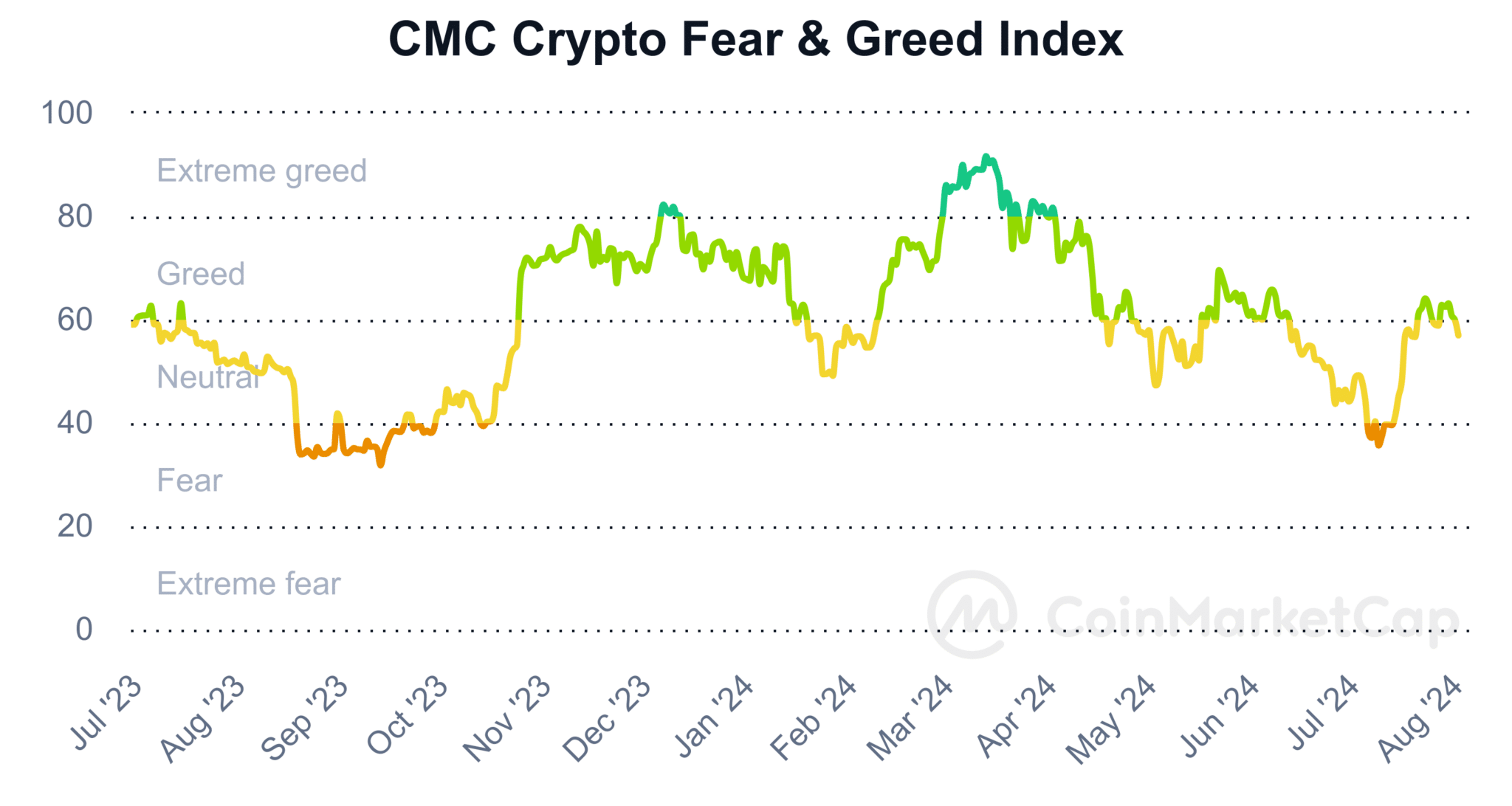

Bitcoin, has caught investors’ attention with its sharp declines in recent weeks. The Crypto Fear and Greed Index provides clues about Bitcoin’s new price bottom. The index measures market sentiment to guide investors.

