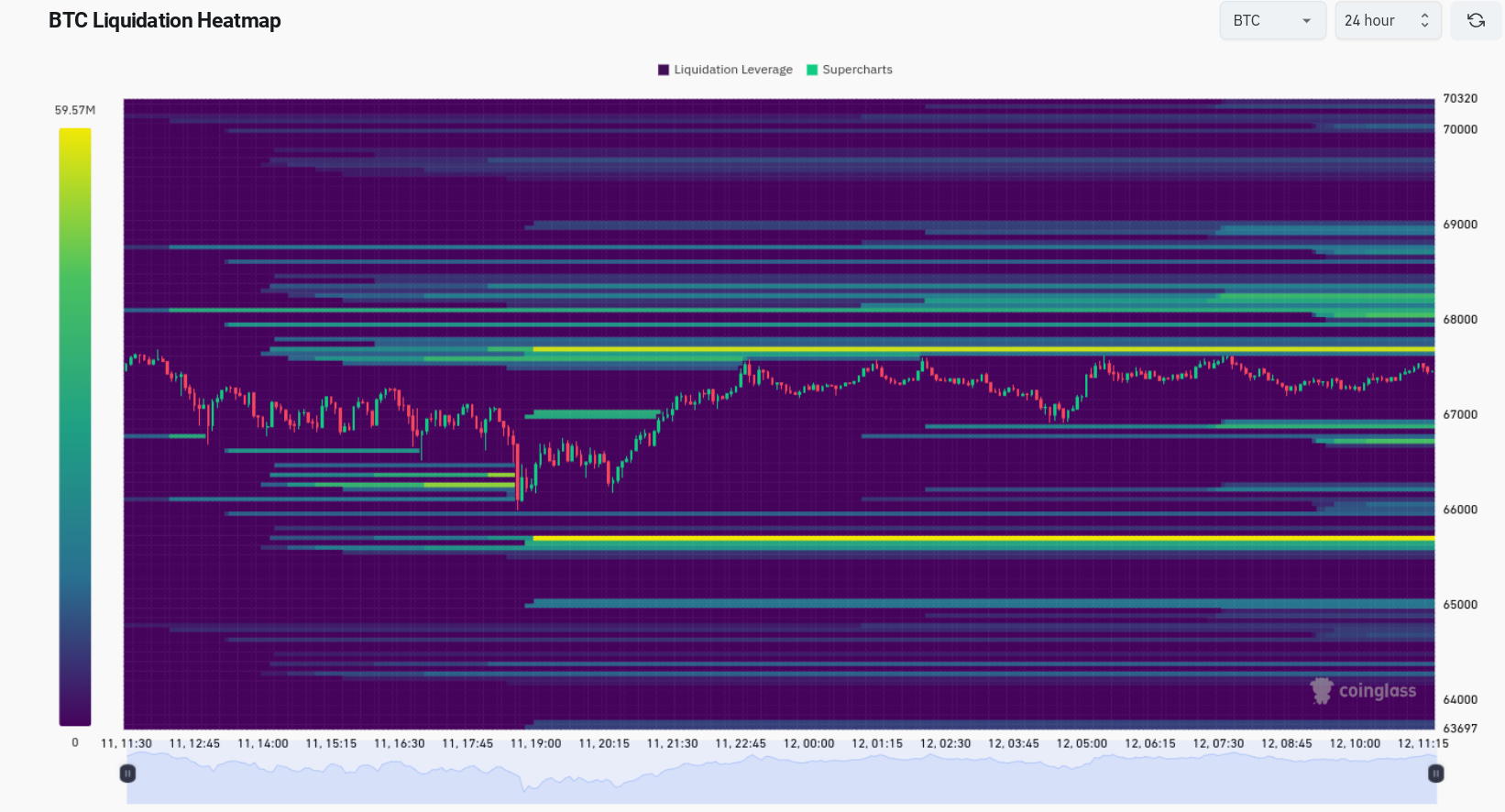

Bitcoin, after triggering major exchange withdrawal transactions among cryptocurrencies, returned to $67,500 on June 12. Data from TradingView showed Bitcoin’s price movement was stable as markets prepared for macroeconomic events in the US. Bitcoin had fallen to $66,000 the previous day, leading to over $50 million in long liquidations according to data from CoinGlass.

