After yesterday’s market fluctuations, Binance CEO Richard Teng announced that the exchange recorded a net inflow of $1.2 billion in the last 24 hours. This amount is one of the highest net inflows seen since the beginning of the year. According to Teng, despite the macroeconomic climate and yesterday’s market downturn, Binance’s high net inflow reflects strong investor confidence.

Investor Confidence and the Meaning of Net Inflows

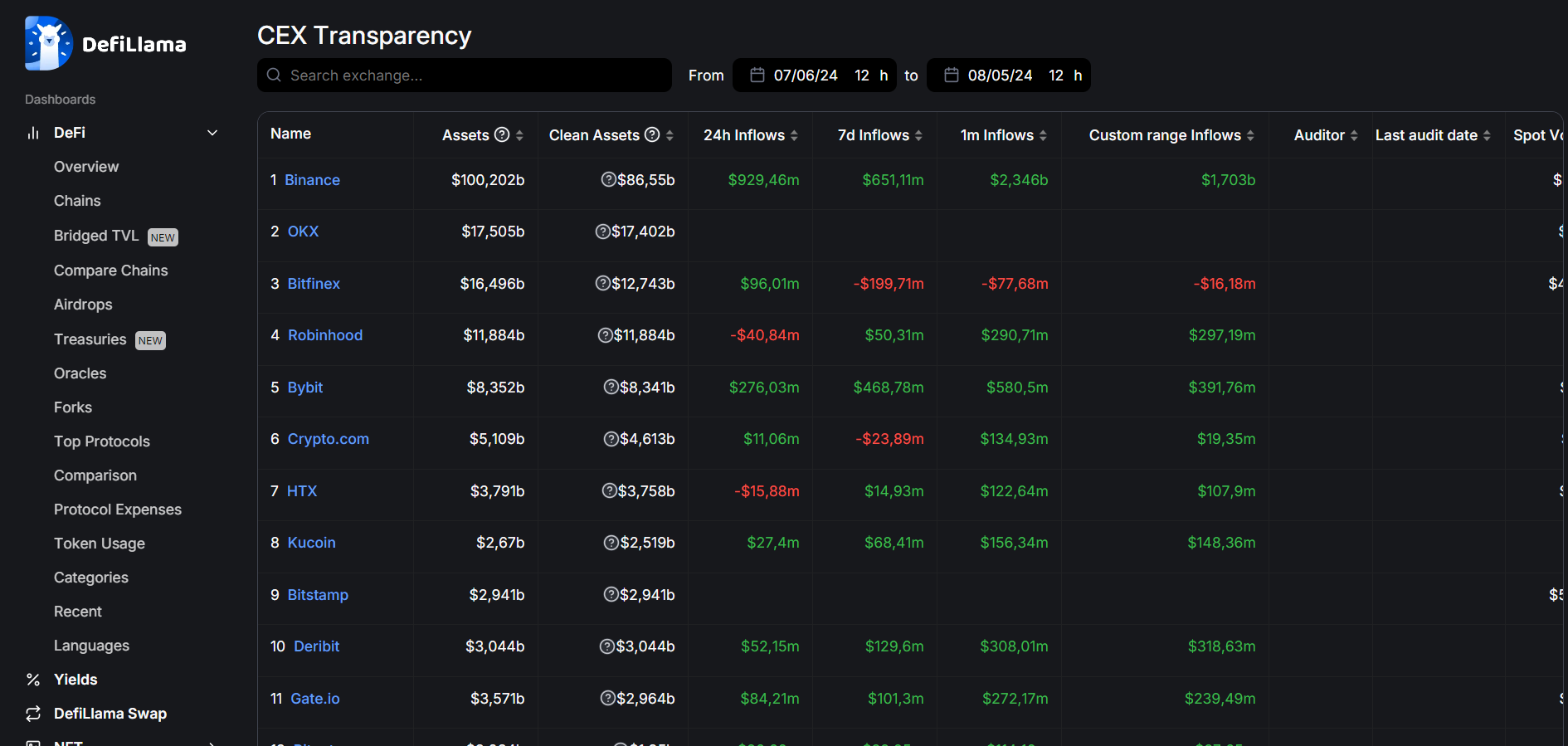

Binance stood out as a safe haven in the cryptocurrency markets with a net inflow of $1.2 billion in the last 24 hours. According to CEX Transparency metrics provided by DefiLlama, the size of this amount is remarkable. At the time of writing, this amount was approximately $929 million.

Yesterday, one of the highest net inflow days of 2024, can be considered an indicator of Binance’s dominance over the market. Because Binance is currently the leader among cryptocurrency exchanges.

Increase in Trading Volumes and Market Trends

Richard Teng stated in his post on X that Binance saw one of the highest trading volumes since the beginning of the year. According to Teng, this supports the observed recovery in the prices of major tokens. Current market trends also confirm this recovery.

After yesterday’s strong crash, altcoin prices are currently experiencing a recovery. This recovery shows that investors are evaluating the crashes. On the other hand, this recovery stands out as an indicator of positive trends in the market.

Finally, looking at the cryptocurrencies listed on Binance, we see that the most increased cryptocurrency is Pendle. The increase in Pendle’s price has reached 48%. This increase in Pendle is connected to South Korea’s leading exchange, Upbit, as Upbit listed Pendle today. The double-digit rises in other altcoins show that the market is taking a breather.

Türkçe

Türkçe Español

Español