Ethereum ETF launch is days away, and the crypto market is focused on this development. While Ethereum struggles with price corrections, Bitcoin shows a stronger upward momentum. The crypto world closely watches the debates around spot Ethereum ETFs and their potential market impacts.

Different Performances Between Ethereum and Bitcoin

The upcoming Ethereum ETF launch has excited investors, but ETH price has seen significant drops. Just last week, Ethereum’s value fell by 12%. However, market data and technical indicators suggest a potential trend reversal.

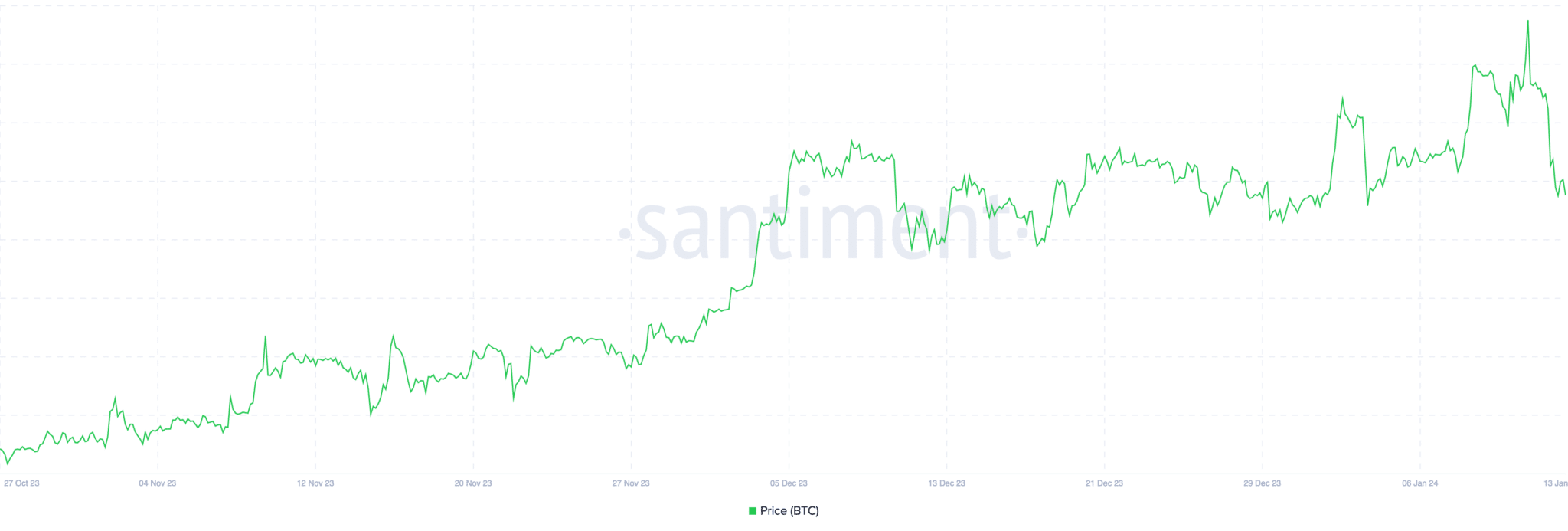

Comparing Bitcoin’s performance before its ETF launch with Ethereum’s current state, Bitcoin shows a stronger upward momentum. Bitcoin started gaining value months before the January 2024 ETF launch, building significant investor confidence. However, BTC’s price saw a notable drop post-launch.