Weekly Time Frame and Crypto Fear and Greed Index

Bitcoin has entered a downtrend on the weekly time frame. This situation may create potential buying opportunities for long-term investors. Bitcoin’s price has dropped by 9.74% since reaching its peak on Monday, falling below $63,000. This decline signals that the market may move further downward.

The Crypto Fear and Greed Index helps investors make buy-sell decisions by measuring their emotional state in the market. The index indicates that extreme fear is a buy signal, while extreme greed is a sell signal. Currently, the index is at 56, a neutral value, showing that the market is neither in extreme fear nor extreme greed.

Bitcoin Rejected at $70,000

Bitcoin failed to surpass the $70,000 level and was rejected. On July 29, Bitcoin rose to $70,100 but experienced a sharp decline, resulting in $343 million in liquidations. Fibonacci retracement levels of $56,100 and $52,000 may offer attractive buying opportunities in the coming weeks. However, the $52,000 level seems like a distant target for now.

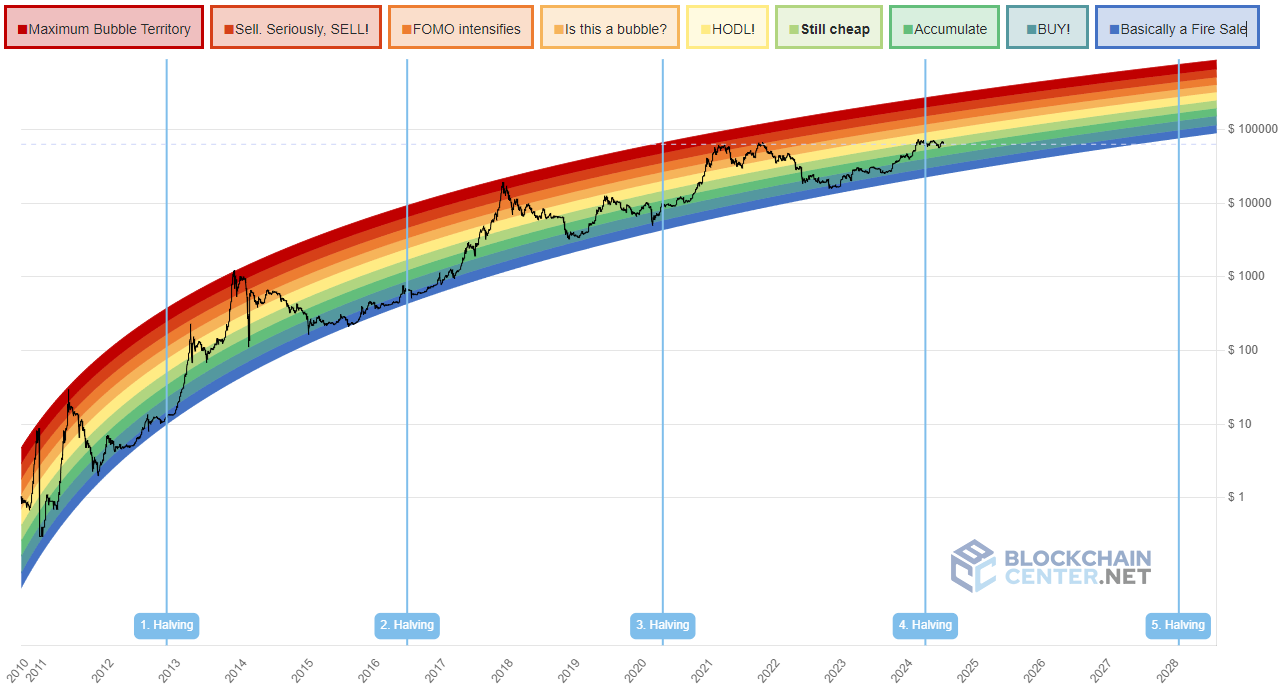

Long-term investors may view such price drops as opportunities. Market panic usually creates price bottoms, and a drop below $60,000 could create ideal buying opportunities. The Bitcoin Rainbow Chart shows that Bitcoin is still in a “cheap” zone.

Future Trends and Index Values

The Crypto Fear and Greed Index is not at extreme levels, indicating that a trend reversal is not expected in the short term.

The current neutral value suggests that more declines are possible before a real uptrend begins. Therefore, it is important for investors to be patient and prepared for market fluctuations.

Türkçe

Türkçe Español

Español