What Is Happening on the Bitcoin Front?

The events followed a pattern seen before the Fed’s interest rate meetings and the release of the May Consumer Price Index (CPI). Many investors reacted by noticing the classic Bitcoin price behavior, combined with the fact that the BTC/USD pair was at key resistance below all-time highs.

Popular investor Follis shared the following statements on X regarding the process:

“The same accounts in the crypto community are starting to demand higher and say $100,000 is programmed. We say we will leave the bears behind and escape. The truth is Bitcoin has been trading in a specific range for only 3 months.”

At the time of writing, CoinGlass data showed liquidity increased downward around $65,700, and $67,700 formed the main obstacle to overcoming higher rises.

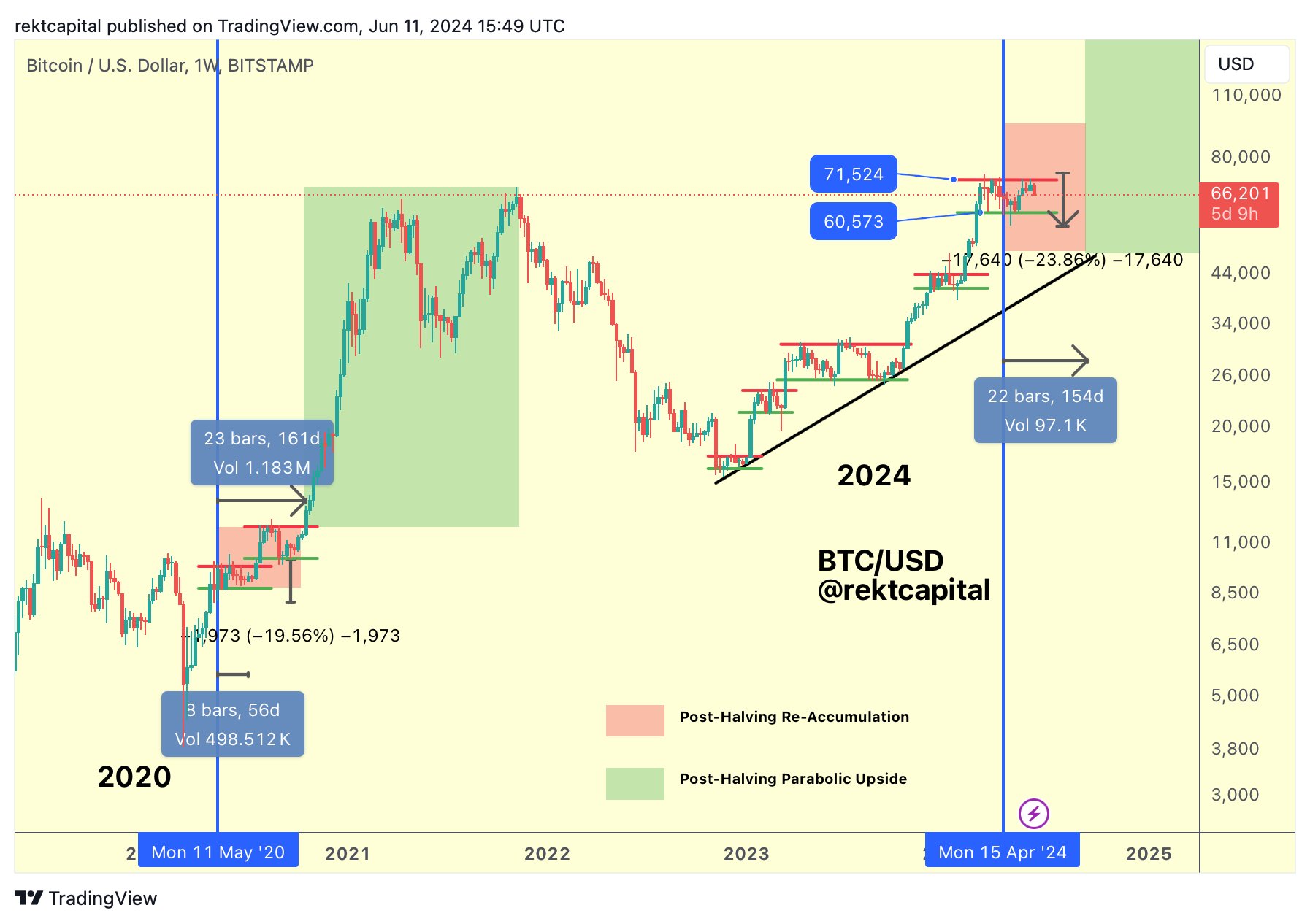

Popular investor and analyst Rekt Capital compared this Bitcoin price cycle with previous ones, stating that history prevails and added:

“Bitcoin has not made such an early exit in the post-halving period as history suggests.”