Ethereum’s Price Performance and Technical Indicators

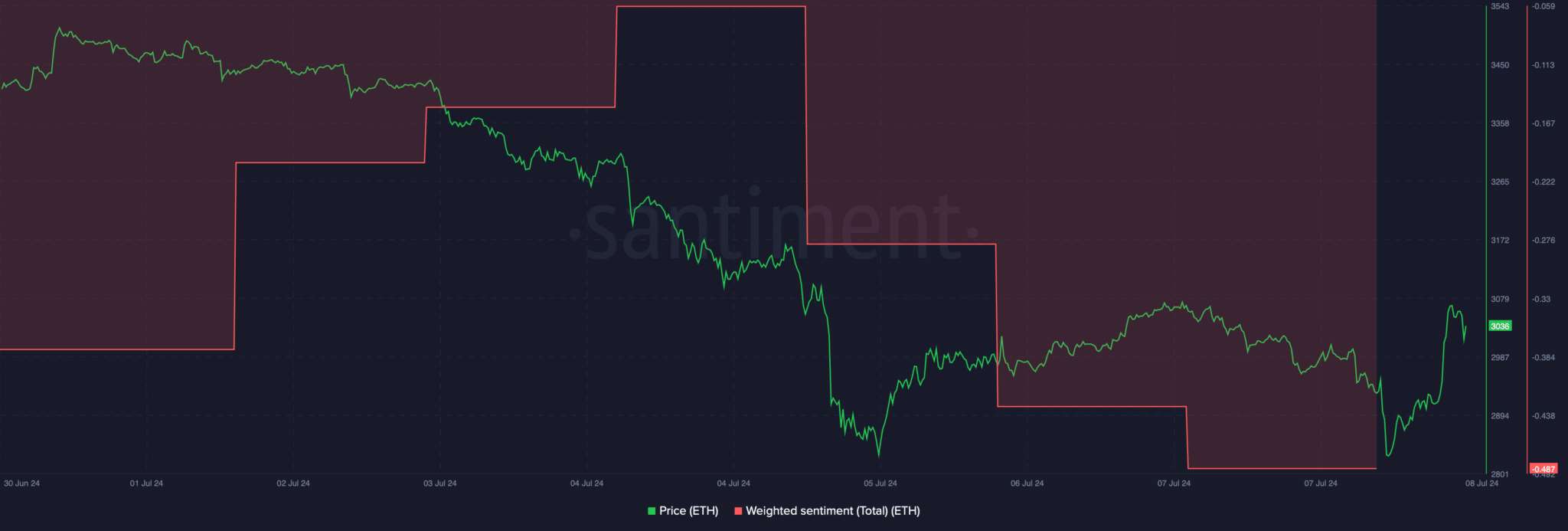

Despite high expectations around Ethereum ETFs, ETH faced significant price corrections. The decline in ETH’s weighted sentiment has shaken investor confidence. According to Santiment data, investor sentiment towards ETH has recently turned negative.

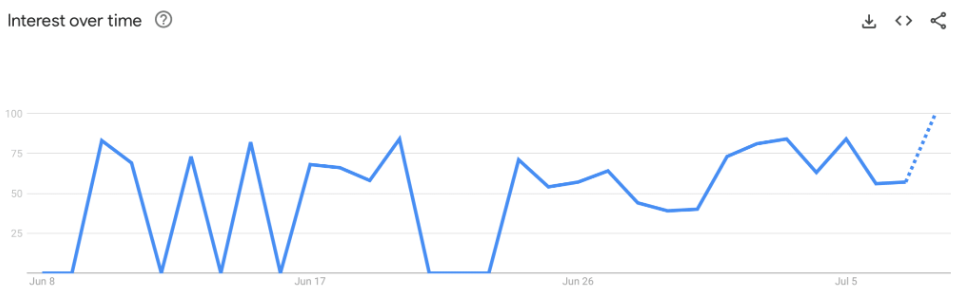

Google Trends data shows interest in Ethereum ETFs in the US remains steady, but this interest hasn’t reflected in the price. At the time of writing, ETH trades at $3,045.32 with a market cap exceeding $366 billion.

The drop in ETH’s price can be attributed to decreased investor confidence. However, some technical indicators show positive signs. ETH’s daily chart shows an increase in the Relative Strength Index (RSI) and a similar trend in the Money Flow Index (MFI) after reaching the oversold region. These indicators suggest a potential rise for ETH.

Pre-Launch Uncertainty and Expectations

Other technical indicators like the Chaikin Money Flow (CMF) and MACD create uncertainty about ETH’s near future.

As the launch date approaches, the crypto community will closely watch whether ETH can challenge its downward trends and perform stronger. The crypto world eagerly awaits to see if Ethereum can surpass Bitcoin during this crucial period.

Türkçe

Türkçe Español

Español