Tokenized US treasuries could reach $3 billion by the end of 2024, highlighting the benefits of financial asset tokenization and widespread adoption. To reach $3 billion by the end of this year, tokenized treasuries need to nearly double. According to Tom Wan, a research strategist at 21.co, the $3 billion level is achievable due to the increasing tendency of decentralized autonomous organizations to diversify their holdings in tokenized US treasuries.

What’s Happening on the US Front?

Thanks to product offerings from global giants like Securitize and BlackRock, tokenized US treasuries will reach $3 billion. Strategist Tom Wan wrote in an X post on July 15:

“With two projects allocated to tokenized US treasuries, we could see the total market value of tokenized US treasuries rise to $3 billion by the end of 2024.”

According to data from the blockchain data analytics platform Dune, tokenized US government bonds have accumulated over $1.6 billion in total assets under management (AUM). BlackRock’s BUIDL-coded USD Institutional Digital Liquidity Fund became the largest tokenized treasury fund after surpassing Franklin Templeton’s fund.

BUIDL became the largest tokenized fund in just six weeks, achieving a market value of over $375 million during this period. The fund’s value is currently over $528 million, with a market share of over 28.8%.

According to Wan, BlackRock’s fund will significantly accelerate inflows into tokenized treasury bonds:

“The strategy put forth by Securitize and BlackRock aims to provide diversity for accessing risk-free US treasury yields without needing to separate from the blockchain ecosystem of the crypto ecosystem.

Details on the Subject

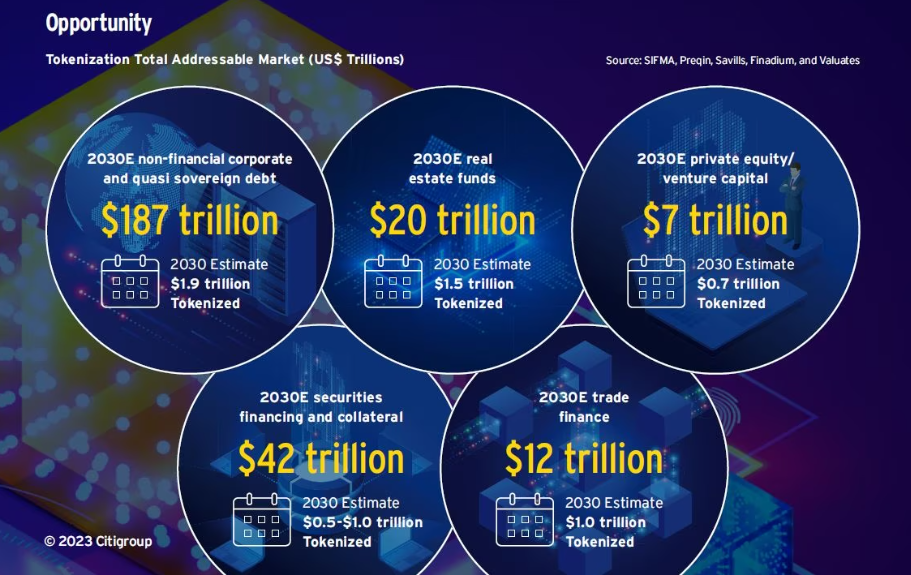

According to the world’s largest management consulting firm, tokenization could be the next multi-trillion-dollar market opportunity. A report published by the Global Financial Markets Association (GFMA) and Boston Consulting Group estimates that the global value of tokenized illiquid assets will reach $16 trillion by 2030.

Other estimates suggest that analysts at Citigroup predicted in a 2023 report that $4 trillion to $5 trillion worth of tokenized digital securities will be issued by 2030. Major companies worldwide are aware of the potential of tokenization. For example, Goldman Sachs is preparing to launch three new tokenization products by the end of the year, citing increased customer interest.