Notable Data for Bitcoin

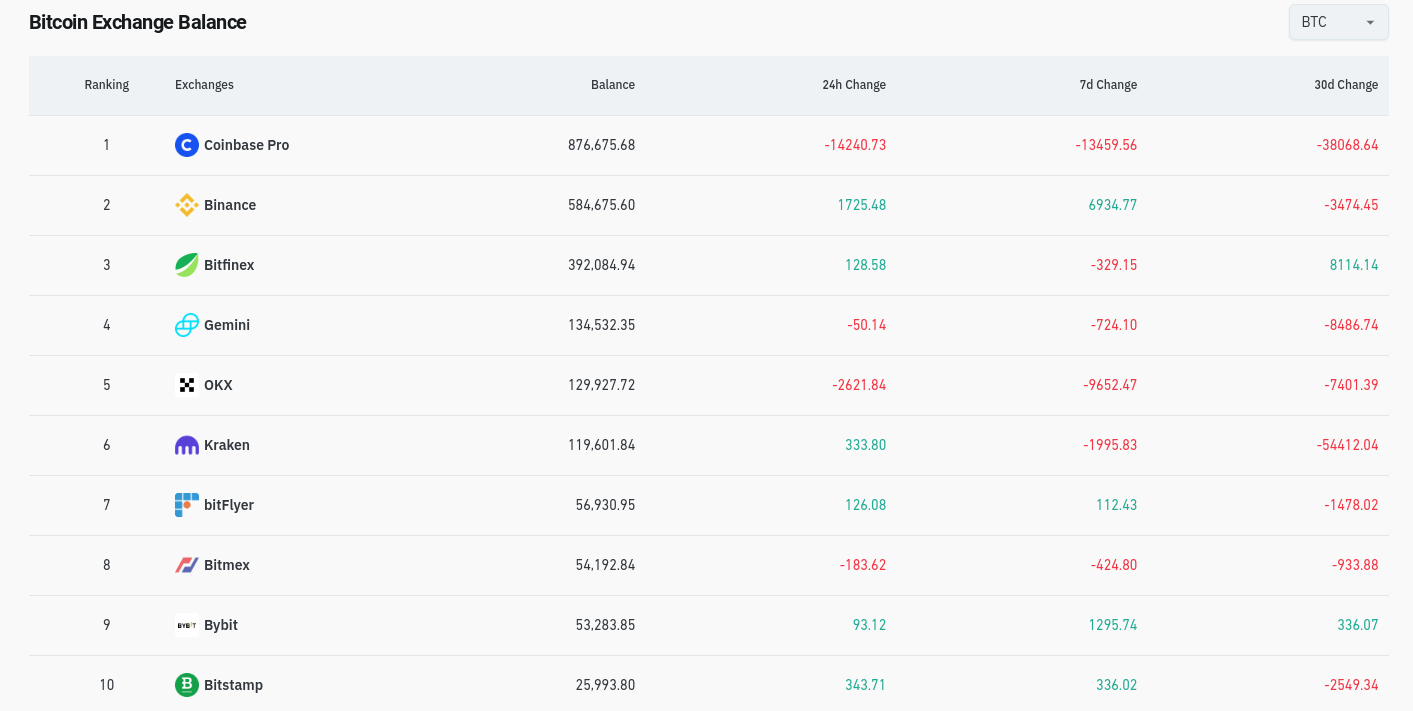

Meanwhile, on-chain data captured ongoing exchange withdrawals, particularly focusing on the US’s largest exchange, Coinbase. As highlighted earlier this month, the total Bitcoin balance on Coinbase Pro dropped by 14,420 Bitcoin within 24 hours of writing this. This added to the current exchange balance declines.

