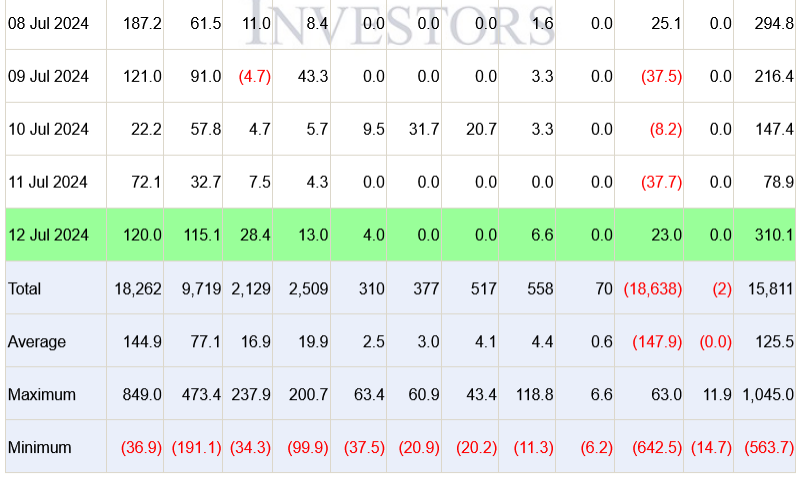

United States-based spot Bitcoin exchange-traded funds (ETFs) recorded over $310 million in inflows on July 12, marking the best-performing day since June 5. According to Farside Investors, BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity Wise Origin Bitcoin Fund (FBTC) saw the majority of the flows, with $120 million and $115.1 million, respectively.

What is Happening in the ETF Sector?

Bitwise Bitcoin ETF fund ranked third with $28.4 million, while Grayscale Bitcoin Trust (GBTC) recorded another rare inflow day with $23 million. VanEck Bitcoin Trust ETF and Invesco Galaxy Bitcoin ETF also recorded $6 million and $4 million in inflows. Meanwhile, spot Bitcoin ETF funds issued by Hashdex, Franklin Templeton Valkyrie, and WisdomTree did not record any inflows during the day.

It was the largest inflow day since June 5, when spot Bitcoin ETF issuers reached $488.1 million in flows. The calculation for July 12 indicates that Bitcoin ETF issuers have obtained a total of $1.04 billion this week.

Spot Bitcoin ETF funds have accumulated $15.8 billion in net inflows since the products were launched a little over six months ago. This figure includes over $18.6 billion in outflows from Grayscale’s flagship Bitcoin product, which was converted to a spot form following approval from the US securities regulator in January.

Details on the Subject

Hashdex Bitcoin ETF fund (DEFI) was the only other Bitcoin ETF fund with a net outflow, but it was a relatively small amount of $2 million. According to CoinGecko data, Bitcoin increased by 1.1% in the last 24 hours and is currently trading at $57,858, although it has dropped by about 15% in the past month and is now 21% away from its all-time high.

According to Nate Geraci, President of The ETF Store, some of these Bitcoin ETF issuers are now preparing to launch spot Ethereum ETF funds as early as next week. These issuers are now waiting for the US securities regulator to sign off on amended S-1 registration statements after receiving the first round of feedback late last month.

Türkçe

Türkçe Español

Español