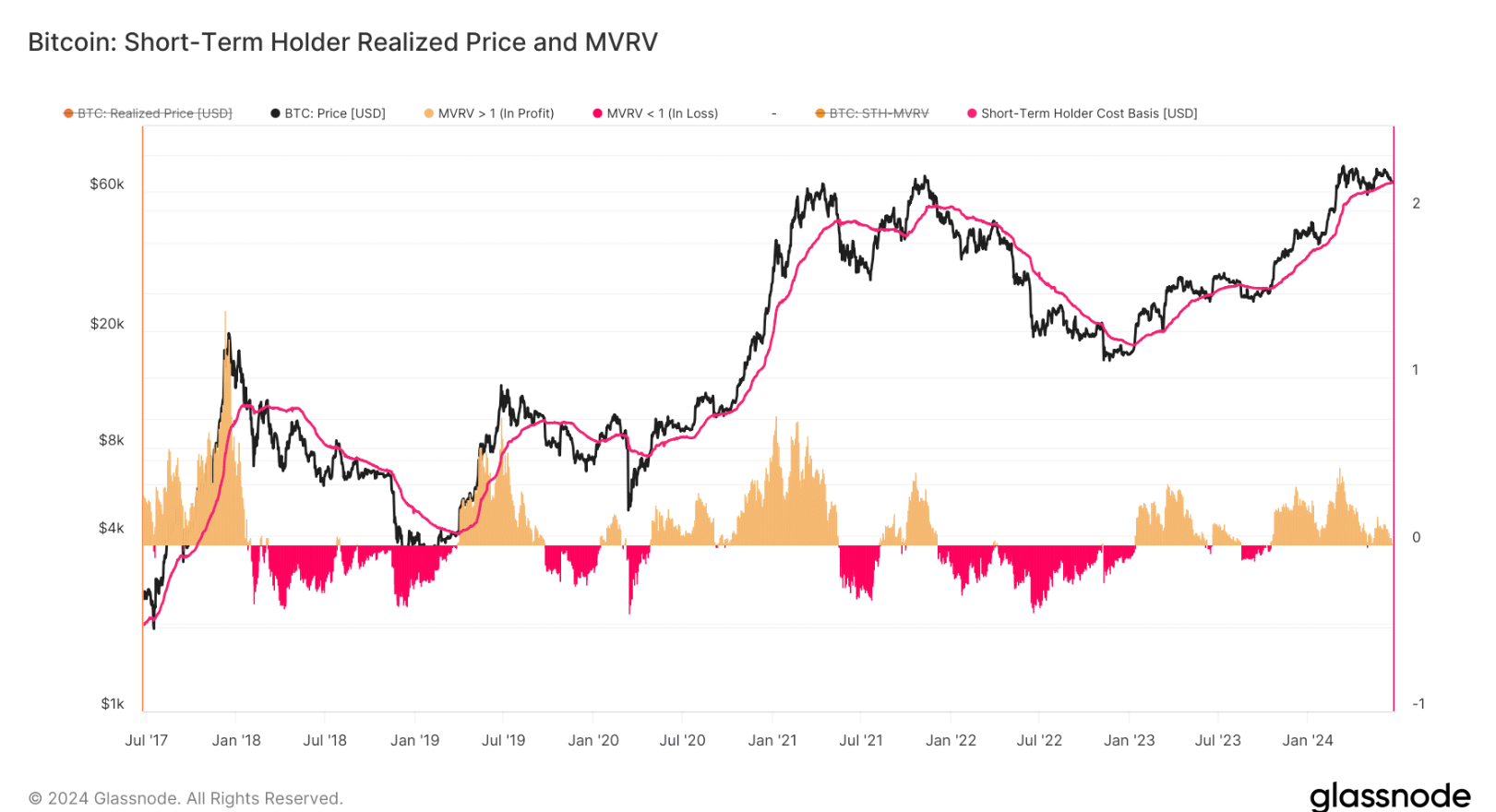

Bitcoin’s (BTC) recent price movements contain some significant signals that worry investors. According to Glassnode data, Bitcoin’s short-term holders (STH) realized price is set at $64,372, which is above Bitcoin’s current value of $64,066. This indicator represents the average cost of investors who bought Bitcoin within the last 155 days, known as STH. This metric is generally used to assess BTC’s short-term market health.

Critical Threshold in BTC

When the STH realized price level is breached, the likelihood of a market price correction increases. Bitcoin falling below this critical support level has historically been a precursor to significant price movements. In 2018, when Bitcoin’s price fell below the realized price of $11,012, the market soon dropped to $8,455. A similar situation occurred at the end of 2021, with Bitcoin’s price falling from $48,962 to $42,306.

These data suggest that Bitcoin may experience a new correction in the coming days. The market value to realized value (MVRV) Long/Short difference metric also supports this possibility. This metric measures the impact of new entries into the Bitcoin market and long-term holders. Currently, this ratio is at 21.16%, indicating that there has not been sufficient new capital entering the market recently, meaning Bitcoin’s price could fall in the short term.

Analyst Opinion on BTC

However, the MVRV long/short difference metric also reveals whether a cryptocurrency is in a bull or bear market. Positive values indicate that Bitcoin is still in a bull market. Therefore, even if the price drops to $61,000, there is potential for long-term value appreciation. This market fluctuation can present significant buying opportunities for investors. The relative strength index (RSI) also supports these negative expectations. In the 4-hour chart, the RSI value is at 40.87, signaling a downward momentum in the market. RSI is used to evaluate a token’s momentum, and values below 50 generally indicate a bearish market.

Bitcoin’s complex price movements lead to different interpretations among investors. For instance, an analyst known as Crypto Caesar considers Bitcoin trading below the STH realized price as a buying opportunity, typically indicating a return to an upward trend. Historically, such drops have been considered suitable times for BTFD strategies. In conclusion, although historical data and technical indicators point to a short-term price drop, a potential long-term recovery is also possible.

Türkçe

Türkçe Español

Español