Bitcoin price dropped by 2.25% in the last 24 hours and is currently trading 16% below its all-time high of $73,835 reached on March 14. Bitcoin price fell by 8.75% in the last 30 days and 5.5% in the last three months, following a downward trend in June, leading market analysts to wonder if the cycle peak for the leading cryptocurrency has arrived.

What’s Happening on the Bitcoin Front?

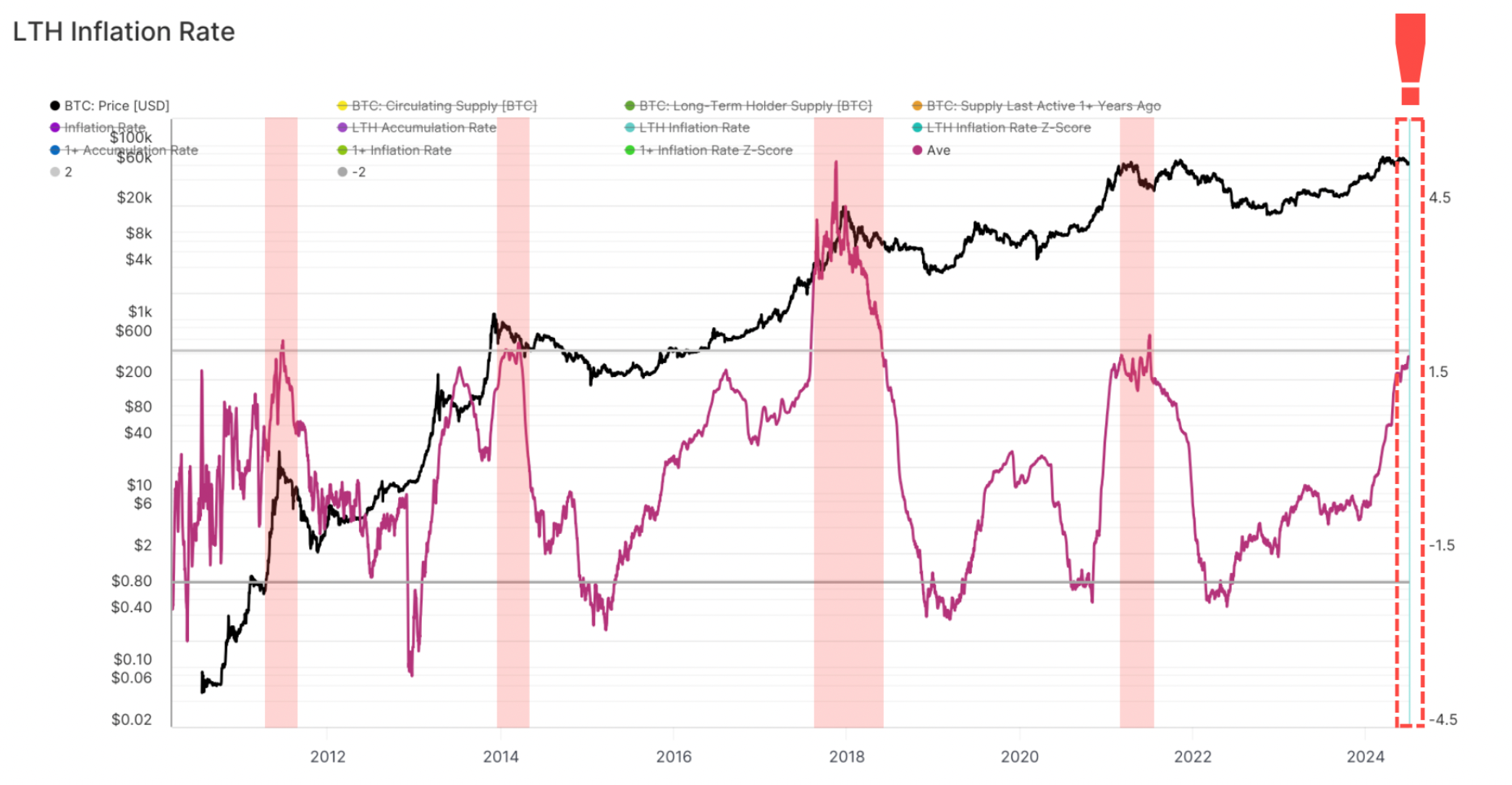

Capriole Investments founder Charles Edwards explained that multiple data points indicate Bitcoin’s inability to reach new highs after two tests is a sign of weakness. In his latest newsletter, Edwards stated that the inflation rate of Bitcoin long-term holders (LTH) has steadily increased over the past two years.

According to Glassnode, the LTH market inflation rate measures the annual accumulation or distribution rates beyond the daily issuance to miners. Higher values indicate increased selling pressure as Bitcoin holdings decrease on the LTH front. At bull market peaks, market inflation surpasses nominal inflation, often indicating a high likelihood of the cycle peak occurring.

