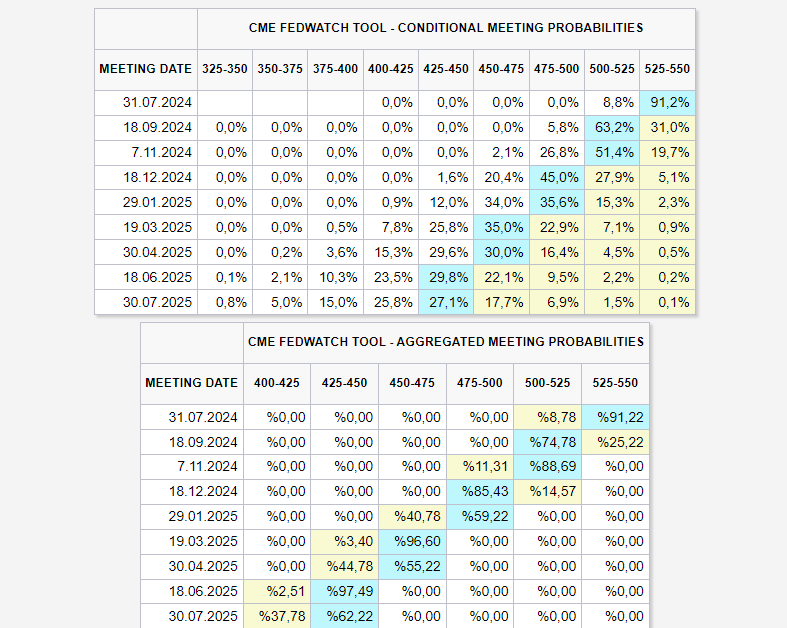

At the time of writing, Fed Chair Powell is making significant statements that are also impacting cryptocurrencies. Highlighting progress in inflation during the speech is extremely important for risk markets. If the Fed starts to be convinced of a decline in inflation, markets may begin to price in rate cuts.

Fed Latest Update

Powell is currently mentioning that new signals on disinflation indicate a renewed weakening in inflation. If it weren’t for the poor inflation data in the first quarter, we would likely have seen the first rate cut by now. The key points of Powell’s statements are as follows.

“Solid growth and a strong labor market continue. The disinflation trend shows signs of restarting. We have made quite a bit of progress on inflation. We need to be more certain before lowering policy rates. As we have seen recently, we need to see more data. The data represents significant progress. If the labor market unexpectedly weakens, that would also prompt us to respond. We have the ability to take our time and do this right. Risks are becoming much more balanced. Service inflation is usually more stubborn.”