While uncertainties continue in cryptocurrencies, some altcoins are experiencing overbuying and overselling. Amidst all this, fluctuations in Bitcoin and Ethereum prices persist. Recent data indicates that many altcoins are in the oversold region, and we have analyzed two of them for you.

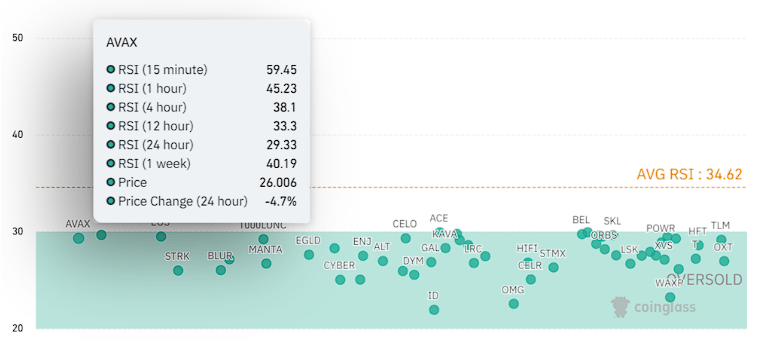

Avalanche (AVAX) Analysis

Avalanche (AVAX) recent data reveals significant information. The 24-hour RSI for AVAX indicates 29.33, showing it is in the oversold region.

Historical data shows that cryptocurrencies with such low RSI values often experience price increases. However, there is no guarantee that the price will rise.

On the other hand, it is worth noting that AVAX’s price has dropped by 6.7% in the last 24 hours, indicating that sales are continuing rapidly.

The average RSI value of 34.76 for AVAX indicates that the cryptocurrency is experiencing a larger oversell compared to other altcoins in the market, reflecting its recovery potential.

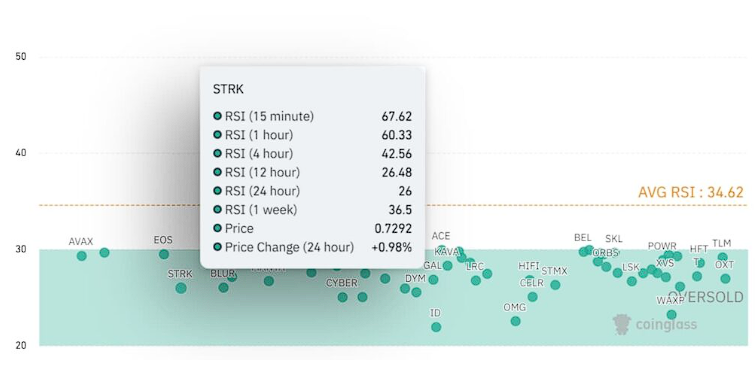

Is Starknet (STRK) Worth Buying?

Starknet (STRK) also appears to have faced significant selling pressure like AVAX. RSI value analyses and additional technical indicators suggest buying signals, but they are not definitive.

The 24-hour and 12-hour RSI values for STRK are far from 30, indicating an oversold condition. These values are calculated as 26 and 26.48 respectively, showing strong overselling. This overselling situation could make STRK a candidate for cryptocurrencies with potential for price increases if the bears are exhausted.

Like AVAX, STRK also experienced a decline in the last 24 hours, but it was only a 1.5% negative outlook. Despite the overselling RSI indicators, the slowdown in the decline can be interpreted as investors starting to buy the dip and gradually turning their eyes towards profit.

STKR has an average RSI value of 34.76. This value can be interpreted as STRK being oversold compared to the market, similar to AVAX.

Türkçe

Türkçe Español

Español