Bitcoin price started the week positively, rising above $63,000. This affected other cryptocurrencies in the market. A well-followed crypto analyst highlighted key points in BTC, noting increased interest.

Analyst’s Bitcoin Comments

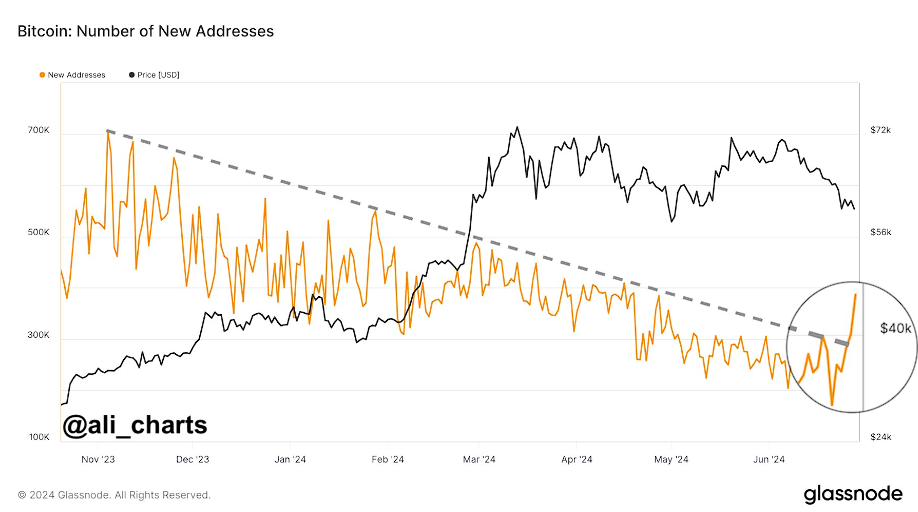

A well-followed crypto analyst noted that despite weeks of market uncertainty, the number of new Bitcoin (BTC) addresses continues to rise, possibly due to individual investors. Crypto analyst Ali Martinez stated on X that there has been a break in the long-term decline of new address entries.

Retail Bitcoin investors are returning! The number of new BTC addresses on the network rose to 352,124, the highest since April.

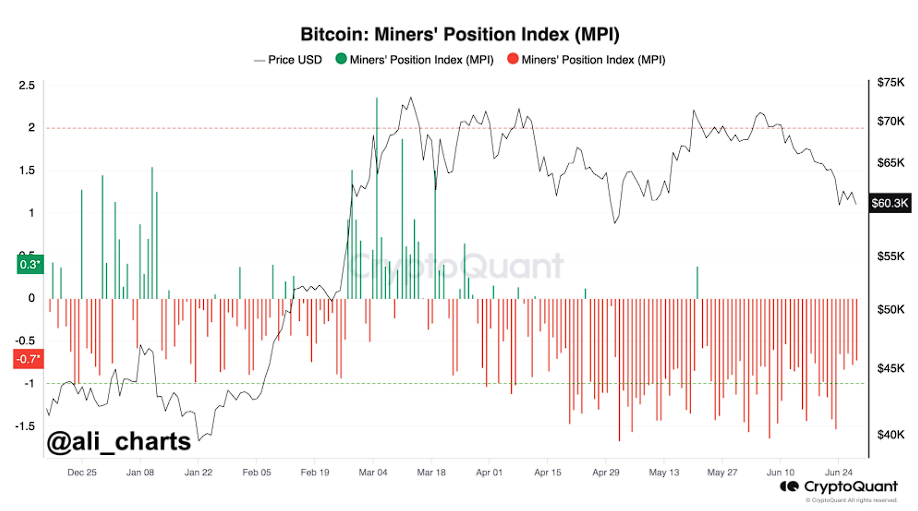

Martinez noted that miners of the largest crypto asset by market value are transferring their positions, often seen as a precursor to a Bitcoin bull market.

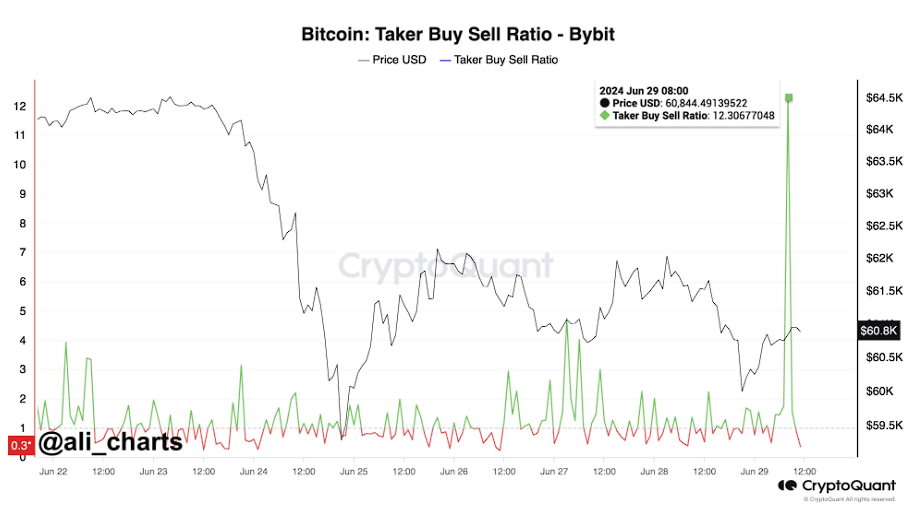

The analyst published another chart, suggesting that investors might be buying the dip, creating excitement in the market.

Someone on Bybit is buying the Bitcoin dip, as indicated by the recent increase in the BTC buy/sell ratio!

The chart shared by Martinez shows that the BTC buy/sell ratio and the long/short ratio indicate 12,306. A value above 1 is critical for a rise, as it means that long positions taken by BTC bulls are increasing in the market.

How Much is 1 Bitcoin?

Looking closely at the Bitcoin price, it seems to have settled after the rise. After a 0.1% increase in the last 24 hours, it continues to find buyers at $62,800.

Bitcoin’s volume also increased, surpassing $1.24 trillion. The volume had been falling along with the price for weeks. Meanwhile, the 24-hour trading volume continues to rise today. BTC’s trading volume increased by 48%, reaching $25.5 billion, indicating growing investor interest in the market.

Türkçe

Türkçe Español

Español