Bitcoin and the broader cryptocurrency market are eagerly awaiting data to be released tomorrow. Following the release of US CPI inflation data last July, BTC prices experienced volatility. Today, with only one day left until the data release, BTC is trading around $60,000. Altcoins are known to be more clearly affected by macro events. Despite weak price movements in BTC over the past 24 hours, Ethereum and some other high-volume altcoins have shown gains of over 4%.

Bitcoin and Ethereum Price Movements

Ahead of the US CPI inflation data release, which is of global interest, short positions in Bitcoin and Ethereum are being rapidly closed. More importantly, in the last 24 hours, there has been $91 million in short liquidations and approximately $86 million in long liquidations.

According to preliminary statements, the US CPI data may show an inflation rise that increases concerns about whether the Fed will cut rates in September. Market predictions suggest that July inflation will increase by 0.2%, contrary to the 0.1% decrease last month.

In the past few weeks, Bitcoin’s price has been fluctuating between $50,000 and $60,000. Following last week’s declines, some market analysts indicated that BTC might drop below $50,000 once more before the anticipated bull run.

As of the time of writing, Ethereum is trading at $2,646, up 2.35%, with a market cap of $318 billion. Today’s price increase is being discussed as possibly just a “dead cat bounce,” attributed to sales from wallets created during the ETH ICO.

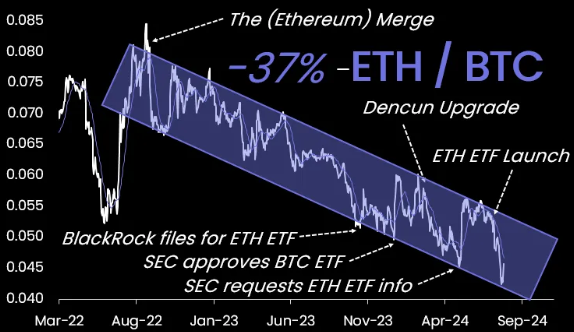

ETH/BTC Pair Analysis

According to research by 10X Research, since the Merge event in September 2022, the ETH/BTC pair has been moving within a downward channel and is showing signs of recovery ahead of the expected CPI announcement.

Contrary to expectations, previous upgrades like Merge and Dencun had very little impact on Ethereum’s price, disappointing investors. The chart shared by 10x Research also highlights the impact of these events on ETH, presenting an interesting picture (above).