Bitcoin price fluctuates, and the recent drop due to short-term concerns isn’t too alarming. As expectations for more rate cuts from the Fed grow stronger, global giants like Morgan Stanley are now offering BTC ETF to their clients. These factors make the recent drops insignificant in the medium and long term. But what about AAVE?

AAVE Coin

Genesis moved $1.5 billion worth of BTC and ETH, but this hasn’t caused a significant drop in BTC as of the time of writing. On the other hand, positive news, as mentioned earlier, brightens the medium and long-term outlook. So, what’s the latest on AAVE?

The leading lending protocol Aave’s governance token, AAVE, has been on the rise since early July. The altcoin, which reached a three-month high, is hovering at $115.8. More gains wouldn’t be surprising. But why?

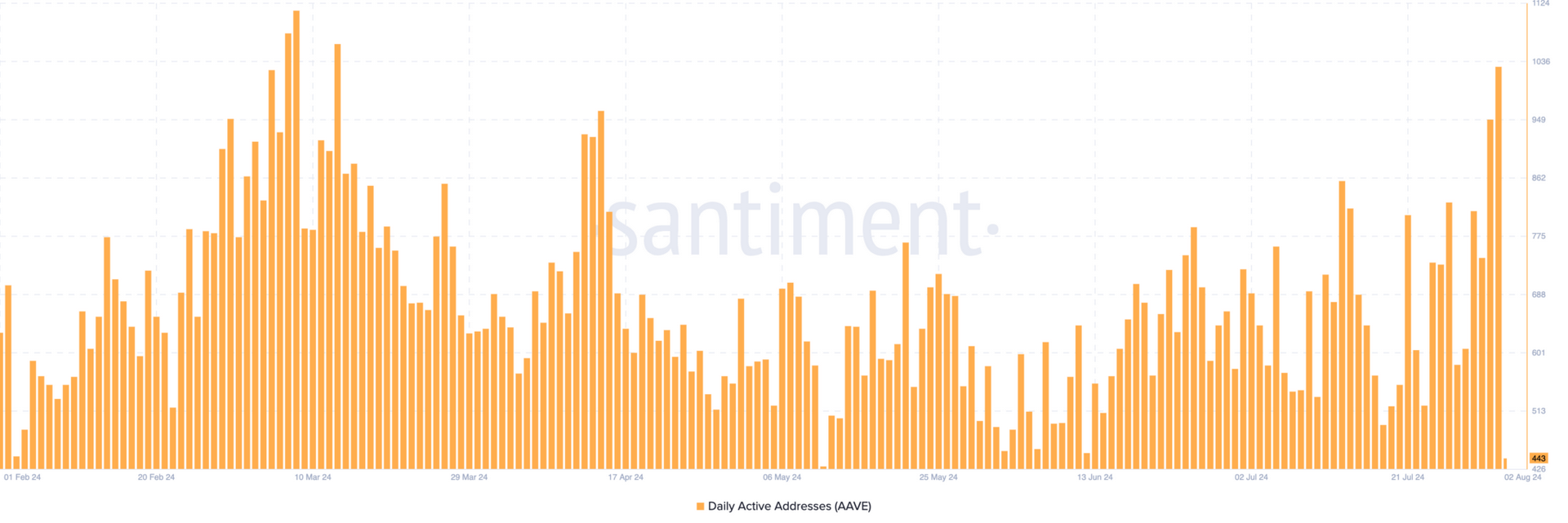

According to Santiment data, AAVE’s daily active addresses have reached their highest level since March. After many peaks, 1,029 addresses interacted with the protocol daily, reflecting the increasing appetite of experienced investors in the market. When read alongside the nearly 10% price increase, the network activity boost presents a positive outlook.

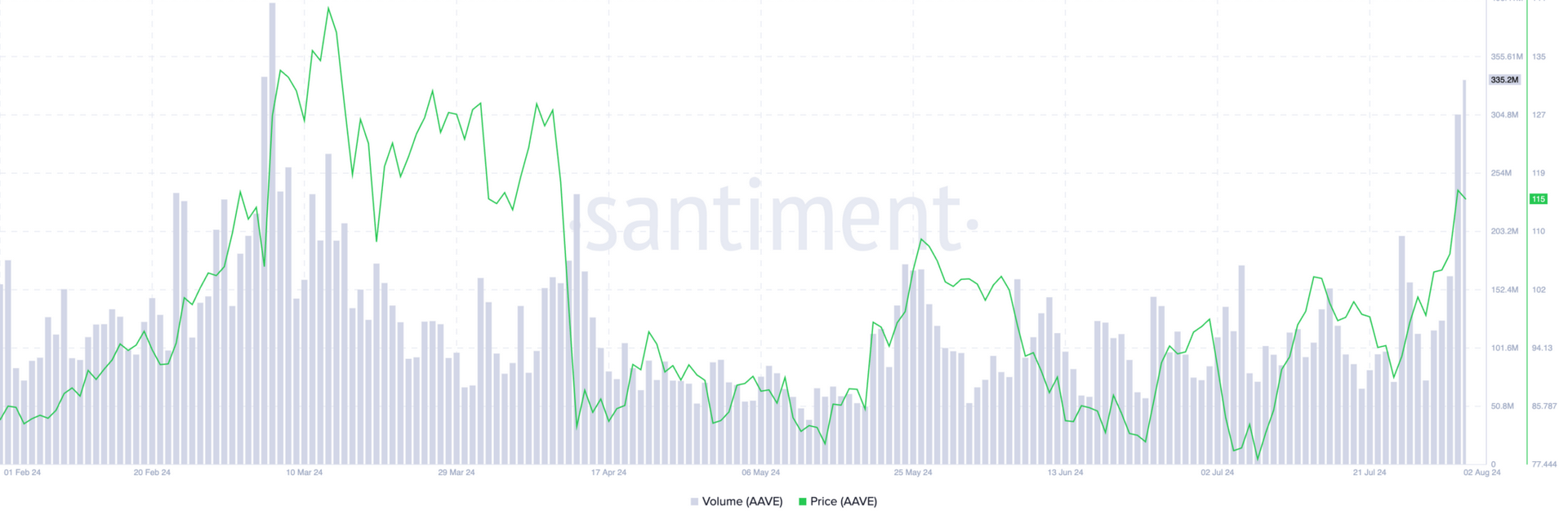

Moreover, on July 31, Aave V3.1 was launched. With centralized crypto lenders like Genesis shutting down, AAVE has become even more significant. Additionally, on-chain data shows a 95% increase in AAVE’s transaction volume in the last 24 hours. For the first time since March 6, the volume exceeded $335 million.

AAVE Price Prediction

The altcoin, which saw a record price of $666, has started to attract more interest from whales. According to data compiled by Lookonchain, whale addresses accumulated $7 million worth of AAVE within two days of the new version going live on July 31. The Chaikin Money Flow (CMF) data for the popular altcoin also confirms strong accumulation. CMF data indicates capital inflow, and while BTC is weak and altcoins have taken significant hits, AAVE remains strong.

The Elder-Ray Index is at 21.27, confirming the bullish sentiment. Investor sentiment is positive, and the bullish sentiment is strong. If BTC doesn’t experience abnormal losses, a new peak above $120 could be seen soon.