Real Vision CEO Raoul Pal suggested that nearly two-thirds of net inflows into Bitcoin exchange-traded funds (ETFs) might be for arbitrage purposes. Pal, in a June 11 X post, referenced data presented by crypto analyst and MV Capital partner Tom Dunleavy, indicating that the majority of ETF flows are primarily arbitrage, with individual investors not yet being the main factor.

Notable Claim Regarding ETF Funds

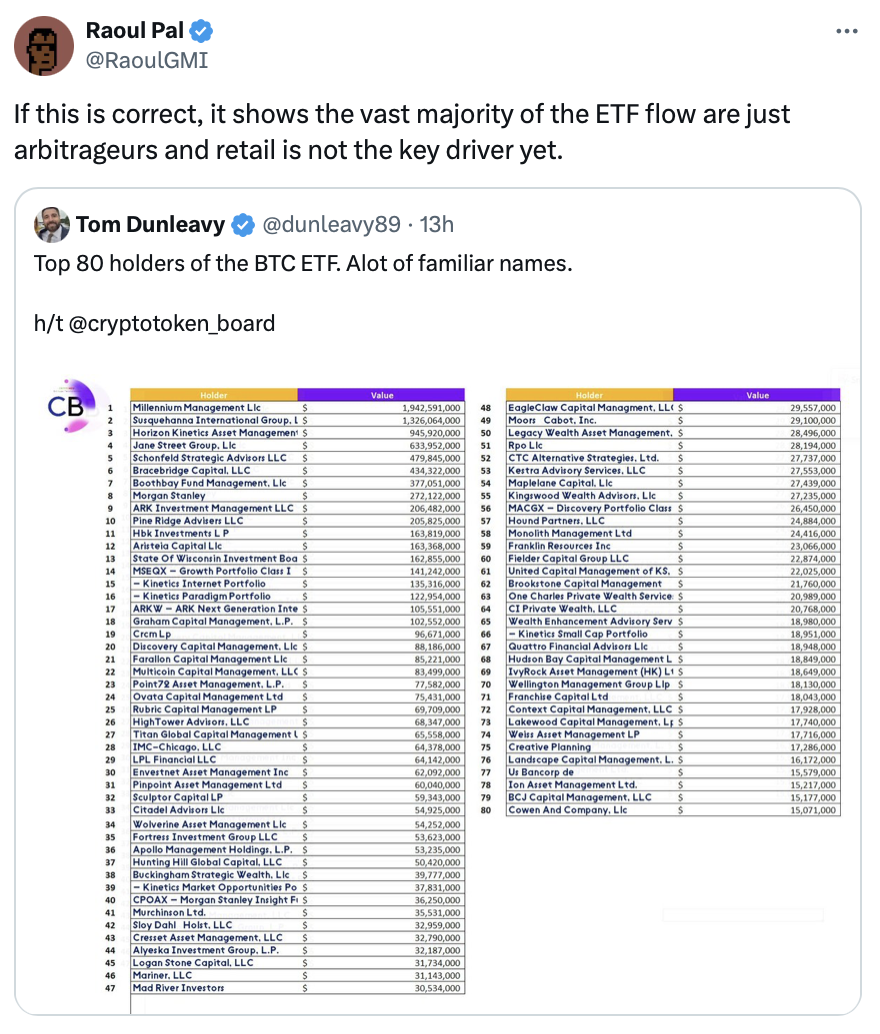

The data indicated that the top 80 holders of U.S. Bitcoin ETF funds were hedge funds with capital from various institutional and individual investors.

Farside Investors data shows that 80 firms collectively hold approximately $10.26 billion worth of spot Bitcoin ETF shares, which accounts for about two-thirds of the $15.42 billion net inflows since the launch of spot Bitcoin ETF funds on January 11.

International hedge fund Millennium Management held $1.94 billion worth of Bitcoin ETF shares, making it the largest among all firms. On May 16, it distributed its Bitcoin ETF assets among multiple issuers, holding shares in ETFs from Bitwise, Grayscale, Fidelity, BlackRock, ARK, and 21Shares.

Notable Statements from a Renowned Figure

Many analysts disputed Pal’s claims that excluding Grayscale Bitcoin Trust (GBTC), ten U.S. Bitcoin ETF funds collectively manage $42 billion in assets and also have short-term interest in CME. Crypto investor Joseph B. commented:

“Recent inflows can definitely be attributed to core trading activities, but basic trades make up less than 15% of overall ETF flows.”

Pal claimed that these firms’ flows are primarily arbitrage because that is mainly what the listed major hedge funds do. They are not actually risk-takers; they are not investors deciding based on the expected direction of Bitcoin prices. Arbitrage transactions involve identifying short-term opportunities by finding differences between the net asset value (NAV) of the spot Bitcoin ETF fund and the price of the underlying asset, Bitcoin.