The cryptocurrency market recently faced significant turbulence, and Bitcoin (BTC) fell below $55,000 due to large-scale liquidations and notable fund movements from the 2014-collapsed Mt Gox exchange. Data shows a concerning $678 million liquidation in the market within the last 24 hours, and Bitcoin dropped by 7.4% to $53,400 for the first time since February 26, 2024. This sharp decline in Bitcoin caused double-digit losses in altcoins.

Movements at Mt Gox Caused Major Liquidations in Bitcoin and Altcoins

The sharp decline in Bitcoin followed Mt Gox’s transfer of approximately $2.7 billion worth of BTC as part of preparations to pay creditors, expected to start earlier this month. The exchange moved 47,228 BTC to a new wallet address, with some of it later redistributed to other addresses.

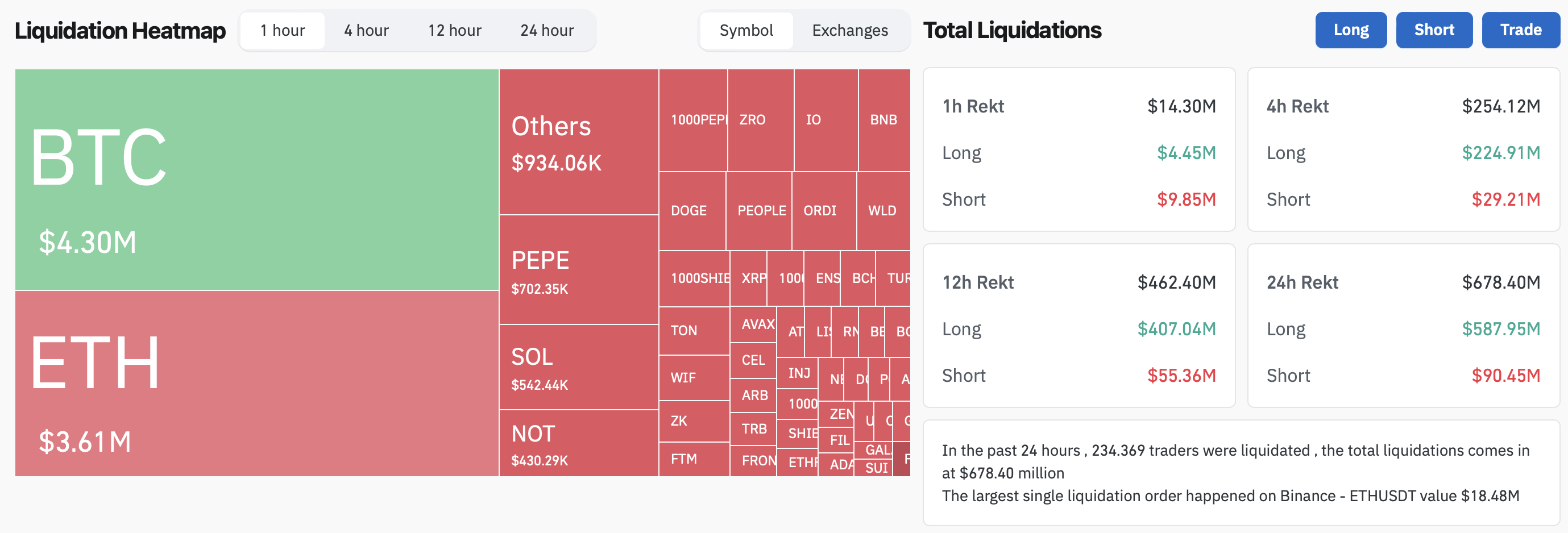

The wave of liquidations that began with the decline in Bitcoin and altcoins affected over 230,000 investors, with BTC accounting for the majority of the $222.1 million liquidations. Most of the liquidated positions were long positions, totaling approximately $181.8 million. Similarly, the altcoin king Ethereum (ETH) experienced a significant decline with $163.4 million in liquidations, most of which ($143.3 million) were long positions. Ethereum’s price dropped significantly by 10.57% to $2,890.

Liquidations in the cryptocurrency market typically occur when investors do not have enough margin to support their positions amid price fluctuations. This situation forces the closure of positions, and forced closures generally lead to further downward pressure on prices.

Experts Issue Special Warning for Bitcoin Cash

Observers like Peter Chung from Presto Research and Ben Caselin from VALR commented on the recent situation in the cryptocurrency market. Chung noted that the selling pressure could be more pronounced for less-supported cryptocurrencies like Bitcoin Cash (BCH) as Mt Gox creditors might prefer to cash out quickly. On the other hand, Caselin suggested that the fundamental market structure has not changed and Bitcoin could stabilize below $50,000 for a while.

Despite the current volatility and downward trend, industry experts remain optimistic about Bitcoin’s fundamental value and long-term prospects. They emphasize that the current price movements are primarily a concern for short-term speculators and do not reflect any fundamental changes in market dynamics.

Türkçe

Türkçe Español

Español