In the 30 days up to June 12, Coinbase experienced a drop of over 38,000 Bitcoin, with overall exchange balances at their lowest in seven years.

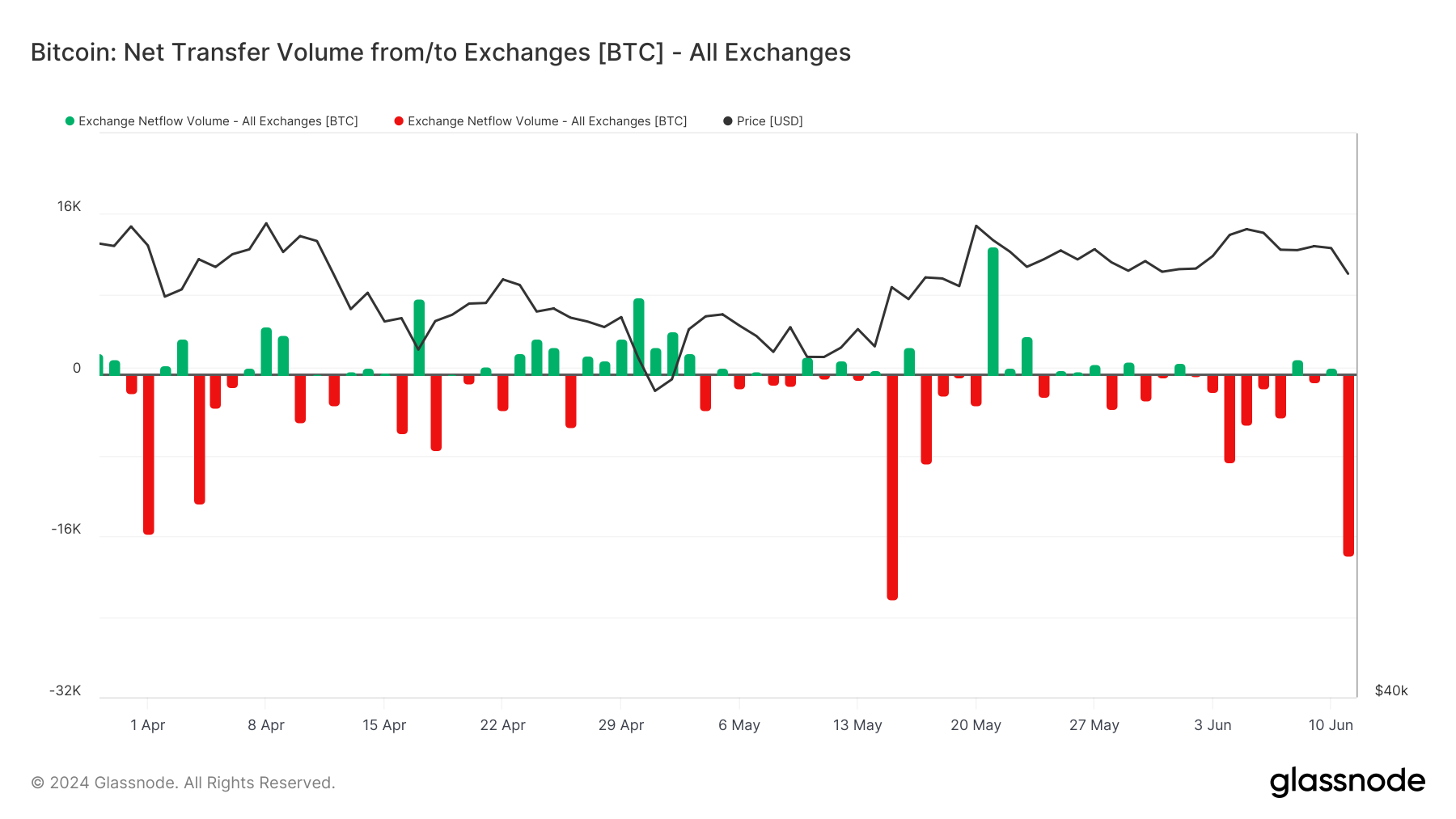

Blockchain data analysis platform Glassnode identified the net transfer volume from exchanges as 17,967 Bitcoin on June 11.

Türkçe

Türkçe Español

Español