Polygon price has only recorded a decline for the last month and a half and now, according to many analyses, it may start to rise. Changing market conditions and renewed demand for MATIC could help the rise. MATIC price plans to make a comeback with the decline in the bearish trend, given that the altcoin has already fallen into the oversold zone.

What is Happening on the Polygon Front?

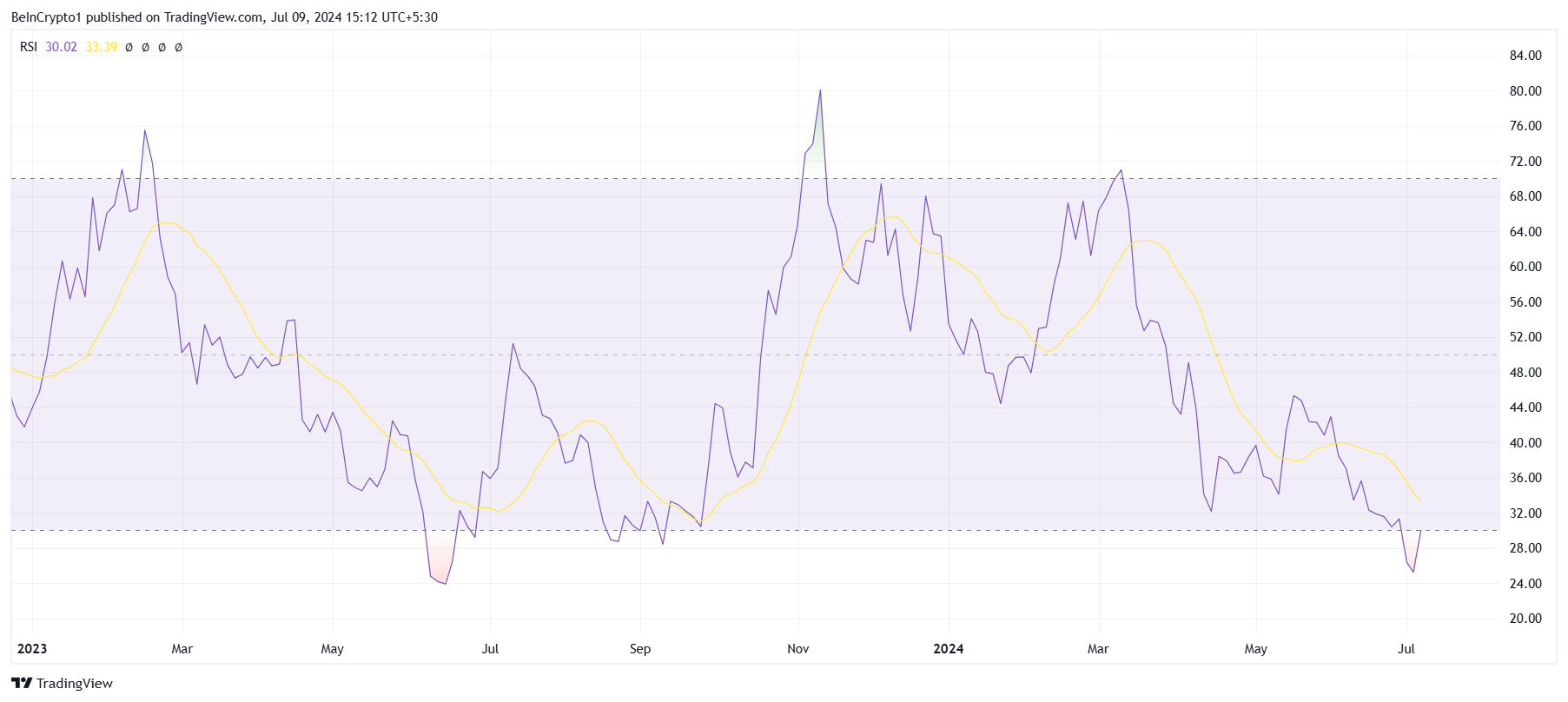

The Relative Strength Index (RSI) currently shows that the altcoin is oversold, indicating a potential trend reversal in the near future. RSI, a momentum oscillator that measures the speed and change of price movements, has slipped into the oversold zone. This usually means that the asset has been sold very aggressively and it might be time for a recovery. Investors and analysts often see such RSI levels as a signal for potential buying opportunities and predict that the bearish trend will reverse as the selling pressure decreases.

Additionally, market data reveals a remarkable statistic regarding MATIC’s hold addresses. Currently, less than 8% of all MATIC hold addresses are in a profitable position, which could significantly affect market behavior. The fact that the vast majority of asset holders are at a loss or have not yet made a profit could be a deterrent to selling. Investors are less likely to sell at a loss, which could potentially stabilize the price and even create upward pressure as buyers perceive current price levels as attractive.

With fewer shareholders wanting to make a profit or reduce losses, there may be less incentive for widespread selling. This event usually results in the asset’s price stabilizing or, in some cases, gradually recovering if buying interest increases.

MATIC Chart Analysis

MATIC price is currently at the $0.50 level on the three-day chart. The macro outlook is consistent with the aforementioned bullish potential. The altcoin, which rose from $0.49, aims to surpass $0.60, the next major hurdle in the recovery. If this happens, the altcoin will be open to reconsolidation between $0.75 and $0.64.

On the other hand, a failed breach could keep the price in the $0.53 to $0.64 range and minimize investors’ profit opportunities. This process could invalidate the bullish thesis and keep the MATIC price low until stronger bullish signals emerge.

Türkçe

Türkçe Español

Español