Noteworthy Details

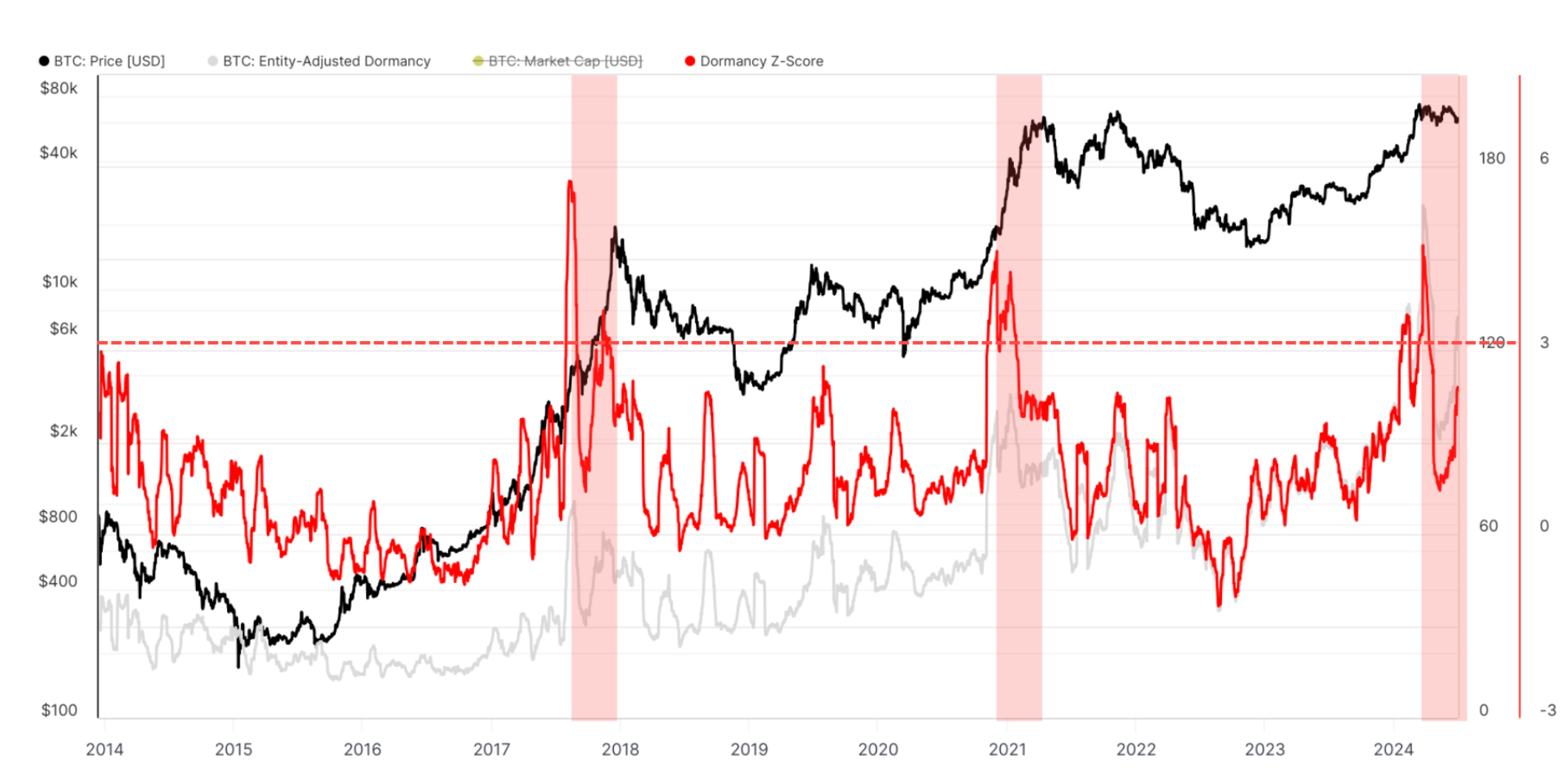

Another useful data point for determining market cycles and assessing whether Bitcoin is in an upward or downward trend is the Dormancy Flow data. It is on-chain data used to measure the number of tokens spent according to the general trend. Additional data from Glassnode reveals that Bitcoin Dormancy Z-score has sharply increased in the last 90 days.

Edwards observed that this data peaked significantly in April and suggested that the average age of spent assets was significantly higher in 2024. The analyst explained this process with the following words:

“Peaks in this measurement typically reach cyclical peaks only three months later. Yes, three months later, the price fell further, and the Dormancy Z-Score peak remains quite comparable to the peaks in 2017 and 2021.”

At its current value, the Dormancy Flow Z-score means that Bitcoin is overvalued relative to the total assets in a transaction without being supported by trading volume. This suggests that the Bitcoin price may have reached a cycle peak, indicating a bearish trend for the broader crypto market.

Türkçe

Türkçe Español

Español