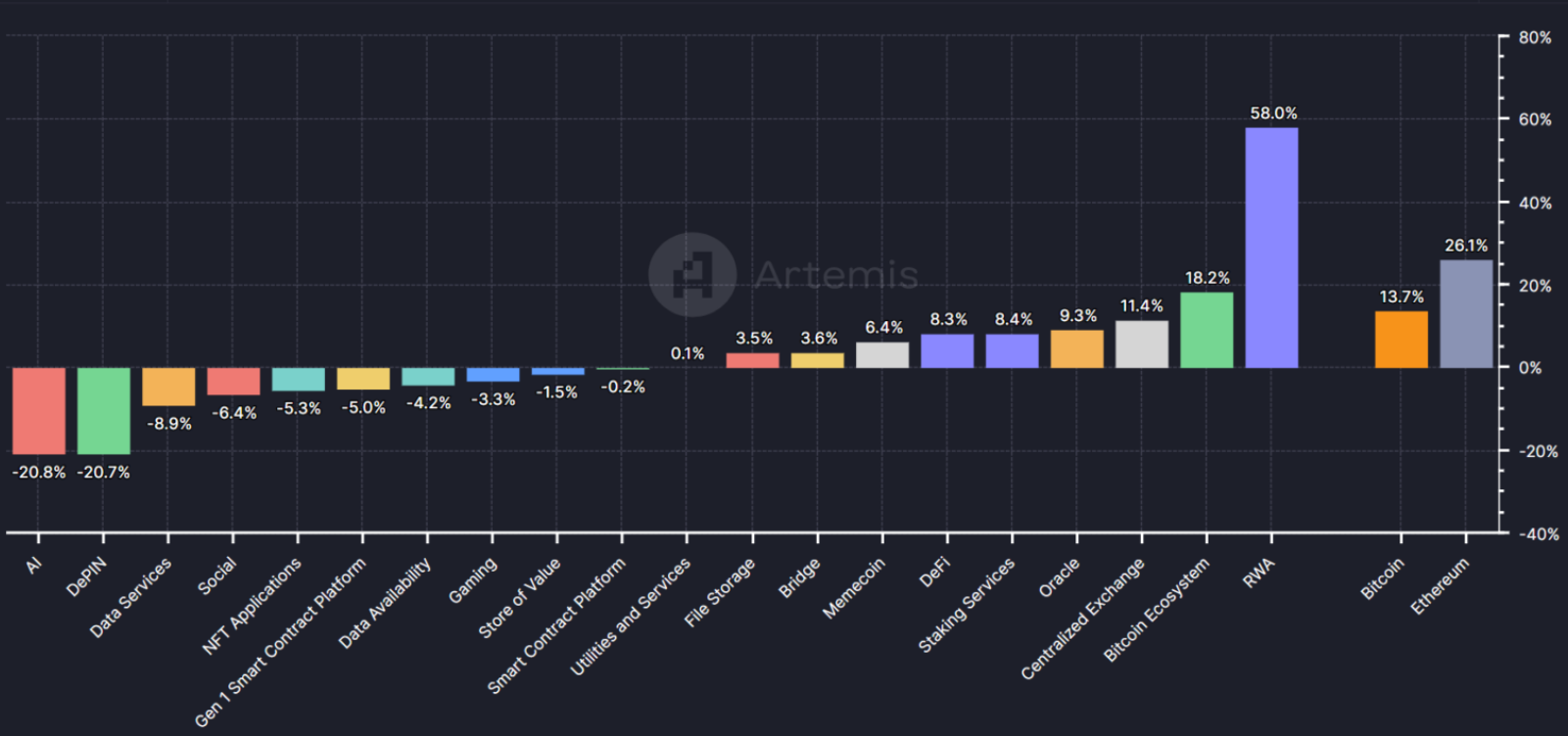

The tokenization of real-world assets, which maximizes cost efficiency, transparency, and security for investors, has led to the emergence of many initiatives in the crypto space. According to data from the crypto analysis platform Artemis Terminal, cryptocurrencies in the RWA sector showed a positive performance of 58% in May.

In the review conducted for 21 different categories, RWA came out on top and seems likely to remain prominent in the long term. The RWA sector is followed by the BTC and Ethereum ecosystems, with performances measured at 26.1% and 18.2%, respectively.

Significant RWA Experiments

On June 4, Galaxy Digital created a multi-million dollar loan collateralized by a 316-year-old Stradivarius violin. The loan uses the Stradivarius violin and its NFT version as collateral. This strategy provides asset management flexibility while offering strong collateral for Galaxy Digital. The physical violin is preserved in Hong Kong, while its NFT serves as its digital counterpart.

On the same day, Watford Football Club (Watford FC) launched a digital stock sale. 10% of the club was tokenized in this manner. The US Financial Services Committee held a session titled “Next Generation Infrastructure” on June 7. The benefits and necessary regulations for the tokenization of real-world assets were discussed.

BlackRock CEO Larry Fink frequently emphasizes the potential in the RWA sector, while Franklin Templeton CEO Jenny Johnson commented on Rihanna’s NFT royalties and various crypto-backed loyalty programs:

“These loyalty programs are a combination of real-world assets, and I think you will see more companies making this combination. Because technology allows you to do so.”