10x Research report reveals growing concerns about the US economic strength with potential significant implications for the crypto market. The report suggests Bitcoin value could fall below the psychological level of $50,000, signaling red flags for other cryptocurrencies.

What is Happening in the Markets?

At the center of these concerns is the ISM Manufacturing Index, a traditional economic health barometer, which has recently witnessed a significant decline. Speaking on the matter, 10x Research founder Markus Thielen explained that it might be too early for crypto investors to take more long positions:

“The market structure, including fiat-crypto on-ramps, has been weak for months. Amid high volatility and unpredictable prices, it’s unlikely significant players will invest. Many still need to exit positions and remove their portfolios from the futures market.” Crypto Traders Are Rushing to This App – Here’s Why You Should Too

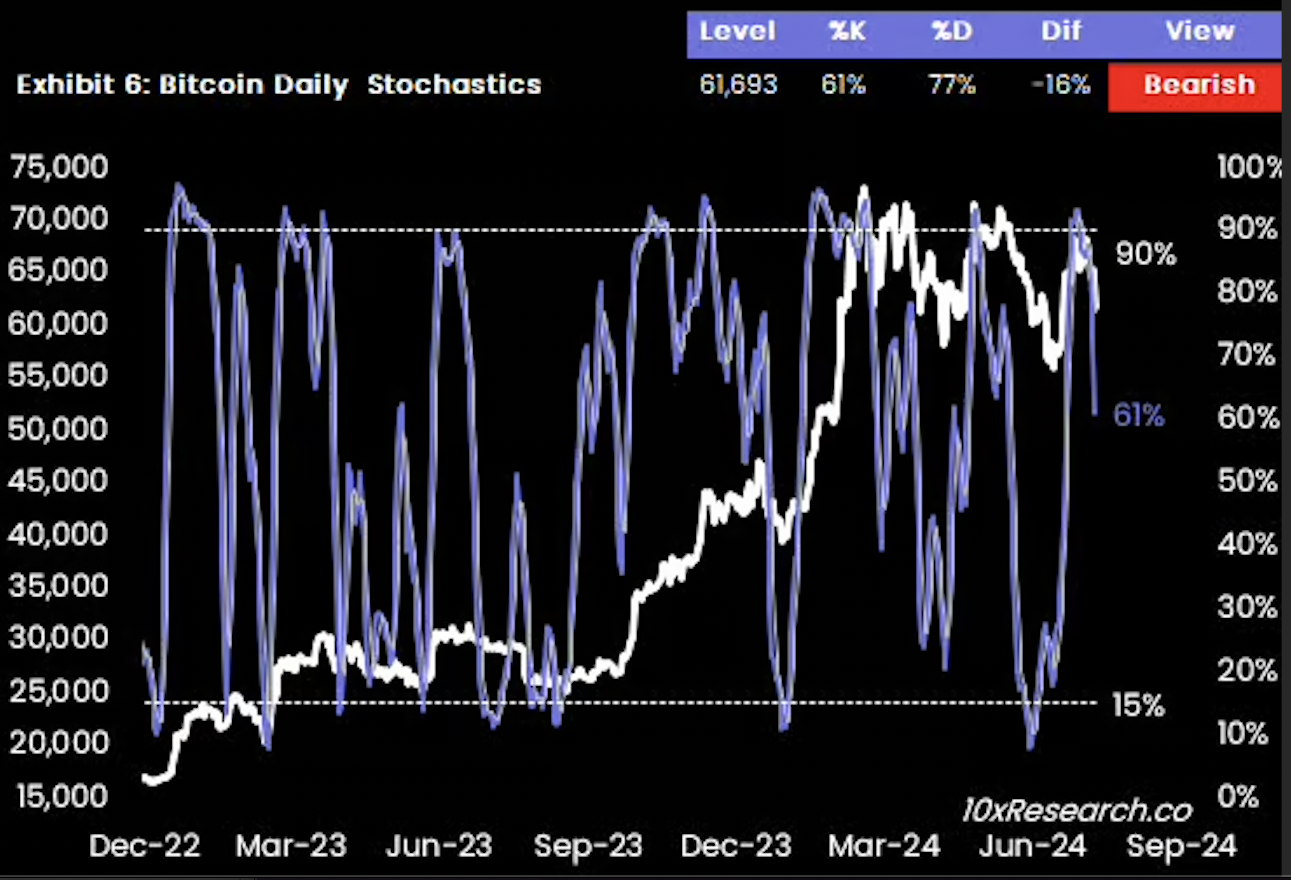

The disconnection highlighted in the 10x Research report suggests a grim forecast for the crypto market due to the historical correlation between the ISM Index and Bitcoin:

“Historically, Bitcoin has experienced sharp corrections when the ISM peaked.”

With the ISM Index now indicating economic weakness and the stock market potentially inflated, the report suggests adjustments are expected soon:

“The S&P 500 may need to align with the real economy, potentially leading to a 20% stock drop.”

The report’s insights emphasize that the state of the US economy is unstable due to the changing position of the US Federal Reserve:

“In the past 48 hours, it has emerged that the US economy is weaker than the Federal Reserve initially believed.”

Details on the Matter

The report also highlights that Federal Chairman Powell reinforced this point, indicating a potential moderate policy shift if inflation decreases as expected, aiming to soften further economic downturns. On August 5th, Bitcoin dominance, the ratio of Bitcoin’s market value to the rest of the crypto market, reached a new annual high of 58% as crypto and stock markets crashed.

The change in dominance coincided with a sudden sale of Ethereum, which dropped by up to 18% within two hours. IG Markets analyst Tony Sycamore reported that amid the increase in Bitcoin dominance, the market crash reminded investors that cryptocurrency sits at the sharp end of the risk assets spectrum.

Türkçe

Türkçe Español

Español