According to data from the blockchain data analysis platform Santiment, Bitcoin is facing an extended FUD level at the $65,000 horizontal trading range on the social media platform X. Santiment stated in a post on X dated June 20 that this extended FUD level is rare because investors continue to surrender. FUD stands for fear, uncertainty, and doubt.

What Is Happening on the Bitcoin Front?

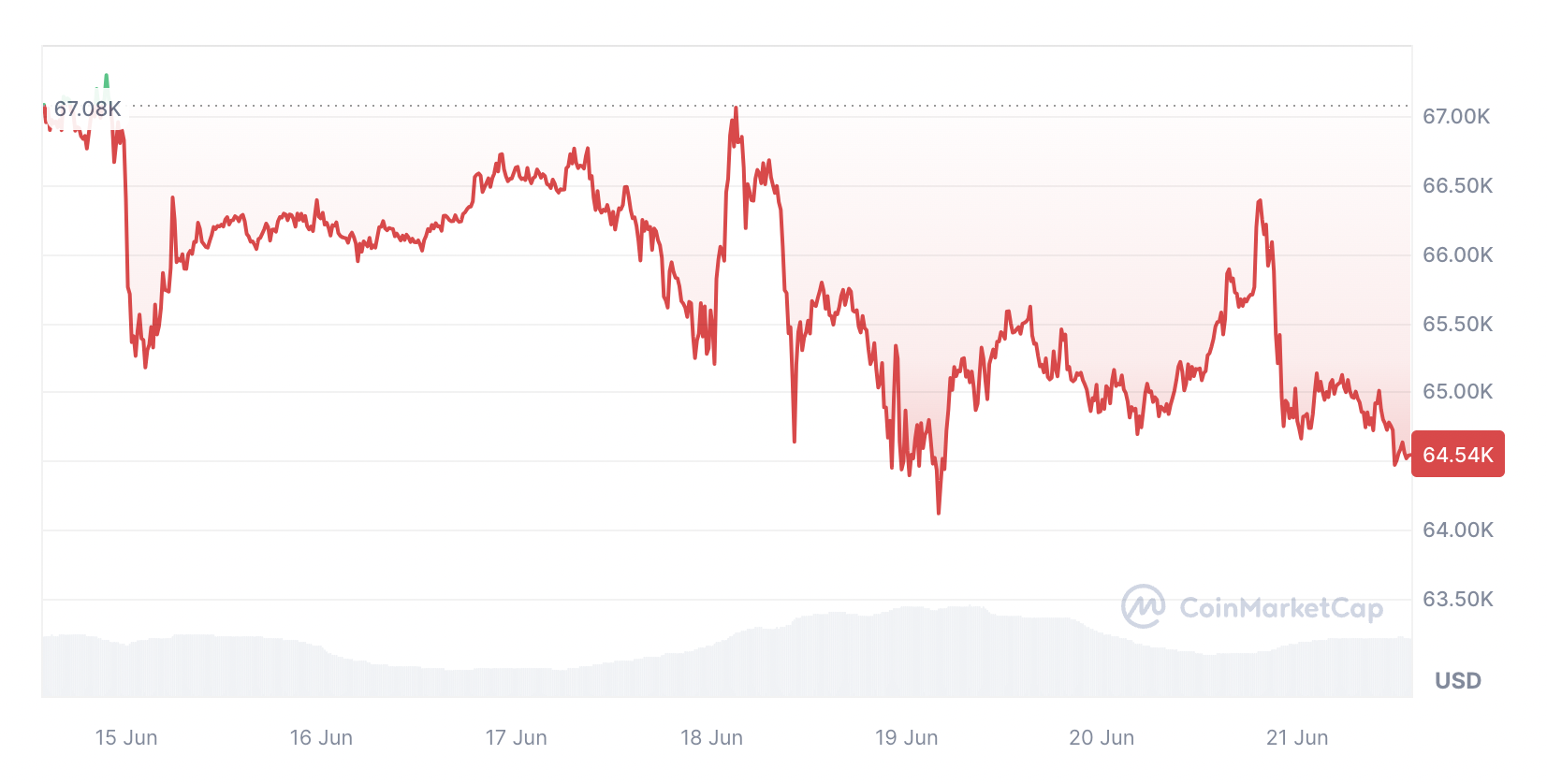

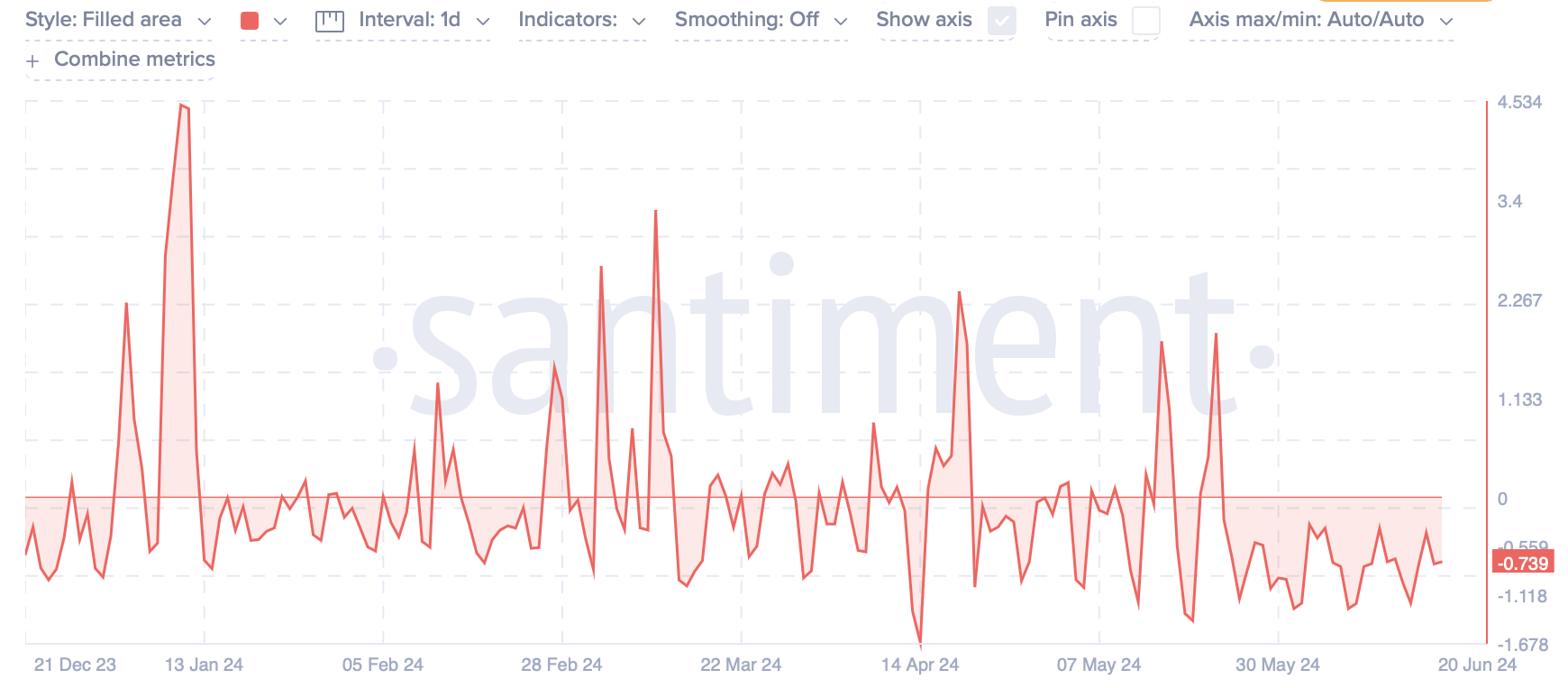

CoinMarketCap data shows that Bitcoin’s price traded between the highest levels around $67,294 and the lowest level around $64,180 last week. Santiment noted that the Weighted Sentiment Index, a data point measuring Bitcoin mentions on X and comparing the ratio of positive to negative comments, has remained negative since May 23.

At the time of publication, the data stood at -0.738, indicating that mentions of Bitcoin were predominantly negative on X during this period. However, positive events for Bitcoin, such as the approval of 11 spot Bitcoin ETF funds on January 10 and the Bitcoin halving event on April 20, caused the indicator to rise to positive levels of 4.49 and 2.35, respectively.

Comments on Bitcoin from Famous Figures

Negative sentiment towards Bitcoin on social media came from all segments of the crypto community, including investors and analysts with significant followings. Glassnode’s chief analyst James Check shared the following remarks in a post on X dated June 19:

“We are about 60 days into a 150-day horizontal stagnation since the Bitcoin halving event.”

Another crypto analyst, Jelle, stated that the months-long horizontal price movement is the most boring phase of the bull market. Some believe that prolonged consolidation could lead to a very rapid price increase. Popular analyst Daan Crypto Trades explained to his followers that the longer the consolidation, the greater the subsequent expansion.

Meanwhile, another crypto market sentiment indicator, the Fear and Greed Index, showed a Greed reading of 63 at the time of writing, down 11 points over the past seven days. This data also considers social media sentiment while analyzing other factors such as volatility, market momentum and volume, market dominance, and current trends.

Türkçe

Türkçe Español

Español