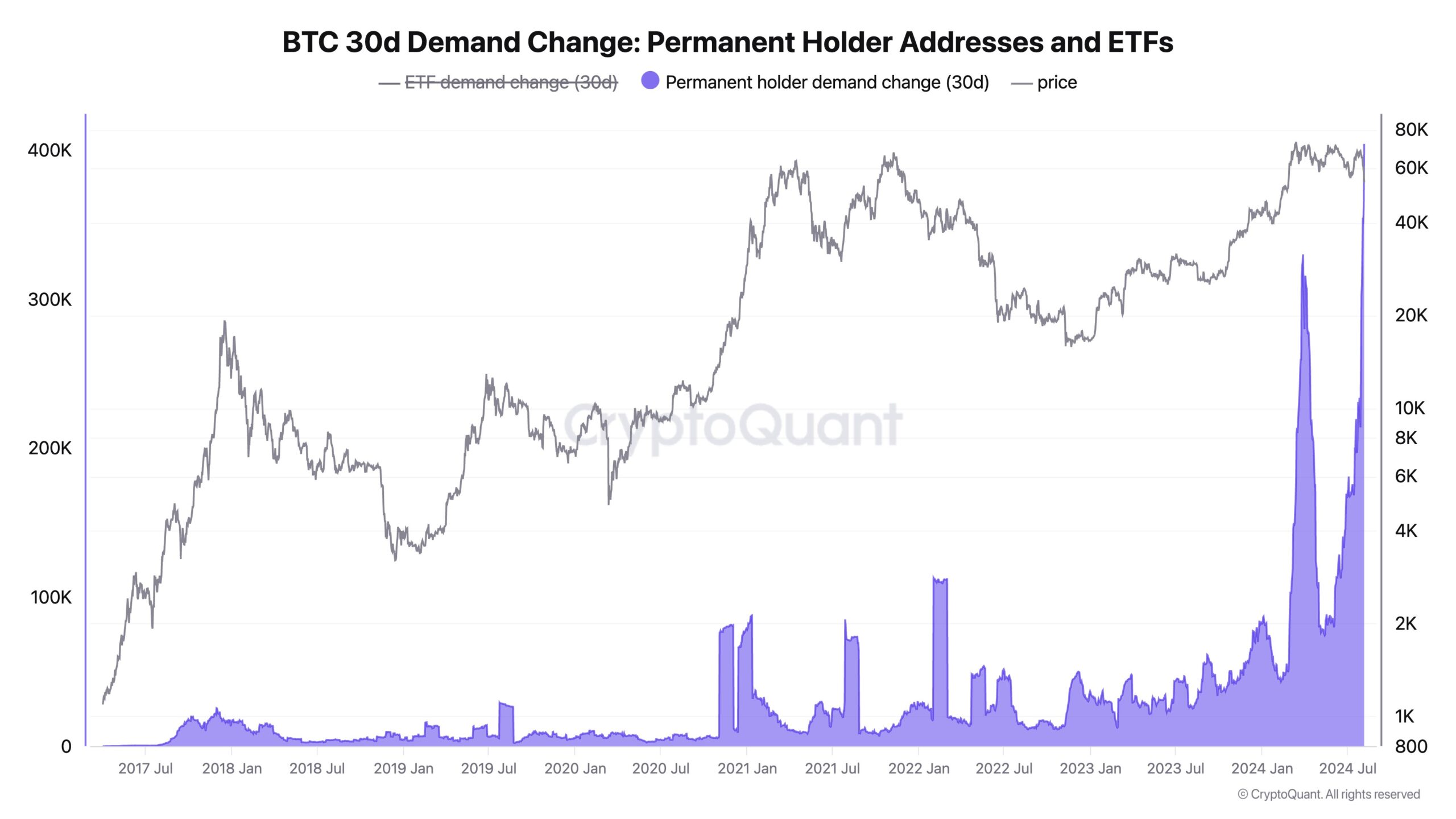

In the last month, Bitcoin (BTC) HODL’ers, or wallet addresses holding BTC at all costs, accumulated nearly $23 billion. CryptoQuant founder and CEO Ki Young Ju evaluated the current situation by sharing on his X account, “Something is definitely happening in the background,” based on the latest on-chain data.

Bitcoin Accumulation Frenzy

Ju’s observation refers to the recent increase in demand change over the last 30 days among Bitcoin HODL’ers. According to the data, this group of investors acquired approximately 404,448 BTC worth $22.8 billion in the last 30 days. He stated that this is clearly an accumulation. At the end of July, significant inflows were observed into Bitcoin HODL’ers’ wallet addresses, and he highlighted flows into wallet addresses like exchange-traded funds, saying, “Large investors are clearly accumulating, and this is at an unprecedented level.”

Ju predicts that within a year, TradFi institutions, companies, governments, or some other entities will announce that they bought Bitcoin in the third quarter of 2024. He also added that individual investors will regret not buying Bitcoin due to the German government’s sales, Mt. Gox, or macroeconomic events.

In another X post, Ju mentioned several other positive factors, such as Bitcoin miner activity. He stated that “miner capitulation is almost over,” noting that the hash rate is approaching all-time highs and that mining costs in the US are around $43,000 per BTC. He predicts that the hash rate will remain stable as long as the price does not fall below this level.

“Bull Market Still Strong”

“Individual investors are largely absent, and this situation is similar to mid-2020,” said the CryptoQuant CEO, noting that long-term investors who held Bitcoin for over three years sold between March and June but that there is currently no significant selling pressure from former large investors. He emphasized, “Based on this data, I believe the bull market is still strong. If the market does not recover within two weeks, I will reassess my observation. I follow smart money, so if I am wrong, either new large investors were misled or they underestimated the macro environment.”

Moreover, since the market drop on August 5, accumulation seems to have increased. During the drop, Bitcoin’s price fell to $48,800 but recovered by 14% to $57,000 on August 6. Additionally, the Crypto Fear and Greed Index rose from extreme fear to fear levels, indicating a slight improvement in market sentiment.

Türkçe

Türkçe Español

Español