Bitcoin mining sector shows strong signs of recovery after a three-month crisis and miner capitulation. According to the Hash Ribbon metric, the profitability crisis caused by the halving in April, which halved Bitcoin miners’ revenues, has started to show signs of recovery. How will this development affect BTC prices?

Crisis in the Mining Sector is Ending

The Bitcoin mining sector took a significant hit, especially after the halving. The reduction in miners’ revenues led many small-scale players to exit the market. According to the Hash Ribbon metric, large players invested in new technologies to overcome the crisis. For example, large mining companies like Marathon Digital started using more efficient equipment and revived their mining activities.

The hash rate of the Bitcoin network, which is the computing power required for BTC mining, reached an all-time high of 638 EH. This level indicates that miners are working with more efficient machines and have accelerated their activities. The acceleration in activities also shows that miners tend to hold onto the BTC they earn, reducing the selling pressure. These developments suggest that the miner-induced pressure on BTC prices has eased, paving the way for a potential future price increase.

How Did Miner Flow Volume Affect Bitcoin Price?

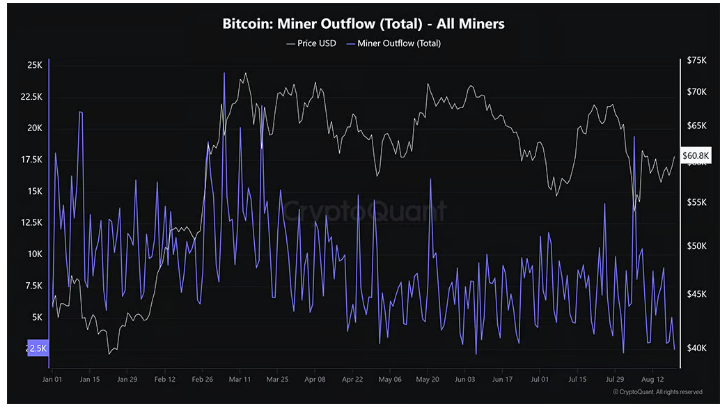

According to data, miners’ activities are decreasing relative to the overall on-chain volume. The miner flow volume, which reached up to 20% in May, has fallen below 10% in August. This decline indicates that the pressure from miners on the market is decreasing and the impact on BTC price is weakening. The reduction in the amount of BTC transferred from miner wallets to centralized exchanges supports this trend.

After the significant drop at the beginning of August, the BTC price is struggling to stay above the $60,000 level. Prices are still trading below the 200-day simple moving average (SMA), indicating a negative market structure for BTC in the short term. If the price surpasses the supply zone at the $63,000 level and turns it into support, BTC’s recovery potential could strengthen.

Türkçe

Türkçe Español

Español